Toronto-Dominion Bank (TSX:TD)(NYSE:TD) — the second-largest Canadian bank by market cap — announced its fourth quarter of fiscal 2020 results on Thursday last week. The bank impressed investors by beating analysts’ consensus earnings estimates in the second quarter in a row. Let’s take a closer look at how investors reacted to TD Bank’s quarterly earnings beat and find out why it’s a great stock to buy right now.

TD Bank stock

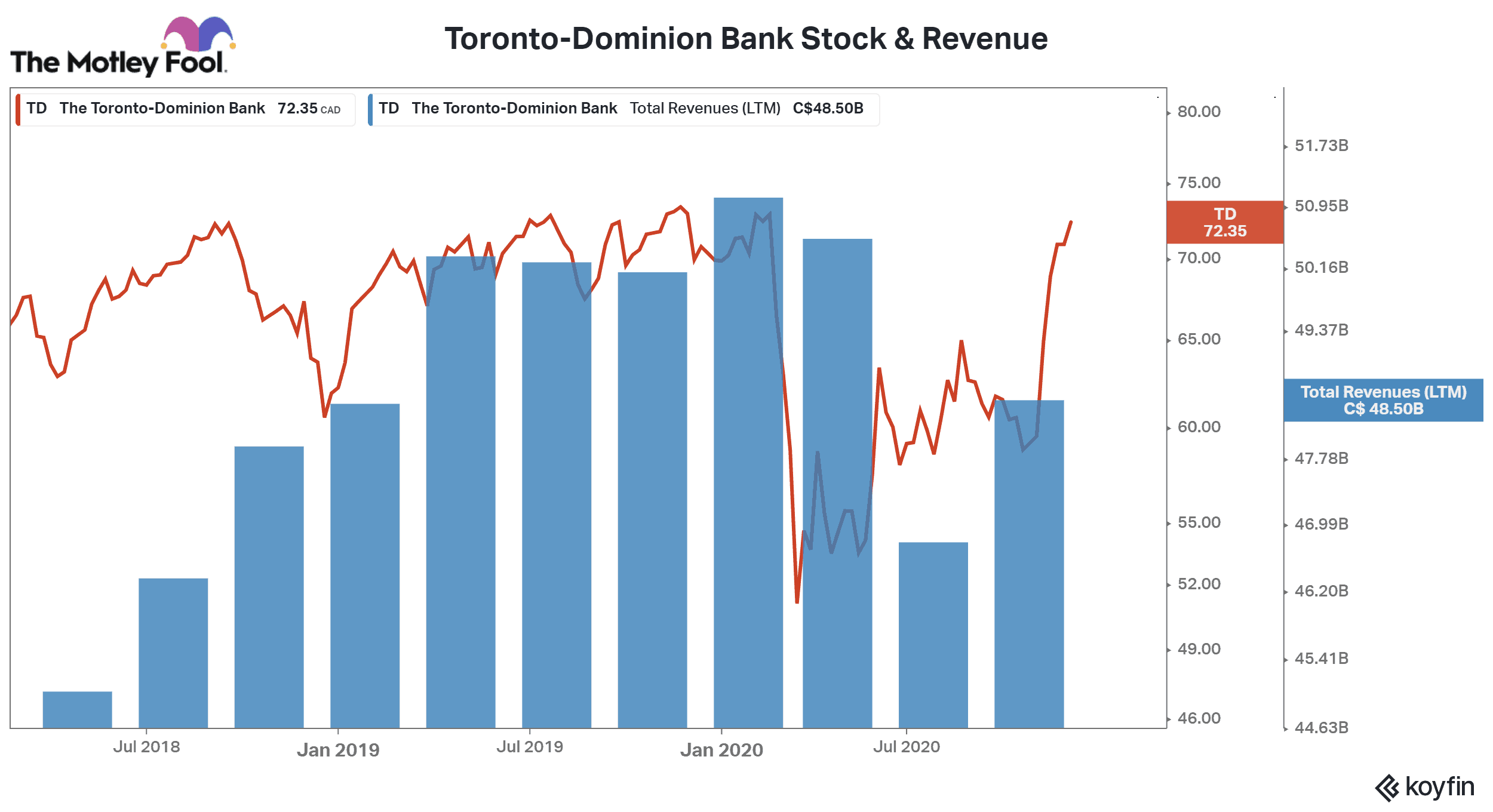

While Toronto-Dominion Bank’s latest quarterly results didn’t trigger a massive rally, its stock has largely been trading on a positive note after the results. In the last week, the stock has risen by about 2.5%. TD Bank stock had already seen a sharp rally in the last month — possibly due to investors’ high expectations from its earnings event. The stock rose by nearly 18% in November against a 10.3% rise in the S&P/TSX Composite Index for the month.

TD Bank is continuing to outperform the broader market in December as well. As of December 10, its stock has risen by 4.4% on a month-to-date basis. The index has seen only a 2.3% rise during the same period.

What drove optimism?

In the quarter ended October 2020, TD Bank reported adjusted earnings of $ 1.60 per share — reflecting a minor 0.6% year-over-year rise. With this, its year-over-year earnings growth returned to the positive territory after remaining in the negative zone in a previous couple of quarters due to the pandemic related headwinds.

Its Q4 of fiscal 2020 earnings were also significantly better than its earnings of $1.25 per share in the previous quarter and exceeded analysts’ consensus estimates of $1.28 per share by a wide margin. These are some of the reasons why its stock has steadily been rising after its earnings event.

Other key highlights

In the second and third quarter of fiscal 2020, TD Bank’s Canadian and the United States retail banking operations suffered due to the COVID-19. In Q4, the bank’s US retail operations remained weak as it reported a 27% decline in its net income from the segment to $871 million.

Nonetheless, its Canadian retail operations saw a major recovery — helping the bank post far better-than-expected Q4 results. TD Bank’s adjusted net income from the Canadian retail segment rose by 3% year over year to $1.8 billion. This positive trend was mainly driven by lower provision for credit losses during the quarter and lower insurance claims.

In Canada, the bank’s deposit and loan volumes also rose with the help of increased client activity in its wealth management arm.

TD Bank’s solid wholesale banking performance continued in the last quarter. It reported wholesale banking revenue of $1.3 billion — up 48% year over year.

Foolish takeaway

Despite a recent rally, its stock is still down 0.7% on a year-to-date basis compared to TSX Composite‘s 9.1% rise. Early recovery in TD Bank’s Canadian operations clearly indicates a strong hold on its home market retail banking. The bank currently offers an attractive 4.4% dividend yield.

Based on this early fundamental recovery, I expect its stock to outperform the broader market in the coming quarters. That’s why you may want to buy its stock — that could potentially double or even triple your investments.