TC Energy (TSX:TRP)(NYSE:TRP) announced its Q3 results on October 29. The event seemingly disappointed investors, as its stock fell by 1.1% for the day. The event may have raised some major concerns about TC Energy’s financial growth in the near term. Let’s take a look.

TC Energy’s Q3 results

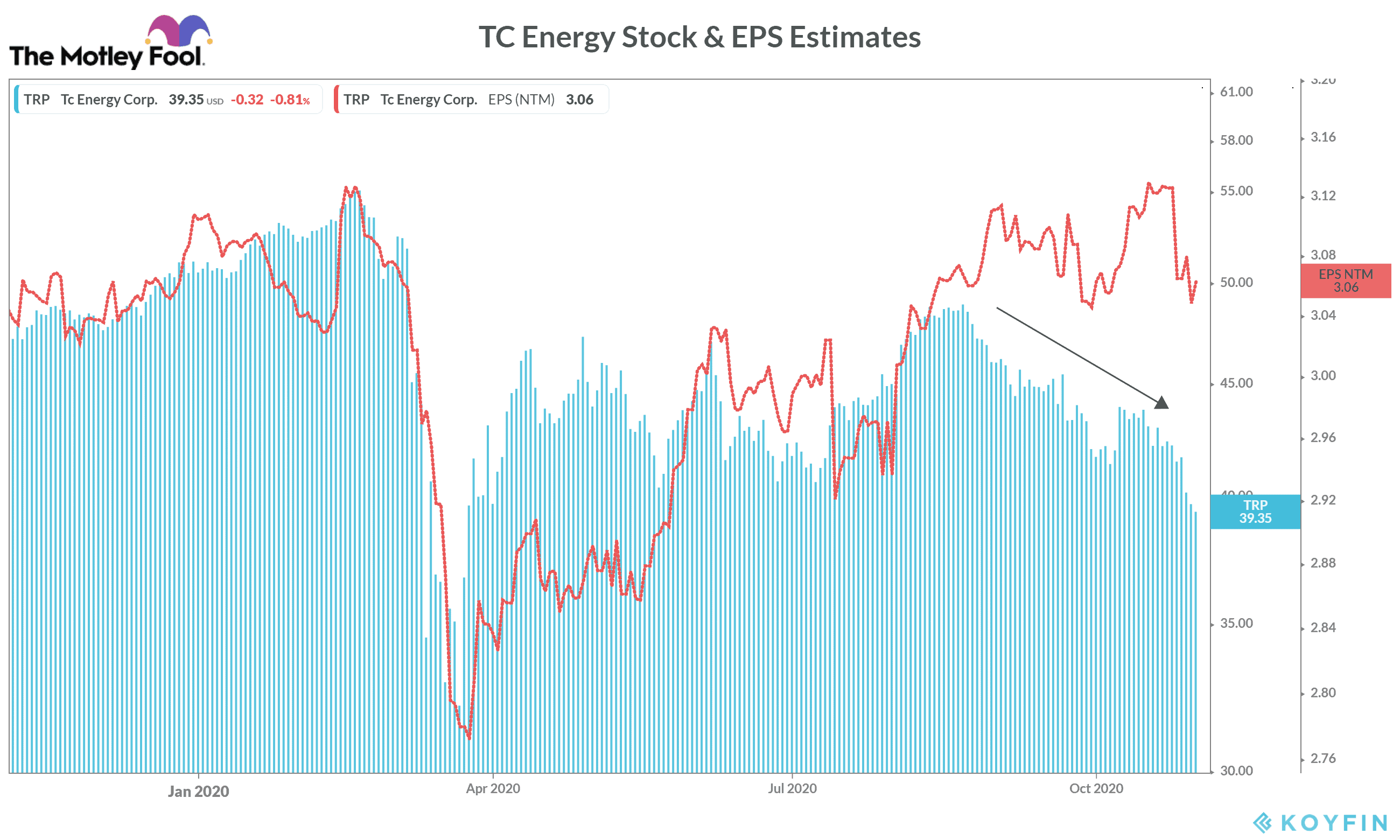

In the third quarter, TC Energy reported $0.95 earnings per share — up 3.3% from $0.92 in the previous quarter but 8.7% weaker on a year-over-year (YoY) basis. It was the second consecutive quarter when TC Energy’s EPS fell on a YoY basis. Nonetheless, its Q3 quarterly earnings were at par with Bay Street analysts’ estimate of $0.94.

During the quarter, the company’s revenue rose by 2% YoY to $3.20 billion but missed analysts’ consensus revenue estimate of $3.22 billion by a narrow margin — marking the seventh quarter in a row when TC Energy’s total sales fell short of analysts’ consensus estimates.

Margins contracted

In Q3, TC Energy’s adjusted EBITDA fell by 2.1% YoY to $2.3 billion and its adjusted net profit saw a 7.9% decline to $893.00 million. As a result, its net profit margin fell to 28% — lower as compared to 31% a year ago.

Notably, COVID-19 has hurt energy demand across the world. While a sharp recovery in the Chinese economy has helped the energy demand to improve in Asia to some extent, it remains comparatively weak in North America, hurting energy companies — including TC Energy — that mainly focus on the North American market.

What’s next?

Currently, TC Energy stock is trading without any quarter-to-date change at $52.82 per share. By comparison, the S&P/TSX Composite Index has lost 2.8% in the fourth quarter.

Apart from affecting the energy demand, the pandemic has also increased global crude oil markets’ volatility. TC Energy’s management acknowledges that this volatility has significantly impacted its market link and liquids marketing business. TC Energy’s stock has been trading on a negative note for the last three quarters. A prolonged pandemic and weak economic outlook could make a recovery in its stock really difficult in the next couple of quarters.

What are analysts recommending?

A total of 24 analysts are tracking TC Energy stock. Among these 24 analysts, about 20, or approximately 83%, suggest a “buy” with a target price of $71.61 for the next 12-month period. About 17% of these analysts recommend “hold” on the stock, and no analyst is recommending a “sell.” Bay Street’s consensus target price on the stock is $71.61 — showcasing upside potential of 35.6% from its Thursday’s closing price.

Could the stock fall to $40?

Despite analysts’ positive target price on its stock, it’s in a strong medium-term downtrend. The stock fell below a key support level of $54.60 earlier this week. Continued dismal fundamentals like weakening profitability and slowing revenue growth along with a challenging macro environment could take its stock further down towards a major support level near $40.30.

TC Energy has been one of the top dividend stocks in the Canadian energy sector. Currently, the company offers a solid 6.1% dividend yield. However, I don’t consider its solid dividends alone to make to worth buying at the moment.