Human dreams of building generational wealth often drift to flashy tech stocks, volatile cryptocurrencies, or the next best theme that promises to double overnight. When such dreams take over one’s trading, the line between investing and gambling gets blurred. Long-term compounding opportunities, which often lie in plain sight, can easily be overlooked.

The path to real, lasting wealth is far clearer, and frankly, a lot less stressful. True wealth is built on unbreachable economic moats – a term popularized by Warren Buffett. Moats are durable competitive advantages that keep would-be competitors at bay, allowing the business to continuously generate good profits and persistently compound its investors’ wealth for decades.

The market, in its endless quest for “what’s next,” often overlooks the very best moats. Let’s look at two TSX-listed powerhouses with two very different, but equally unbreachable moats.

Canadian National Railway stock: The irreplaceable tollbooth moat

Canadian National Railway (TSX:CNR) stock has suffered a 10% decline over the past 12 months, yet the railroad’s economic moats remain tangible despite near-term headwinds.

CNR’s moat is its expansive 32,000 kilometres of steel railway line in North America that connects three coasts: the Atlantic, Pacific, and U.S. Gulf Coast.

Why is CNR’s moat unbreachable? Because competitors simply cannot build another one due to cost deterrents and regulatory hurdles. This gives CNR a duopoly advantage (along with its main rival) on the entire Canadian economy. This moat allows CNR to act as a “tollbooth.” Nearly everything Canadians buy, from grain and lumber to cars and consumer goods, travels on its rails. This gives the railroad company immense pricing power and a business that grows in lockstep with the economy.

Canadian National Railway stock appears overlooked and underappreciated in 2025 as Trump tariffs, trade strains, and slow freight dominate current market chatter, while artificial intelligence (AI) stocks get all the limelight today. That is, until the market gets a reminder of this moat’s power.

CNR stock surged by 5% after a third-quarter revenue and earnings beat, driven by strong fundamental freight volumes. And the company has never stopped raising its dividends over the past 28 years, with a five-year dividend growth rate of 9.2% appearing too good to ignore.

The current dip in CNR stock provides long-term-oriented investors a discounted entry point to buy the compounding machine. The stock’s growing dividend could make the current 2.7% yield a powerful source of returns, on top of future capital gains when trade flows improve.

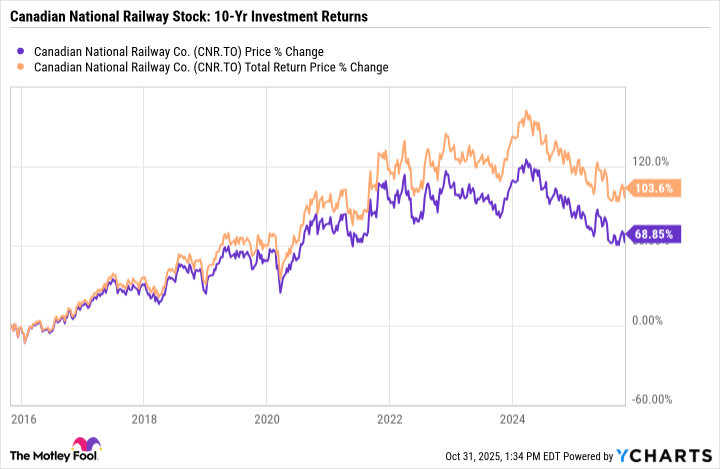

Despite its recent dip, CNR stock has generated 68% in total returns over the past decade, with dividends lifting total returns beyond 100%.

EQB Inc.: The high-growth “challenger”

My second pick’s moat is more modern, but just as powerful. EQB Inc. (TSX:EQB), the parent company of Equitable Bank, has underperformed its peer group this year with a 17% drop over the past 12 months, overshadowing its visible moats.

EQB’s moats are two-fold. Firstly, it operates within Canada’s regulatory fortress. Like the Big 6, EQB is a chartered bank enjoying strong barriers to entry that protect banking earnings from fintech competitors. Secondly, EQB has a structural cost advantage. As a market challenger, it relies on a digital-first, branchless business model. While the Big 6 incur thousands in physical branch operating expenses, EQB’s lean structure gives it a massive cost advantage.

This unbreachable moat combination, high regulatory walls, plus a low-cost structure, creates a profit machine.

Yet EQB is the cheapest Canadian bank stock one could buy right now because the market is worried about the housing market and a slowing economy, while EQB goes through a leadership change with significant mortgage loans exposure.

But this is where the moats provide protection. EQB isn’t a sub-prime lender and it could improve its credit quality, just as it has done in past downturns, and it may continue to raise cheap trading “capital” as its digital platforms continue to draw in customer deposits.

The overlooked EQB stock trades at a forward P/E of ratio of just 9.8. Its larger, slower-growing bank peers trade for an average P/E of 14. You get a 30% discount on a business with a jaw-dropping five-year dividend growth rate of 23.3%.

EQB’s current dividend yields 2.5%. The bank stock has generated 205% in capital gains over the past decade, and the dividends amplified total returns beyond 260%.