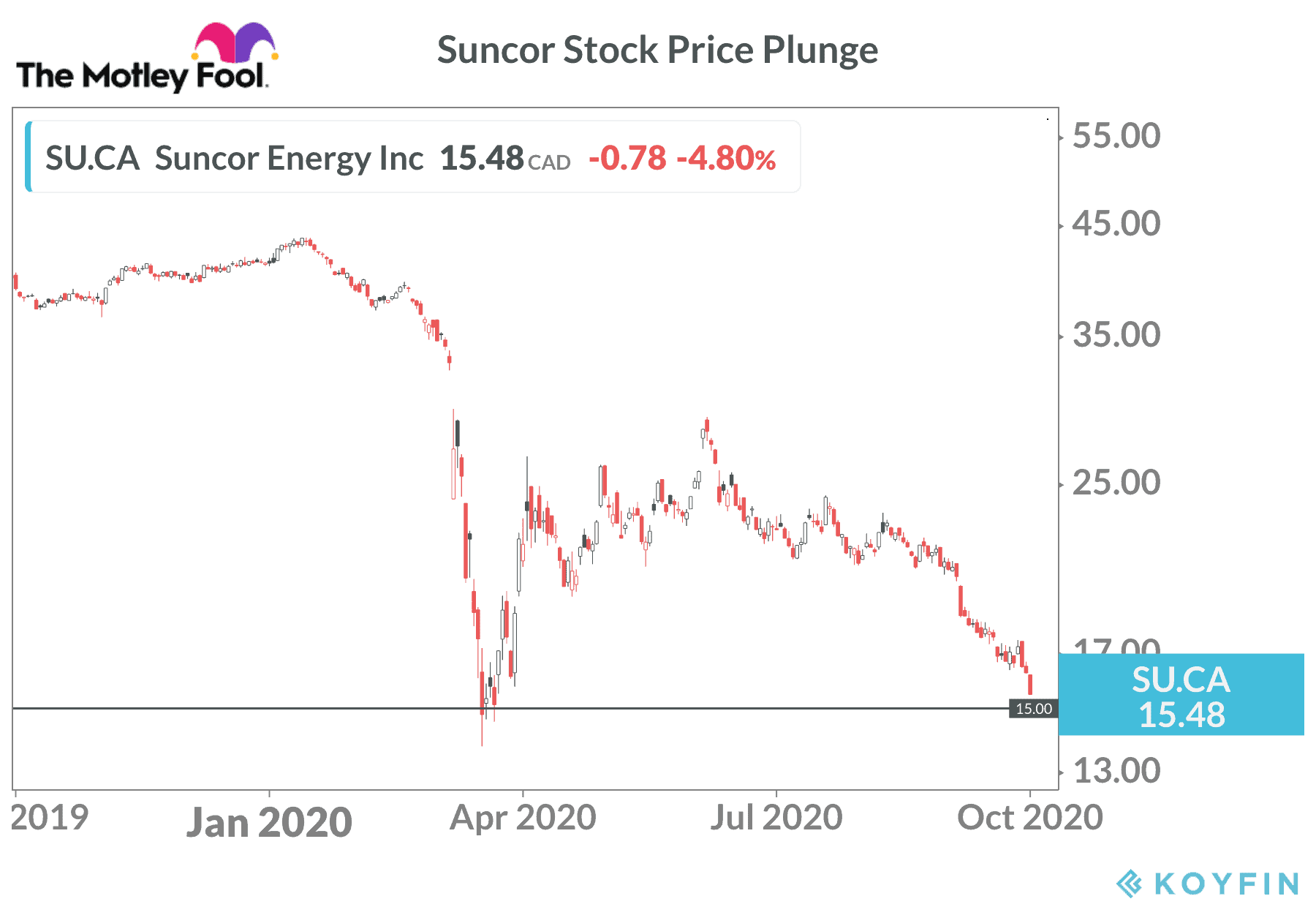

The share price of Suncor Energy (TSX:SU)(NYSE:SU) dropped 25% in the past four weeks. Investors with a contrarian investing style want to know of Suncor stock is now oversold.

Suncor stock and the oil market

Suncor operates oil sands mining and offshore oil production facilities. In addition, the company owns four large refineries and has a retail division that includes roughly 1,500 Petro-Canada stations.

The price of WTI oil started 2020 at US$60 per barrel. Suncor stock began the year at $42 per share. Once the pandemic started to roll across the planet and governments shut down borders, oil prices plunged, and Suncor stock followed.

Lockdowns forced people to work from home over the past six months. That kept cars in the garage and reduced trips to the gas station. Airlines, faced with travel restrictions, cut routes and retired planes to the point where capacity dropped 90% in Q2 2020. Air Canada reduced capacity by 92% in the second quarter and saw passenger levels fall 96% compared to the same period last year.

All of this hammered fuel demand, which in turn reduced the need for crude oil to produce jet fuel, gasoline, and diesel fuel. WTI oil futures briefly traded below zero in April. This occurred due to fears that global storage capacity might not be capable of holding the ongoing supply.

In the end, the market regulated itself and oil prices rebounded above US$40 in early June on the hopes of new demand driven by the reopening of economies. Suncor stock bounced from $15 in March to as high as $28 on the optimism.

New surges in COVID-19 cases in several developed economies are primarily responsible for the weakness over the past few months. WTI now trades near US$38 per barrel. Suncor stock is back below $16 per share.

OPEC supply increased in September, according to a new Reuters report. This comes as markets anticipate slower demand growth due to the ongoing pandemic.

In addition, the broader stock market gave back gains through September, putting extra pressure on Suncor’s share price.

Is Suncor Energy a contrarian buy today?

Suncor moved quickly to shore up its cash position in the early weeks and months of the pandemic. The board slashed the dividend by 55% and beefed up liquidity.

Difficult times should be expected in the coming months, but the medium-term outlook is positive. Governments expect COVID-19 vaccines to be widely available by the middle of next year. This should result in the removal of travel restrictions and boost fuel demand.

The U.S. just approved a new rail line to carry oil from Alberta to Alaska for shipment to international markets. Once the project gets completed, Suncor should benefit.

Massive cuts to capital programs across the energy industry could lead to tight market conditions when oil demand recovers. Some pundits anticipate a surge in oil prices.

Big investors, including Warren Buffett, apparently have a similar opinion. Warren Buffett’s Berkshire Hathaway increased its holding of Suncor stock in the second quarter.

I wouldn’t back up the truck today, but contrarian investors might want to start nibbling on Suncor stock at this level. The reduced dividend should be safe and offers a yield above 5%.

Five years from now, this stock could easily be back above $30 per share.