October is a busy month for the stock market, because it’s when companies start reporting their operating results for the quarter ended Sept. 30. As has been the case for the last few years, Wall Street will be laser-focused on the tech giants powering the artificial intelligence (AI) revolution, because they typically deliver the fastest revenue and earnings growth.

Meta Platforms (NASDAQ: META) is one of those companies. It’s scheduled to release its third-quarter results on Oct. 29, and management’s guidance points to a further acceleration in its revenue growth, thanks largely to AI. The upcoming report could be a very positive catalyst for Meta stock, so here’s why investors might want to pay attention.

Look for accelerating revenue growth

More than 3.4 billion people use at least one of Meta’s social media apps every single day, which include Facebook, Instagram, and WhatsApp. Considering that is nearly half the population of the entire planet, finding new users is getting harder and harder, which is why the company is focused on boosting engagement instead.

Simply put, the longer each user spends on Meta’s apps, the more ads they see, and the more money the company makes. AI is a huge part of that strategy; Meta uses the technology in its algorithms to learn what content each user likes to see, so it can show them more of it. During the second quarter of 2025 (ended June 30), this drove a 6% increase in the amount of time users spent on Instagram compared to the year-ago period, and a 5% increase for Facebook.

Meta adopted a similar strategy for its ad-recommendation engine to target users more accurately on behalf of businesses. During Q2, this led to a 5% increase in conversions on Instagram, and a 3% increase on Facebook. This typically means Meta can charge more money per ad because businesses are yielding a higher return on their marketing spend.

The social media giant generated $47.5 billion in total revenue during the quarter, which was a 22% increase from the year-ago period. That marked an acceleration from the first quarter when revenue jumped by 16%. Management’s guidance suggests the company delivered as much as US$50.5 billion in revenue during the third quarter, which would represent even faster growth of 24%.

That would be a very bullish result for Meta stock on Oct. 29.

Here’s an even more important number to watch

Meta’s AI strategy also involves developing new features, like its Meta AI chatbot which can answer complex questions, generate images, or even join your group chat to settle debates. It only launched in late 2023, yet it already has almost a billion monthly active users.

Meta AI is powered by Meta’s Llama family of large language models, which are improving so rapidly that they already rival some of the best models from leading start-ups like OpenAI and Anthropic, even though those companies had a multiyear head start on development. But in order for the Llama models to continue improving, Meta has to invest heavily in data center infrastructure and chips to unlock the necessary computing power.

The company came into 2025 expecting to allocate somewhere between US$60 billion and US$65 billion to capital expenditures (capex) for the year, but it has since revised those numbers to US$66 billion and US$72 billion. Meta would only spend that kind of money on AI infrastructure if it expected a positive financial return, and the signs are already there considering the company’s growing engagement, higher ad conversions, and accelerating revenue growth.

A further upward revision to Meta’s 2025 capex forecast on Oct. 29 would probably be bullish for its stock, because it might be a signal that management expects an even bigger payoff than originally anticipated.

Meta’s stock looks like a bargain heading into Oct. 29

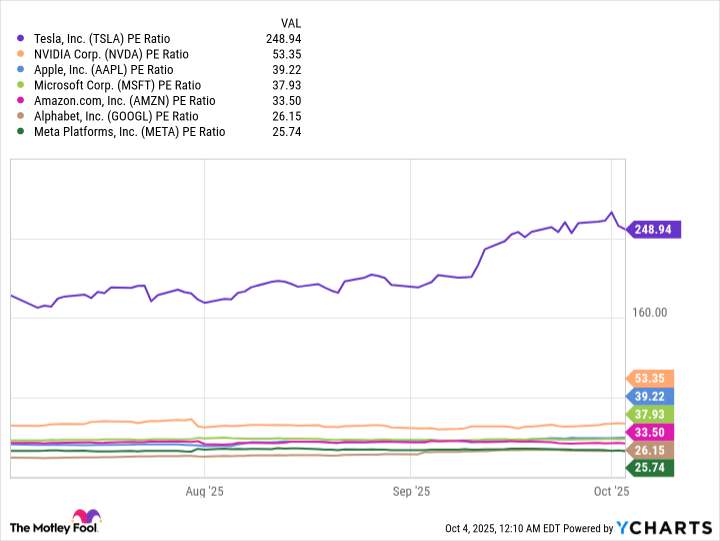

Meta shares are trading at a price-to-earnings (P/E) ratio of 25.7 as I write this, making it the cheapest stock in the “Magnificent Seven,” which is the group of tech titans driving the AI revolution forward.

PE Ratio data by YCharts

Personally, I think Meta deserves a much higher valuation considering it grew its earnings per share by a whopping 38% in the second quarter, outpacing the earnings growth of every other Magnificent Seven company except Nvidia.

Typically, investors will pay a premium for a company that is growing quickly, so there might be some upside on the table for Meta stock through multiple expansion alone. If the company’s third-quarter results match or exceed the high end of management’s guidance on Oct. 29, that could be the spark that ignites a powerful rally for the stock into the end of the year.