Want some extra passive income to help you pay the bills? You’d be smart to buy big Canadian bank stocks when they’re cheap. Bank of Nova Scotia (TSX:BNS)(NYSE:BNS) stock fits the description. Lock in a juicy yield for nice dividend income at an excellent value now!

A big dividend

A big dividend offers consistent periodic returns without any reliance on the stock price. Specifically, Scotiabank pays a quarterly dividend of $0.90 per share that’s good for a yield of 4.9% as of this writing.

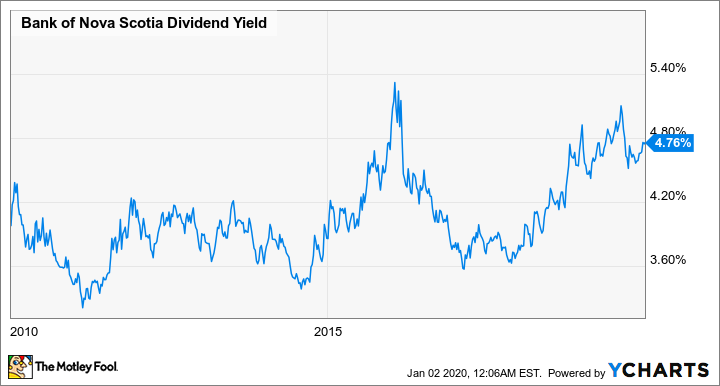

As shown in the graph below, the last decade has offered a good opportunity to accumulate Scotiabank shares at a yield of about 5%, which is at the high end of its yield range. The yield history suggests that the stock earns support from its safe dividend at a yield of about 5%.

BNS Dividend Yield data by YCharts

Scotiabank’s payout ratio is about 49% this year’s earnings. That leaves a big margin of safety to protect the dividend in temporary downturns. Here’s a piece of exciting news that’s coming real soon on February 25 – investors can look forward to a dividend increase that should push the yield over 5%.

Its dividends are important. They contributed to more than half of Scotiabank stock’s total returns over the last 10 years.

An excellent value

Scotiabank stock has underperformed its Big Six Canadian bank peers in total returns in the last decade. However, it has repositioned itself for future growth while increasing its dividend by 6.5% per year over the last six years.

Specifically, the bank retrieved $9 billion of capital from non-core operations with the majority in countries that were either unrated or had a non-investment-grade rating.

Simultaneously, Scotiabank deployed roughly $7.5 billion into core businesses and geographies – namely wealth management in Canada and the Pacific Alliance countries of Mexico, Chile, Colombia, and Peru.

Because of all these changes, BNS stock trades at about 10.2 times earnings, which is roughly a discount of 15% from its long-term normal price-to-earnings ratio at $73 and change per share as of writing,

By buying BNS stock at an excellent value, investors will get a succulent yield and boost their future returns.

Growth

After refocusing its business, Bank of Nova Scotia now has about 87% of its earnings coming from its core operations in Canada, the Pacific Alliance countries, and the United States.

Scotiabank is set up for higher long-term growth from the Pacific Alliance countries due to their greater expected GDP growth and underbanked nature.

Additionally, the markets of the combined Pacific Alliance countries are bigger than Canada’s. Canada’s GDP is estimated to be about $1.7 trillion in 2019 compared to the combined GDP of about $2.5 trillion in the Pacific Alliance countries.

Investor takeaway

You’d be smart to buy Scotiabank stock at about a yield of 5% or higher in 2020. The refocused international bank is set to outperform its big Canadian banking peers because of its big yield, undervalued stock, and unique growth profile.