The Software-as-a-Service (SaaS) model has been gaining steam for quite a few years, and the COVID-19 pandemic gave it an extra boost. The SaaS subscription model emerged in 2000 with the advent of cloud computing. The many advantages SaaS offers over licensed software encouraged customers and software companies to move to the cloud. In the last decade, software giants like Microsoft, Adobe, and Open Text (TSX:OTEX)(NASDAQ:OTEX) adopted the cloud-first approach, and many small pure-play SaaS platforms emerged.

The pandemic-driven lockdown has created a once-in-20-years opportunity for SaaS companies. The emergence of remote working has accelerated the digitization efforts of enterprises. Stocks of high-growth SaaS companies like Zoom Video Communications and Shopify, which encourage stay-at-home culture, have soared to their all-time highs. Stocks of mature enterprise software companies like Adobe and Open Text have recovered from their March sell-off and are trading near their all-time highs.

Open Text is resilient to an economic downturn

A SaaS company’s growth depends on acquiring new customers, retaining them, and upselling add-ons to existing customers. Most SaaS companies post losses in the early and hyper-growth stages as their priority is customer acquisition, which is expensive. However, revenue earned from these new customers is only profitable when SaaS companies succeed in retaining them for a more extended period.

Open Text is a mature software company with a high retention rate. In the third quarter of fiscal 2020, it earned 81% of its revenue from annual recurring revenue (ARR). A higher ARR generates stable cash flows and increases profit margins over time, thereby making Open Text resilient to an economic downturn.

Open Text will generate stable returns in the long term

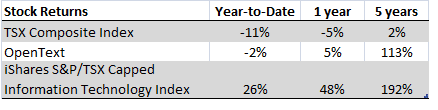

Open Text is a low-risk stock that generates returns in the long term. In these uncertain times, when many companies have cut their dividend, Open Text has maintained its dividend per share. Its stock has outperformed the TSX Composite Index. If you had invested $10,000 in the stock five years back, you would have earned approximately $12,000 through dividends and capital appreciation.

Open Text has transitioned from a licence model to a SaaS model in the last few years. In the licence model, it develops the software and earns a one-time licensing fee. After selling the licence, it generates recurring revenue from consultation services and customer support. This process is time-consuming and inflexible. Hence, it adopted a more flexible SaaS model, in which it puts the software on the cloud and gives customers access to the platform for a subscription fee. The SaaS model helped it earn higher recurring revenue from the same software for many years.

Back in 2011, when Open Text had no cloud business, it earned 26% of its revenue from licensing, and the remaining 56% from ARR. As of March 2020, the cloud was the largest business segment, contributing 42% towards the company’s revenue. The company is banking on the SaaS model to generate higher ARR and stable returns over the next five years.

The pandemic has created an opportunity for Open Text to help more and more companies adopt digitalization in the mid-term. However, it will face tepid demand in the short term, as some of its major customer industries, including auto, airlines, hospitality, oil, and travel, struggle to meet ends in the current crisis.

There are better investment options

If you are a risk-averse investor, Open Text is a good option for you. But there are better investment options that can fetch you higher returns while keeping your risk low.

The iShares S&P/TSX Capped Information Technology Index ETF has holdings in both mature and high-growth software stocks like Shopify and Open Text. This diversification minimizes the risk and maximizes the returns. The ETF has outperformed the market and Open Text by a considerable margin. It is currently trading near its all-time high of over $36. At this price, it is an unattractive bet given the market uncertainty.

If you had invested $10,000 in this ETF five years back, you would have earned over $19,000 by now. You can cash out your investment and invest it in high-income REITs that are trading at their 10-year lows. When the economy stabilizes, you can once again switch to high-growth stocks.