Retail is dead.

You’ve probably heard that refrain dozens, if not hundreds of times over the past several years. The thinking is that all shopping is moving online, and that traditional brick-and-mortar retailers simply can’t compete.

It’s tough to disagree with that assessment. High-profile bankruptcies like Circus City, Radio Shack, and Blockbuster reinforce that belief. And e-commerce gorilla Amazon doesn’t look like it’s slowing down anytime soon.

But here’s the thing: retail isn’t dead. It’s simply changing — as it always has.

Many decades ago, it was all about department stores in the city. After that, big suburban shopping malls were all the rage. And in the 90s and 2000s, big-box stores dominated the retail scene.

In other words, retailers have always needed to adapt in order to survive. Today, e-commerce poses the biggest threat. But make no mistake about it: there are definitely retailers out there that are not only surviving, but thriving in 2018.

You just need to find them.

To help you do that, here are three retail stocks that have absolutely thumped the TSX over the past year. Additionally, they’ve all grown their revenue at a brisk clip in recent years.

Without further ado:

| Company | 1-Year % Return | 3-Year Revenue % Growth |

| Aritzia (TSX:ATZ) | 29% | 41% |

| Dollarama (TSX:DOL) | 22% | 30% |

| MTY Food Group (TSX:MTY) | 30% | 99% |

Just a word of caution: these stocks aren’t formal recommendations. Instead, they’re ideas for you to do further due diligence on.

With that said, discount retailer Dollarama really catches my eye.

Dollar days

Dollarama’s approach to battling the Amazonian beast is simple: it sells small things at cheap prices. Specifically, it provides everyday consumer products at low, fixed price points — generally $5 or less. And with millions of Canadians being both financially and time-strapped these days, providing cheap stuff, as well as convenience, is a recipe for prolonged success.

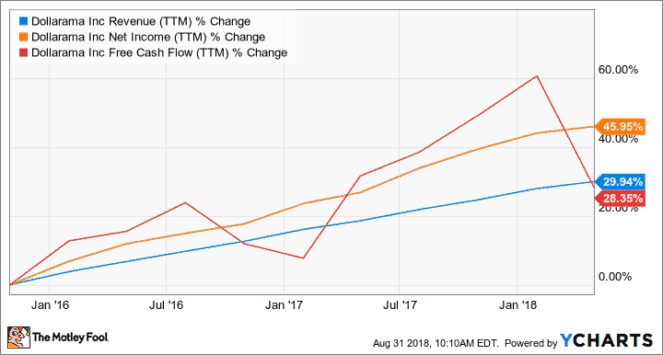

While growth has been slowing of late, Dollarama’s revenue, net income, and free cash flow growth over the past three years is still impressive.

In the last quarter, Dollarama even managed to post sales growth of 7.3% in the face of less-than-ideal shopping weather.

“Despite lighter than usual summer assortment sales in the first quarter due to poor weather, we delivered another solid performance and our underlying assumptions for the full year remain unchanged,” said CEO Neil Rossy. “We are also pleased with the tangible results of our continued focus on cost control and productivity improvements.”

But here’s the best part for conservative investors: management shares the wealth. The company has grown its modest dividend by nearly 200% over the past five years, all while buying back boatloads of stock. Over the last 12 months, Dollarama has repurchased $640 million worth of shares.

Of course, that kind of quality and shareholder-friendliness comes at a price. Currently, Dollarama shares trade at forward P/E of 33. That’s steep on the surface, but fellow Fool Mat Litalien makes a good case that it’s even more expensive when you factor in Dollarama’s slowing growth.

But valuation aside, Dollarama remains a great company that proves retail isn’t dead. And with enough of a pullback, it’ll be a great investment once again.

Fool on.