Picking the candidates for a core investment portfolio is a significantly important task that influences investment success over the long term. Whether it’s an income-oriented or a growth-focused portfolio, there is need to include some proven, stable, somewhat defensive, and highly regarded cash flow-rich stocks whose favourable characteristics could help preserve the capital deployed.

Although coming from a recent quarterly loss position that looks temporary, Suncor Energy (TSX:SU)(NYSE:SU), one of Canada’s largest integrated energy firms, offers a strong investment offering. The company has rich cash flow-generating oil production and refining operations spread across North America, Northern Europe, and North Africa that are expected to support further dividend income growth and capital gains in a portfolio.

I like this company’s investment offering for several reasons, three of which are discussed below.

Strong dividend growth

Suncor Energy declared a $0.42 per share quarterly dividend this February, which was a whopping 17% higher than 2018’s quarterly payouts, marking 17 strong years of consecutive annual dividend increases. The current yield stands at 3.8% on an annual basis.

The integrated energy company has increased its annual dividend by a compound annual growth rate (CAGR) of 8% over five years since 2015, and management is sticking to the policy of consistent payout increases. Should this dividend-growth rate be maintained until 2023; investors who buy into the stock today may see their dividend yield grow to a nice 5.6% per annum.

A history of consistently growing dividends, even during some periods of Canadian economic weakness, makes this company’s shares a darling to own in a core investment portfolio.

Strong and sustainable cash flow generation

Cash flow is the life blood of any business, and Suncor Energy generates lots of it; it did so recently during a period of a heavily depressed oil price, where the Western Canada Select fetched historically low prices in the fourth quarter of 2018, prompting the Alberta government to intervene through forced production cuts.

Actually, the company anticipates enjoying a CAGR of 5% in free funds flow through 2023 supported by production growth at Fort Hills, Syncrude, and Hebron assets, as well as planned structural improvements in operating efficiencies, cost savings and margin improvements over the period.

The company’s spending on major capital projects, Hebron and Fort Hills, has been completed, and this may free up some breathing space for liquidity growth and allow the company to execute new growth plans management may deem necessary for future growth.

Historically stable investment returns

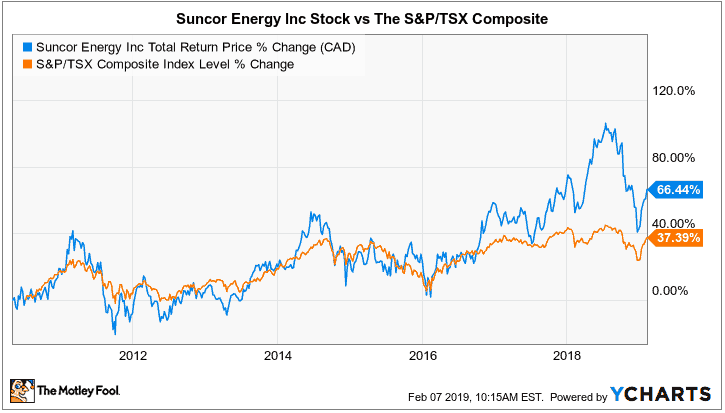

The company’s stock beta of 1.03 may imply that Suncor’s share price performance tracks the broader S&P/TSX Composite Index level quite closely, making it a worthwhile investment candidate for a core holding, especially considering the bonus dividend that keeps growing.

That said, the shares have evidently outperformed the TSX in total returns over the long term, more so during the most recent three years.

Past performance may not predict future returns, but the company has been consistently improving its businesses over time, and management seems capable of continuing to execute very well.

Investor takeaway

Suncor Energy is a strong candidate for inclusion in a core investment portfolio. Its strong dividend-growth rate and increased cash flow generation capacity will sustain portfolio income while announced share-buyback programs and an expected return to long term profitability will support further share price growth.

Dividend increases are supported by sustainable free cash flow generation improvements and planned operating efficiency upgrades, and the company’s counter-cyclical investments could continue to offer dependable distributions, even during some economic downturns.

Picking the dips on the stock could help fortify a core investment portfolio.