Saying that the TSX is heavy on financial stocks is an understatement. Unfortunately, most investors have come to associate the financial sector with banks. However, the Canadian financial sector is full of a diverse range of companies outside the traditional banking space.

Non-bank financial companies include insurers and alternative lenders. Furthermore, if you are looking for growth stocks within the financial sector, the insurance and alternative lending sub-sectors tend to be good places to start.

These two companies are great examples of growth stocks within the financial sector that can be found on the TSX. Both are great candidates for a $2,000 investment.

Intact Financial

Intact Financial (TSX:IFC) is the largest property and casualty insurance company in Canada. The company also has some operations in the United States. Intact Financial owns the Intact Insurance brand, as well as the discount insurance brand belairdirect.

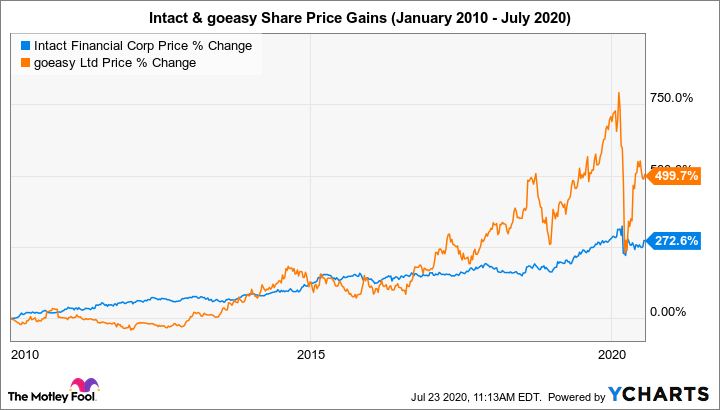

Intact has experienced phenomenal share price growth in the past decade. Intact’s share price bottomed out at around $30 per share after the 2007-2008 financial crisis. From there, the stock has approximately quadrupled in price. The shares have increased in price, on average, about 15% per year for the past decade.

Investors in Intact have also enjoyed explosive dividend growth over the past decade. Intact’s dividend yield usually hovers around 2%. However, the dividend-growth rate is quite high. The annual dividend-growth rate has been around 9% for the past decade. The dividend has increased more than 144% during that time.

After factoring in capital appreciation and dividends, Intact has averaged annual total returns of approximately 17% over the past decade. Therefore, Intact is ideal for investors looking for consistently strong share price appreciation but also those looking for a growing dividend income stream.

goeasy

goeasy (TSX:GSY) is a fast-growing small-cap financial stock on the TSX. The company is best known for the easyfinancial and easyhome brands.

The company’s easyfinancial business provides various types of loans to consumers and small businesses. These include personal loans, savings loans, and small business loans. Intuitively, this business makes a lot of sense, especially when you consider that many people can’t qualify for loans at bigger banks where the lending criteria are stricter.

The easyhome business allows individuals to lease home furniture, appliances, and merchandise instead of buying these items. This business also makes a lot of sense considering that the high upfront costs of purchasing quality furniture and appliances are simply unaffordable or impractical for some people.

The company’s stock price hit a low of around $6 per share in 2011. From there, the stock has risen almost 1,000% in value. In addition, the company pays a $0.45 quarterly dividend per share. This quarterly dividend was recently increased 45%. In total, the dividend has increased over 500% since 2011. Therefore, like Intact, goeasy is also suitable for both investors looking for significant share price appreciation and those looking for dividend growth.

Takeaway

When it comes to TSX financial stocks, there are a lot more options than just banks. Make sure to consider insurance companies and alternative lenders as well. These often-forgotten sub-segments of the financial sector can provide great growth opportunities. Intact and goeasy are perfect examples.