It couldn’t be simpler. If you’re a parent, it’s highly likely you’re receiving the Canada Child Benefit (CCB) payments from the government. These payments come in on the 20th of every month. The maximum you can receive is $6,765 per child under six per year, and $5,708 per child between six and 17 per year.

That can add up quickly. If you’re a parent that has the average two kids per household, you could be bringing in $13,530 per year for your two kids! On top of that, you could also be bringing in child care benefits from your provincial or territorial government. Today, however, I’ll just focus in on CCB federal payments.

So what I’m getting at here is these payments are an easy way to turn you into a millionaire. All you have to do is invest those payments instead of spending them. Granted, it’s hard times right now. CCB is definitely something you need to consider when life throws you a curve ball like a pandemic. However, if you’re able to invest that money, you could certainly turn it into a million dollars in 20 years.

First, the stock

The best investment you can make to keep those funds safe and growing is with a Canada Big Six Bank. These banks fared as some of the best in the world during the last economic crisis. Today, while revenue is down, the banks were prepared. A recession was predicted by global economists well before the pandemic, so banks had plenty of opportunity to prepare.

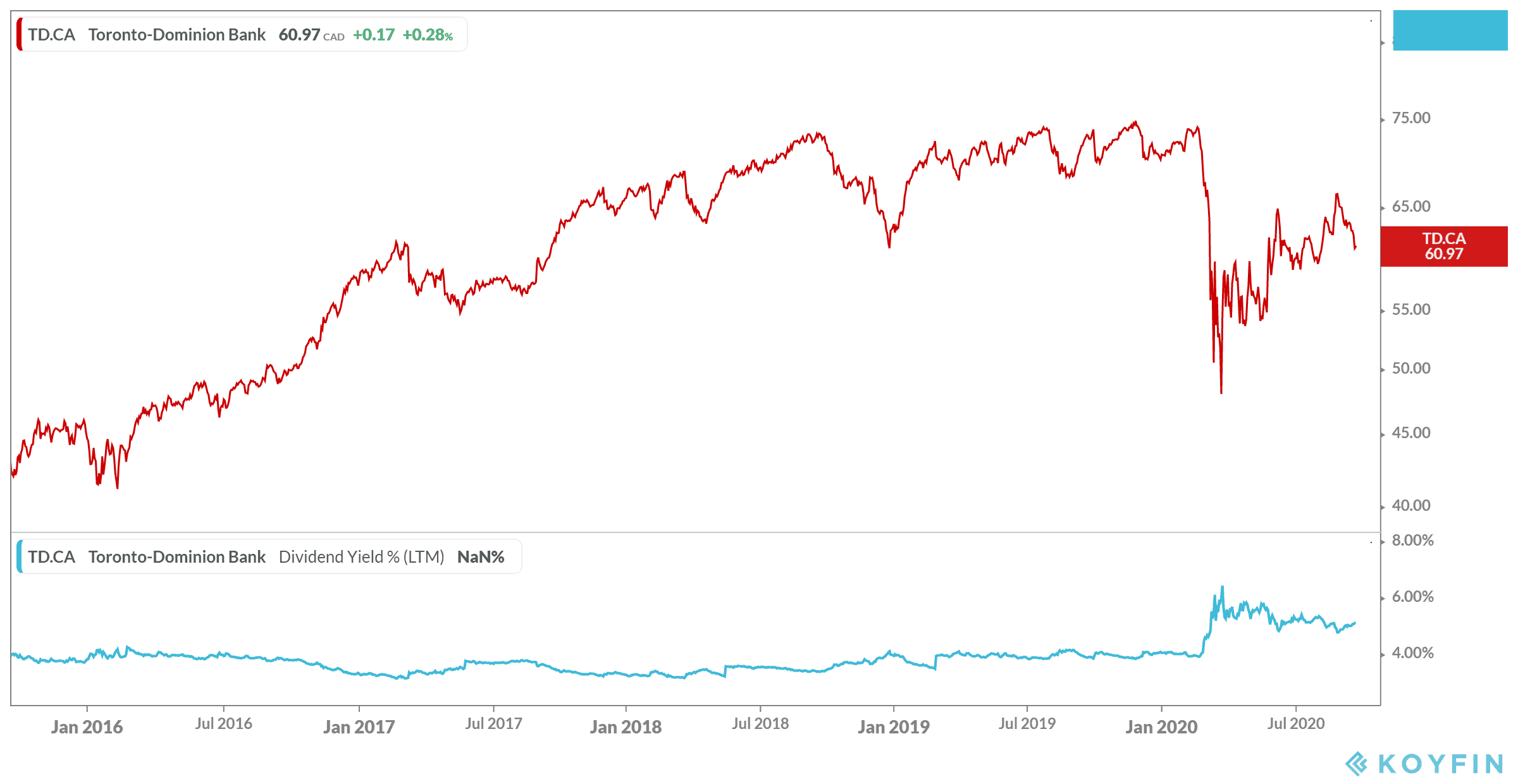

Toronto-Dominion Bank (TSX:TD)(NYSE:TD) was one of those that managed to prepare its assets ahead of time. The company remains strong, tied for first as the largest bank in Canada by market capitalization at $118.12 billion as of writing. While the company is still down from its pre-crash levels, there is a lot to look forward to with this bank stock.

First of all, this is the bank most likely to see huge growth in the coming years. TD Bank is now one of the top 10 banks in the United States, and is only in the northeastern part of the country. As well, the bank has grown into the wealth and commercial management sectors, a highly lucrative industry — growth that has helped boost the company’s dividend in the last few years.

For the near term, economists currently see a potential upside of about 10% for this stock. Even with the downturn, TD Bank has a five-year CAGR of about 40%, and year-over-year revenue growth of 8.2% as of writing. So this is a great stock if you’re looking for strength and growth in the coming years.

Next, the numbers

So let’s say that growth continues for the foreseeable future. If you were to put that CCB money into a stock like TD Bank every year, reinvesting its dividend yield of 5.2%, you could turn that around into a million dollars easily. We would have to assume after those payments ended, however, that you could continue putting in the same amount of money.

If so, it would take 20 years to bring your portfolio to $1,302,917.40 — and if that’s in a Tax-Free Savings Account (TFSA) you can then take out that cash, tax-free.