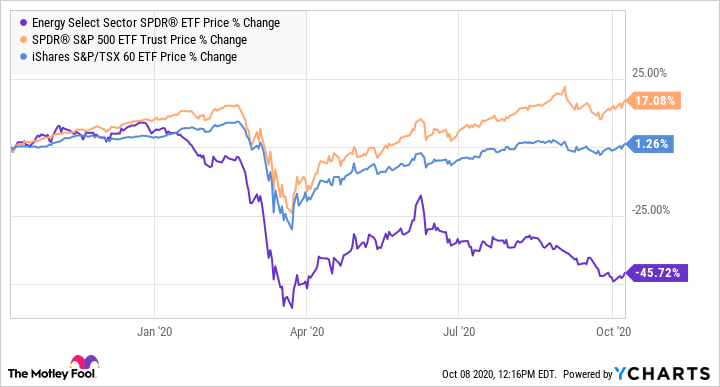

Energy stocks have greatly underperformed the market, led partly by the lower demand for energy during the pandemic. The chart below illustrates this by comparing the price action of an energy fund with the U.S. and Canadian stock markets using SPY and XIU as proxies.

Data by YCharts. Year-to-date price action of XLE, SPY, and XIU.

Today, the energy sector is experiencing a bounce and outperforming the markets. XLE is up 2.4%, while the U.S. and Canadian stock markets are up 0.69% and 0.52%, respectively.

It’s a good time to review cheap energy stocks that have an exceptional chance to deliver nice total returns.

Here are three energy stocks on the top of my list.

Suncor stock

At writing, Suncor Energy (TSX:SU)(NYSE:SU) stock has appreciated 3.34%. So, it’s outperforming the sector. This can be an indicator that it can continue to outperform as the energy sector recovers.

In any case, Suncor gained the stamp of approval from Warren Buffett, who owns and added Suncor shares in August through Berkshire Hathaway. So, Suncor is a good representation of the energy sector. When the energy sector comes back, Suncor stock will lead.

Analysts have an average 12-month price target of $30 on the stock, which represents near-term upside potential of 78% from the recent quotation of under $17 per share. Suncor stock’s 5% yield will help boost total returns.

Enbridge stock

Enbridge (TSX:ENB)(NYSE:ENB) stock is up 1.57%. From a price-action perspective, it underperforms. However, it’s understandable given that it’s more of an income investment than the others.

It provides a safe yield of 8.22%. In other words, it doesn’t necessarily need price appreciation to deliver satisfactory returns for shareholders.

Enbridge is the most stable of the three stocks no matter if you look at business or stock performance. It is unfazed by the volatility of commodity prices, because it provides the energy infrastructure required to store oil and gas and helps transport them from the suppliers to the target markets. Its EBITDA, a cash flow proxy, is largely predictable, having 98% of it regulated.

Parex Resources stock

Parex Resources (TSX:PXT) stock has climbed 2.26%. Returns from the stock solely rely on price appreciation, because it doesn’t pay a dividend. Consequently, when the energy sector improves, Parex stock will also take the lead in price gains.

Parex is an oil producer in Colombia. As a result, it enjoys premium Brent oil pricing and a lower cost of production. What’s delightful is that despite today’s super-challenging environment for energy companies, Parex has essentially no debt on its balance sheet. In addition, it has the liquidity to buy back 10% of its undervalued shares this year.

Notably, in a normal environment, Parex increases its revenues in the double digits and maintains strong EBITDA margins. Even in a stressful operating environment, and despite that the company’s revenue fell 20% in the trailing 12 months, it still enjoys a high EBITDA margin of 63.1%.

The stock trades at a price to book of 1.1 times, down from 1.8 times a year ago. Moreover, Parex has a very strong current ratio of 4.6 times, up from 2.2 times a year ago.

Analysts have an average 12-month price target of US$18.80 on the stock, which is roughly 66% near-term upside potential based on a forex of US$1 to CAD$1.30.

The Foolish takeaway

After the pandemic comes to pass, there should be greater energy demand and energy stocks should trade at higher levels than now. Among the top energy stocks that can deliver outsized returns from an investment today are Suncor, Enbridge, and Parex.