One of the hottest cannabis stocks on the TSX today, Village Farms International (TSX:VFF)(NASDAQ:VFF), rallied over 12% on Thursday upon listing on the NASDAQ Capital Market, cementing a strong winning streak so far this year.

Listing on a larger American exchange has been a valuation growth catalyst for almost all Canadian marijuana firms since last year. The same has proved true for Village Farms, an old greenhouse operator that has recently found a new growth path by converting some of its assets to cannabis production.

Elevated liquidity, better visibility among international and U.S. investors, and a new opportunity to tap into a deeper capital market south of the boarder are the new stock attributes that have helped Canadian marijuana firms that have listed on the NASDAQ and the NYSE recently, Village Farms being the latest addition to the growing list.

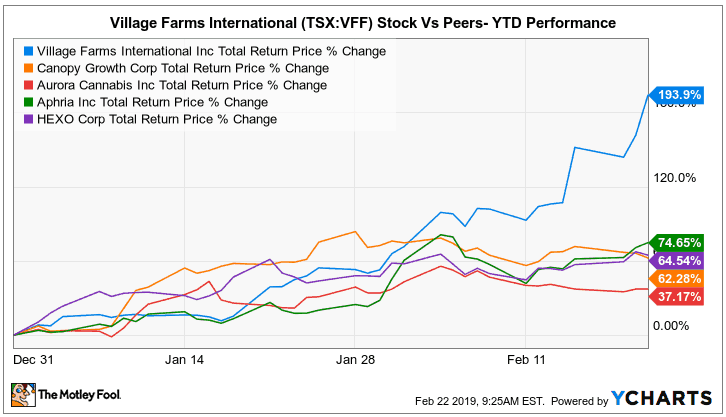

Year to date, the share price is up a whopping 194% at the time of writing, significantly outperforming most popular cannabis peers and a 1380% spike in trading volume could help sustain price momentum in the short term.

Kudos to fellow Fool contributor Nelson Smith, who confidently identified this winner earlier. Interestingly, the ticker’s early gains this year have surprised him beyond his expectations — so much so that he is no longer that confident to recommend further buys for fear of a pullback.

Could there be more juice to the rally?

The company’s Pure Sunfarms joint venture received a $20 million non-revolving credit facility from Bank of Montreal and Farm Credit Canada that matures in 2022, a recent vote of confidence in its cash flow generation capacity. Management expects to begin generating positive cash flow from this cannabis operation this first quarter of 2019.

The potential early route to positive cash flow generation could be in record time for a large scale marijuana operation, and the realization of such a target could easily sustain the share price growth momentum.

Further, as a 30-year-old deeply experienced greenhouse vegetable grower with established grow assets across North America, including the United States, the company intends to leverage its established footprint and retail distribution network to disrupt the nascent U.S. hemp market too. This could be a new source of growth.

Most noteworthy, Village Farms is significantly rejuvenating its income statement’s operating and gross margins by venturing into the cannabis market. Cannabis operations will generate a significant margin expansion and produce 10-15 times more revenue from existing assets. That’s awesome.

As highlighted earlier, the company could easily rank among the top cannabis producers in record time if it so desires, and the recent provincial supply win in Ontario could be the first of many, allowing the company to claim its place among the leading payers quickly. Valuations are very lofty for current market leaders.

Investor takeaway

The elevated volatility in marijuana tickers poses a real risk to invested capital, especially given the wide sentiment swings among industry investors. An ill-timed entry strategy into the stock may produce scorching losses in the near term considering the massive rally on this ticker in such a short time – losses that could trigger profit taking.

Buying the dips could therefore be a safer entry strategy for a long-term hold.

Further, the company is yet to make forays into the international medical marijuana market where significant long-term growth prospects still lie; there could be substantial dilution when this happens.

Actually, management seems poised to raise new capital for a U.S. hemp market entry after this NASDAQ listing, so dilution may be around the corner, but this is an unavoidable consequence of speedy growth that shouldn’t be a serious concern for retail investors in a rapidly growing stock.

Happy investing.