When news of aggressive protectionist tariff impositions and potential trade agreements fallouts continuously hit your screen for several months, it may be wise to take heed and shore up your portfolio’s defences, just in case the situation deteriorates into a full-blown global trade war, leading to an imminent global economic recession.

Picking recession-proof, defensive, dividend-paying stocks could be a rewarding “weatherproofing” strategy during such times, providing the investor with dependable monthly income that could produce needed purchasing power in a down-trending market, and make the portfolio weather a financial storm.

The healthcare sector, supported by a steadily growing but generally ageing population, is one area to look at for high-yielding but stable, monthly, dividend-paying stocks that could outperform in a downturn.

Two healthcare-focused players are up for discussion today, namely Medical Facilities Corp. (TSX:DR) and the expanding NorthWest Health Prop Real Est Inv Trust (TSX:NWH.UN).

Medical Facilities Corp.

Medical Facilities Corp. (MFC) is engaged in controlling interests through its subsidiaries in five specialty surgical hospitals and eight ambulatory surgery centres located in 11 states in the United States. The company owns these medical facilities in conjunction with physician partners.

The company has consistently paid 168 consecutive monthly dividends and is very likely to do so in the future, thanks to its defensible economic moat. Investors can expect to receive a $0.0938 monthly dividend per unit, which yields a juicy 8.02% at today’s $14 stock price.

The stock should benefit from a stronger U.S. dollar during the past quarter, as its strong exposure to the U.S. could bring positive transactional and foreign currency translation gains in the upcoming earnings report.

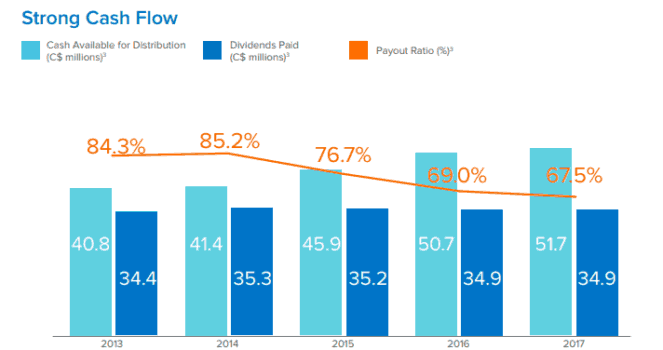

MFC’s dividend quality has been continuously improving over the past five years too.

The company’s cash flow payout rate temporarily increased to 92% for the first quarter of 2018, and investors need to monitor how it slides back down going forward.

Medical Facilities is embarking on an acquisitions-focused growth, as it increases and diversifies its revenue base. At the beginning of 2018, the company announced and completed the acquisition of seven ambulatory surgery centres through a partnership with NueHealth, LLC.

More growth is expected in the stock going forward, and, interestingly, its dividend is an eligible dividend for favourable tax treatment.

Northwest Healthcare Properties REIT

Northwest Healthcare provides investors with access to a portfolio of high-quality, diversified healthcare real estate comprised of interests in a diversified portfolio of nearly 149 income-producing properties spread across territories, including Canada, Germany, Brazil, and it’s eyeing a strong expansion in Australia.

The REIT pays a stable monthly distribution of $0.06667 per unit, yielding a juicy 7.08% annually on a forward-looking basis. Northwest Healthcare’s AFFO payout rate, at 96% for the first quarter of 2018, was an improvement from the 107% achieved during the fourth quarter of 2017.

The debt ratio, at 46.9% of gross assets, and 53.1% after including convertible debentures, is still a long way off the REIT’s target of a 40% long-term leverage ratio, but managements expects leverage to decline towards that target over time.

Strong portfolio occupancy levels of 96.3% by end of first quarter 2018 give the REIT some high-quality revenue trajectory, with the international portfolio holding strong above 99% occupancy.

Further, the REIT’s portfolio enjoys significant inflation protection, with 70.7% of its running leases subject to annual inflation indexation and providing a natural hedge in a rising interest rate environment.

I like the portfolio’s long average lease expiry of 12.7 years, providing strong resilience in a down market. The REIT’s international portfolio averages 16.6 years of remaining lease terms exiting the first quarter of 2018.

Most noteworthy, Northwest Healthcare has a beautiful drip plan, wherein unitholders who elect to reinvest their dividend with the REIT will receive a further distribution of units equal to 3% of each distribution that was reinvested by them, providing quite an incentive to participate and grow your portfolio even at a faster rate.