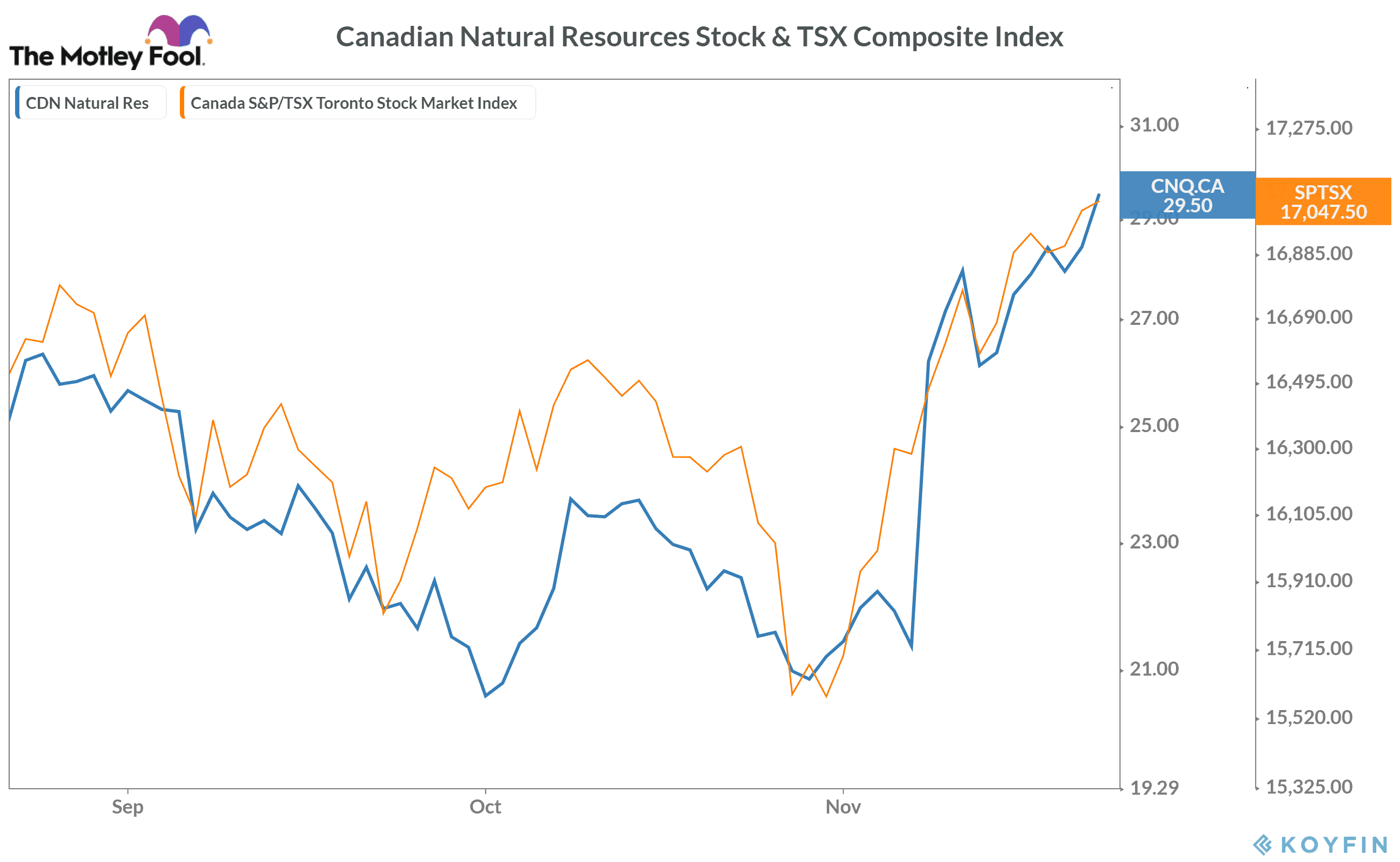

Canadian Natural Resources (TSX:CNQ)(NYSE:CNQ) — the Calgary-based crude oil and natural gas exploration company — has emerged as the top-performing S&P/TSX60 company in the last 10 days. During this period, its stock has risen by a 33.1% — much higher as compared to 5.2% gains in the TSX60 Index.

Let’s take a closer look at what drove these solid gains in Canadian Natural Resources stock and find out if it’s still a good buy.

What drove massive gains in Canadian Natural Resources stock?

A sharp rally in Canadian Natural Resources stock started earlier this month after the company reported its better-than-expected third-quarter results on November 6.

In the quarter ended September 30, it reported an adjusted net profit of $135 million. While this figure reflected a 90% YoY (year-over-year) decline in its profits, it was much better than analysts’ consensus expectation of a $165 million net loss.

These profits translated into adjusted earnings of $0.11 per share for the quarter. More importantly, the company’s Q3 earnings showed a massive improvement compared to its net loss of $0.65 per share in the previous quarter.

Other key positive factors

In Q3 2020, Canadian Natural’s management focused on increasing liquids production from its North American exploration and production assets. As a result, its production from these assets rose 20% sequentially to about 495 thousand barrels per day. At the same time, CNQ managed to minimize its operating costs — boosting its bottom line for the quarter.

These factors demonstrated strength in Canadian Natural Resources’ business model — helping it regain investors’ confidence.

Analysts are turning positive on CNQ

Following its upbeat third-quarter results, analysts at Canadian Imperial Bank of Commerce raised their price target on CNQ stock to $31 per share.

Most other notable Bay Street analysts are already favouring a “buy” on the stock. Currently, 22 out of 24 analysts covering it suggest a “buy.” Only one analyst each is recommending a “sell” and a “hold.”

Is CNQ stock worth buying right now?

After sliding by nearly 22% in the first quarter, the shares of Canadian Natural Resources recovered sharply in the next couple of quarters. It rose by 16% in the second quarter and added another 4% gains in the third quarter. On a quarter-to-date basis, CNQ stock is trading with 6% gains in the fourth quarter.

Interestingly, Canadian Natural Resources is one of the very few TSX companies that didn’t cut or discontinued its dividends amid the COVID-19 crisis. In fact, it has paid 13.3% higher dividends in the first three quarters of 2020 compared to the same period of 2019. The company’s strong dividend yield of about 6% makes its stock look attractive — especially when its financials are showcasing a rapid recovery.

Foolish takeaway

Despite a sharp recent rally, Canadian Natural Resources is still trading within the negative territory on a year-to-date basis. As of Friday’s closing price, its stock has lost 32.3% in 2020 so far.

If the company manages to maintain a robust financial recovery in the fourth quarter, its stock is very likely to outperform the broader market by a wide margin. That’s why if you’re looking to buy a good dividend stock with a reliable business model, you should definitely consider buying Canadian Natural Resources stock.