Canadians are still in the midst of a volatile market. We’ve already seen one market crash in 2020, and it’s very likely we could see another crash before the year is out. With another wave of COVID-19 currently hitting Canadians, businesses could also be in for a crash. It could also mean reverting to a lockdown, which could devastate the already shaky market.

So, that means one of your best bets to keep cash coming in has to be through passive income. If you choose the right companies, you can create a passive-income portfolio that will continue to bring in cash, even amid a volatile market. But pick the perfect stocks, and you could also see massive returns when the markets return to normal.

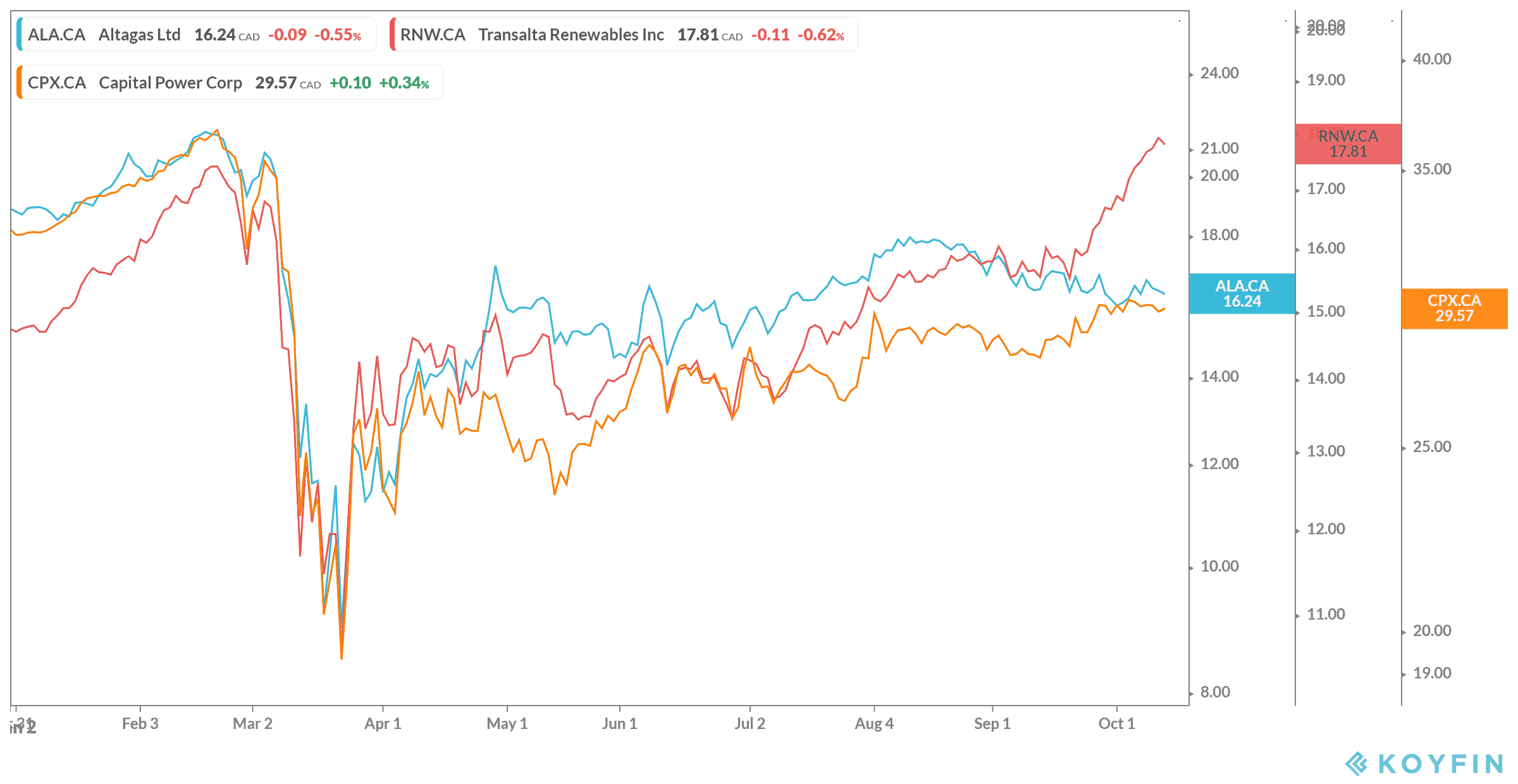

That’s why today I’d like you to consider AltaGas (TSX:ALA), Capital Power (TWSX:CPX), and Transalta Renewables (TSX:RNW).

AltaGas

If you’re looking for a cheap stock with high dividends, AltaGas is your stock. First off, don’t let the name fool you. This company isn’t just into oil and gas, which is still in the midst of a crisis. AltaGas also focuses on utilities, which help support the company, even during this economic downturn.

While it’s true that the company’s year-over-year revenue has shrunk by 8.9%, it still has leveraged free cash flow of $195.2 million as of writing. Furthermore, it’s trading at about $16 per share, providing about 23% upside for today’s investor. Meanwhile, it has a solid 5.88% dividend yield, coming out at $0.96 per share per year. While the dividend is down for now, once the company gets back on solid ground, you should see the dividend, and share price, soar back to normal.

Capital Power

Another company offering a significant discount is Capital Power. The company operates power generators throughout North America, from a variety of sources. Again, we have a strong utility company that should bounce right back, as businesses return to normal. And we also have a company offering a solid dividend in the meantime.

Capital Power is still down 17% from its pre-crash levels, with analysts estimating it to reach those levels in the next year. But while AltaGas has had revenue shrink, Capital Power remains strong. The company saw 38.5% increase in year-over-year revenue during the last quarter, and that should continue thanks to its diverse portfolio. It would also see its dividend of 6.96% remain strong for shareholders, and potentially continue its compound annual growth rate (CAGR) of 7.1% for the last five years.

Transalta

Finally, we have a Transalta Renewables, which isn’t a utility company and instead focuses on renewable energy resources, with some natural gas generation and pipeline facilities across Canada and the United States as well as Western Australia. The company is almost back to pre-crash levels, but it’s still a cheap stock considering its 5.22% dividend yield.

What investors get now from this stock is its high dividend. What they get decades from now is a company that’s already done the heavy lifting. Transalta will continue its focus on renewable energy, where government money is pouring in. As oil and gas become less dependent, renewable sources will become the main source of energy. That puts investors looking to buy and hold a solid opportunity by investing in Transalta.

Bottom line

If you put $10,000 into each of these stocks, you could create a passive-income portfolio that brings in $1,812 in dividends each and every year. You’ll notice that these stocks also mainly stick to renewable resources. So, as I mentioned, this could also mean decades from now your double-digit share prices should be well into the triple-digit price range, if not even higher.