I’ve said it before, and I’ll say it again: We Fools don’t put much weight on analyst opinions. Time and time again, their calls are proven to be average at best.

But that shouldn’t stop us from listening, either. At the very least, analysts can draw our attention to forgotten areas of the market.

Well, Wall Street analyst Citigroup said last week that a specific metal is about to fly for a very, very long time. Naturally, this capitalist was all ears.

What is that metal? Not gold. Not silver. Not palladium. It’s none other than copper.

Let’s take a closer look.

Pennies to profits

Citi’s reasoning is simple. Copper has been beaten up over the past several weeks on global trade conflict. But longer term, the metal’s supply-demand profile is highly favourable.

In other words, now is a great time to jump in.

“We look beyond the potential trade war to longer-term copper market fundamentals and we find that current prices of $6,200 a tonne are nowhere near high enough to enable the market to clear,” analysts Max Layton and Tracy Liao wrote. “Copper is set to outperform most other commodities under our coverage over the coming decade on a lack of mine supply growth.”

That’s right. Citi is preparing us for a “decade of Dr. Copper on steroids.”

Under its baseline scenario, the firm sees an average annual copper price of $8,000 per tonne in 2022, then passing $9,000 a tonne by 2028. When you take the midpoint ($8,500), Citi’s forecast represents upside of more than 40% to copper’s depressed levels today.

I side with Citi’s thinking.

The crash of copper is accelerating. Worries over a trade war between China and the U.S. are intensifying. But they’re still just that — worries. If things don’t end up being so bad, copper could bounce on that basis alone. Add copper’s positive fundamental picture, and there’s good reason to buy in long term.

Copper basket

So, how would I play this copper optimism?

I think a small basket of Teck Resources Ltd. (TSX:TECK.B)(NYSE:TECK), First Quantum Minerals Ltd. (TSX:FM), and HudBay Minerals Inc. (TSX:HBM)(NYSE:HBM) does the trick.

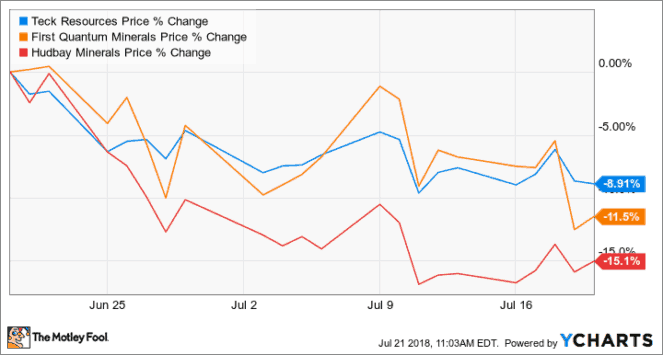

As Foolish mining expert Matt Smith mentioned earlier this month, copper drives 90% of First Quantum’s revenue, 63% of Hudbay’s, and 24% of Teck’s. It’s no surprise that they’ve all fallen right along with copper in recent weeks.

But here’s the thing: if and when copper rebounds, you can expect a reversal that’s just as strong. And that’s exactly the kind of exposure we’re looking for.

The Foolish bottom line

There it is, Fools — three mining stocks that should benefit from Citi’s long-term copper call.

A word of caution: if an all-out trade war happens, these stocks will certainly keep falling in the near term — and sharply. But if you can handle that kind of volatility, the long-term looks favourable.