If you’re looking for a cornerstone Canadian dividend stock to buy, hold, and build a stress-free retirement around, the Royal Bank of Canada (TSX:RY), or RBC stock, is one name that should be at the top of your list. It’s a dominant, cash-gushing, market-leading Canadian bank stock that has proven its resilience for over 150 years. Here’s why RBC stock is the ultimate sleep-well-at-night passive income investment.

RBC stock: A financial fortress

In banking, safety is everything. And RBC’s safety comes from two key places: its diversified business and fortress-like balance sheet.

First, RBC’s stable and growing earnings come from five vibrant business lines: Personal & Commercial Banking, Wealth Management, Insurance, Investor & Treasury Services, and Capital Markets. This diversification acts as a shock absorber, supporting a smooth ride for RBC stock investors. When one segment faces a headwind, others can pick up the slack.

In its most recent third-quarter 2025 earnings report, RBC shattered expectations, posting a record $5.4 billion in net income, a 21% jump from the prior year’s quarter. The bank’s stellar profitability was driven by broad-based growth across all of its segments. Its recent return on equity (ROE) above 17% makes competitors envious.

Second, the bank is built to withstand a storm. Its Common Equity Tier 1 (CET1) ratio, a key measure of a bank’s capital safety, sits at a rock-solid 13.2%. This is far above the regulatory minimum requirements. The Royal Bank of Canada has robust capital buffers to navigate the macroeconomic risks that keep investors up at night, from consumer credit fears to trade uncertainty.

Adequate capitalization gives the bank stock ample capacity to underwrite more financial risks, meet client needs, and generate even more profits.

RBC’s growing profits support its dividend growth policy, and organically grow the bank’s capital base so it can accept more banking business.

RY’s growing payout: A dividend you can count on

A fortress is nice, but retirees need to get paid. This is where the top Canadian bank stock truly shines.

RBC stock has consistently paid dividends to investors since 1870. The payout has survived all economic recessions in modern history. The bank has raised its dividends consistently for 14 years now, earning a deserved place in the prestigious S&P/TSX Dividend Aristocrats Index.

The bank raised its quarterly dividends at an average growth rate of 9% annually over the past three years to $1.54 per share. That dividend is supported by a healthy and stable payout ratio of 47%. After RBC posted a record $3.75 in earnings per share during the most recent quarter, the bank’s dividend is not only safe but has plenty of room to grow.

The long-term investment appeal

Today, RBC’s stock price of around $207 per share gives it a dividend yield of about 3%.

Many new investors would scoff at that. “Why buy into a 3% dividend yield when I can chase a 7% yield?” This would be a classic mistake. With seemingly safe dividend growers like the Royal Bank of Canada stock, the real magic is in the dividend yield you could be earning 20 years from now.

Let’s do the math.

Imagine you bought RBC stock 20 years ago, in October 2005, and a 2-for-1 stock split in 2006 reduced your split-adjusted price to roughly $47 per share. Your one original share has turned into two, and today, those two shares are paying you $1.54 each, per quarter, for an annual income of $12.32. On your original $94 investment, you are now collecting a yield on cost of over 13.1% annually. This is how you retire stress-free: by letting a world-class banking institution do the heavy lifting.

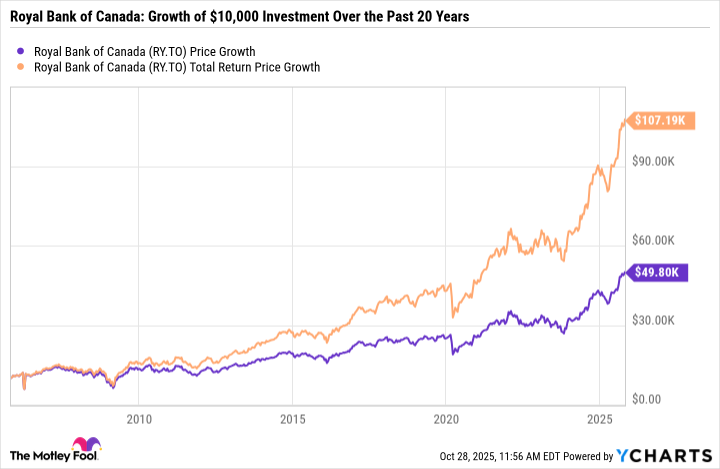

With full dividend reinvesting, a $10,000 investment in RY stock 20 years ago could have grown tenfold to over $107,000 today.

A bank stock built for the future

The biggest risk to a “buy and hold” stock is obsolescence. But RBC doesn’t seem like an old-world bank waiting for disruption; it’s already a technology leader.

According to the Evident AI Index, RBC ranks First in Canada and Third globally for artificial intelligence (AI) maturity in the financial services industry. The bank has aggressively invested in artificial intelligence to drive efficiency, manage risk, and create new value for clients. This forward-thinking approach ensures it will remain a financial services industry leader for many more years.

RBC stock could remain a rewarding core holding for decades to come.