The oil and gas industry is in a six-year downturn and the pandemic just made its worst nightmare come true. The COVID-19 pandemic has significantly reduced oil demand as travel restrictions saw fewer planes in the skies and fewer cars on the roads. The oil crisis pulled down Canada’s largest integrated energy company Suncor Energy’s (TSX:SU)(NYSE:SU) stock to a 17-year low. In April, the stock fell 66% to $15 as West Texas Intermediate (WTI) oil price slipped into negative because oil producers were paying to store oil.

The next three years paint a gloomy picture for the entire oil industry as the slower recovery in air travel and the economy is hurting the industry even further.

Stock price momentum

In September, oil stocks fell as OPEC+ increased supply over the anticipation of the reopening of the economy. But the fuel demand remained subdued, because of which oil prices fell 16% to US$36/barrel. Hence, Suncor stock fell 25% in September.

The oil price is very volatile at the moment. OPEC+ production decisions are driving oil prices. At present, it has halted oil production to balance demand and supply. But the large global crude inventories and the slow recovery in demand is making matters worse. An oil company can’t halt its production for a very long time.

In May, Suncor made some significant cuts to breakeven with the WTI price of US$35 per barrel. It reduced its operating costs and capital expenditures by $1 billion and $1.9 billion, respectively. The company also increased its liquidity by $4 billion and slashed dividend by 55% to save cash. While that was not enough, it is also reducing its workforce by 10%-15% in the next 18 months.

Suncor’s aggressive cost reduction shows its struggle to survive the pandemic, the economic downturn, and the oil crisis. Hence, its stock has failed to recover from the March low, and any rise in stock price is not sustainable. The stock won’t even begin a recovery path for the next two years. It would take many years for the stock to return to the pre-pandemic level of $44.

Is it wise to buy and hold Suncor stock for the long term?

If you are looking to invest in Suncor for the long term, think again. The stock is in a decelerating trend. The oil industry has been in a downturn since 2014 when the shale gas exploration significantly increased oil supply and halved oil prices from over US$100 to US$53/barrel. At that time, all oil stocks fell significantly. Those who invested $10,000 in Suncor in the 2014 oil crisis thinking it to be a value stock now have around $4,700.

A report by global oil major BP analyzed three scenarios, and none of them painted a growth trend. In the first two scenarios, oil demand won’t recover to the pre-pandemic level. In the third scenario, oil demand would recover, but it will flatten for the next 20 years before decelerating.

The overall oil industry outlook is gloomy. Even if Suncor stock recovers to the pre-pandemic level of over $40, that would be the only growth. If you are buying the stock for its 5% dividend yield, there are better profitable stocks like RioCan REIT and Enbridge, which offer an 8% to 10% dividend yield. Hence, Suncor is not a stock you want to hold for the long term.

How to earn from Suncor stock dip

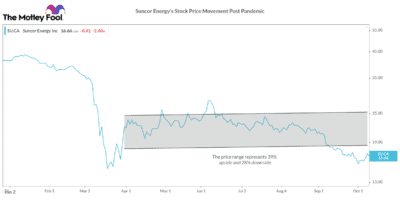

But you can still make money from Suncor stock’s volatility. However, it is a risky bet, and you should only consider it if you are willing to sell. Since the March sell-off, the stock has been hovering in the $18-$25 price range, which represents a 39% upside and 28% downside.

The stock broke the $18 support in September due to a decrease in oil price, but it would grow to $24-$25 on any positive news around international travel and oil prices. At its current price of $17, you can buy Suncor stock and sell it when it reaches $24, thereby making a 40% gain. But do not hold the stock beyond $24 as that price is not sustainable.

Rather than taking this risk, you can invest in other stocks that are benefitting from the pandemic.