A software stock that has made its loyal shareholders wealthy over the past decade is set to release its second-quarter earnings on August 8. In the run-up to the earnings, the stock is seeing buying momentum, up 1.5% in August so far. The stock in question is Constellation Software (TSX:CSU). Is this long-term resilient growth stock a buy ahead of earnings?

A sneak peek at Constellation Software’s earnings seasonality

Constellation is in the business of acquiring vertical-specific software companies that serve mission-critical applications. Its primary source of revenue is from Maintenance services.

Its organic revenue growth was only 0.5–2% on a year-over-year basis, which means the remaining revenue growth comes from acquisitions. The company does not reveal details about its acquisitions to maintain trade secrecy and avoid a bidding war. Thus, it is difficult to identify any seasonality in Constellation’s revenue.

However, we looked at Constellation’s sequential revenue growth since the pandemic and found that the second and fourth quarters are relatively stronger, probably because of higher deal closings.

| CSU Sequential Revenue Growth | Q1 | Q2 | Q3 | Q4 |

| 2020 | -0.30% | -3.30% | 8.80% | 8.80% |

| 2021 | 7.80% | 6.20% | 4.00% | 6.40% |

| 2022 | 3.50% | 13.10% | 6.60% | 7.10% |

| 2023 | 3.80% | 6.30% | 4.30% | 9.30% |

| 2024 | 1.30% | 4.90% | 2.90% | 6.40% |

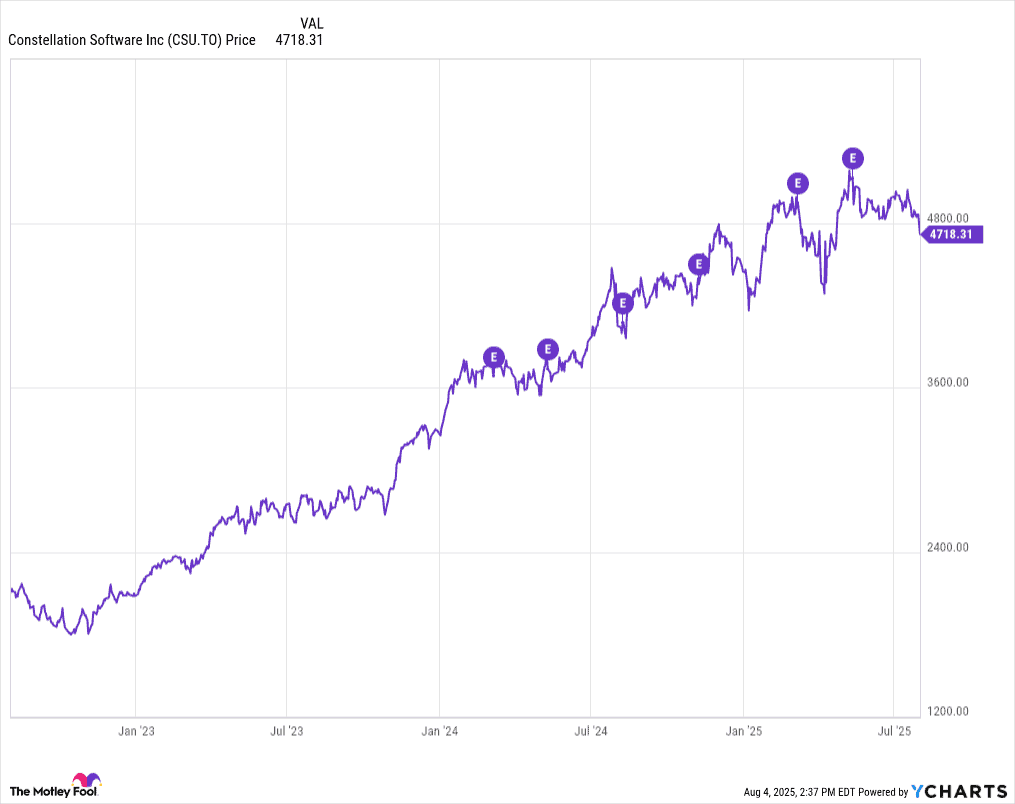

Constellation Software’s stock price momentum

This revenue seasonality was reflected in Constellation Software’s stock price momentum. The stock has seen a sharp jump in the run-up to earnings and dipped later. The dip was steeper after the second and fourth quarter earnings, reflecting profit booking.

This trend has continued over the last six months despite the U.S. tariff uncertainty. This is because Constellation’s portfolio of software companies caters to several markets and verticals, which helps it diversify the risk. However, Constellation did feel the impact of tariff uncertainty, as the company reports its earnings in US dollars, and fluctuations in the dollar’s value increased organic growth from 0.3% to 2% after adjusting for changes in foreign exchange rates.

Constellation reported a 1.8% sequential revenue decline in the first quarter of 2025, its first sequential dip since 2020. Its share price showed tepid growth in 2025, growing 7.9% year-to-date.

The market revived in April as tariff negotiations progressed, and markets adjusted to the tariffs. If the seasonal trend continues, Constellation stock could see a jump in the first half of August. However, the growth may flatten for the next two months before picking up the fourth quarter momentum in October 2025.

How to invest in Constellation Software

You can consider buying Constellation Software stock now and selling it in the February rally. However, such short-term investments carry risks in a volatile market. Instead, you can use this seasonality to buy the stocks in March and July dips and keep accumulating the stock as and when you have money to invest.

Constellation stock trades at $4,790 per share, which is more than a month’s paycheque for many. However, you can be assured of long term growth, considering the compounding model it uses.

Constellation’s enterprise value increases as acquisitions become accretive. Over the last four years, the company’s earnings per share have grown at a compounded annual growth rate (CAGR) of 24%, outpacing the revenue CAGR of 18.5%. This gives assurance of better returns in the long term.