Investing in the TSX stock market today feels like a risky proposition. The market is near all-time highs, the coronavirus pandemic second wave is accelerating, and the economy is being hit hard. But what if I told you that there’s a dividend stock that is immune to most, if not all, of these pressures?

If you have $5,000 to invest, consider buying Fortis (TSX:FTS)(NYSE:FTS). This defensive, dividend-growth stock will be an anchor to your portfolio.

Fortis: A dividend-growth stock with a long and strong history

Dividends are essential to any investment portfolio, especially in these times. When a company returns capital to its shareholders, it reduces the risk of the stock investment. Fortis has been returning capital to its shareholders for a long time. It has 47 years of consecutive dividend increases under its belt.

Today, Fortis reported its third-quarter earnings result. Its adjusted EPS of $0.65 was one cent lower than last year but in line with expectations. The key takeaway from the earnings release is that Fortis’s long-term outlook remains unchanged. The coronavirus pandemic has not changed Fortis’s core business strategy and opportunities.

So, let’s get back to the topic of dividend growth. In the earnings release, Fortis announced a 6% increase in its dividend. The company also reiterated its plan for 6% average annual dividend growth until 2025. In a time of difficult macro headwinds, a defensive stock like Fortis preserves your capital. It also generates safe and reliable dividend income.

Fortis stock is a defensive stock to weather the storm

Fortis is a North American leader in the regulated gas and electric utility industry. Its revenue base is highly defensive, as 80% of it is regulated or residential. This has always provided Fortis with a high degree of predictability and stability. In this pandemic, these are qualities that investors should be looking for in a stock.

Further to this, Fortis is also defensive because of how it manages its capital and its financial health. In its Q3 earnings release, Fortis specified its five-year capital plan. It is a plan that is ambitious as well as prudent. More specifically, Fortis will devote 85% of its $19.6 billion capital plan on smaller projects. This means investing in projects that are highly executable and low risk. System upgrades and modernizations fall into this category.

Lastly, Fortis is ensuring its long-term survival by stepping up its carbon emissions-reduction goal. By 2035, Fortis has committed to reduce its emissions by 75%. The company will do this by exiting all coal-fired generation by 2032. It will also focus on clean energy initiatives by adding wind and solar power systems as well as energy storage units. “By 2035, virtually all of the corporation’s business will be comprised of energy delivery and renewal, carbon-free generation.”

Maximize your return: Timing is everything and patience is key

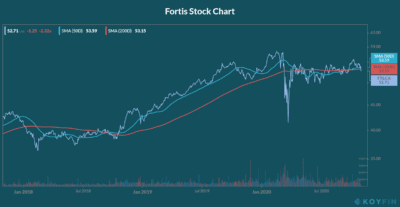

At this time, I am of the opinion that the TSX is setting up for a crash. The timing and the extent of this crash is really impossible to predict. But the point is that a market crash is probably coming. Given this, I recommend being patient and waiting before buying Fortis stock. The chart below gives us an idea of where the stock could fall to. It also gives us an idea of the price at which we should buy.

Fortis stock’s 50-day moving average broke through its 200-day moving average recently. This is not a good signal for the stock. Also, the Fortis stock will be taken down in a general market crash, as we saw in March. There will be a better time to buy for better returns.

On top of the capital gain potential of Fortis stock, it has a dividend yield of 3.84%. If you buy 100 shares today at $52, you would invest $5,200. Your annual dividend income would be approximately $200. If you wait and buy at a lower price, closer to the $40 level, your total return would obviously be much better with lower downside risk.

Motley Fool: The bottom line

Fortis stock is a must-buy if you have $5,000 ready to invest. I would choose my entry point wisely, though. The TSX may be headed for a market crash, so exercising patience will likely get you a better entry point and a higher return.