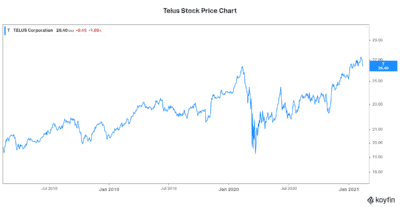

Telus’s (TSX:T)(NYSE:TU) stock price is pretty much flat today after its Q4 earnings report. But I’m energized about the stock. Telus’s conference call today highlighted many things, but the bottom line is simple: Telus is unlike traditional telecom companies. In fact, it’s forging a new road ahead, and this has created a highly differentiated telecom stock. And in my view, it will continue to create strong upside for Telus’s stock price.

This differentiation is giving rise to huge opportunities for Telus. So, let’s dive into this more deeply.

Telus stock: 2020 results show resiliency and strength

Telus stock did not react much yesterday after the Q4 earnings report. It was a report that brought home the fact that Telus is stable. Also, it showed how Telus is participating in high-growth verticals. So, maybe Telus’s stock price didn’t react much because it’s already performed so well.

Or maybe it’s because investors are not appreciating Telus’s value. Whatever the issue, Telus stock is a must-own. It has a generous dividend yield. It also has strong industry leadership and a solid financial position. Looking ahead, Telus’s 2021 targets remain highly achievable. Revenue is expected to increase 10%. EBITDA is expected to increase 8%. And free cash flow will be a whopping $1.5 billion. This will all drive continued investment in its fibre network. It will also support annual dividend increases of 7-10%.

Telus International IPO is a sign of things to come

February 3 was the largest technology IPO ever in the history of the TSX. The IPO was Telus International. Telus took it public to raise money to reduce its debt load. It also wanted to capture the value inherent in this business. After the IPO, Telus retains a controlling interest, and Telus maintains a 55% economic stake.

Telus International is Telus’s digital consulting business. It’s a rapidly growing business. It’s a good strategic fit with Telus the telecom giant. For example, it leverages the company’s infrastructure. Telus International designs, builds, and delivers next generation digital solutions. This has become increasingly relevant, as the pandemic changed the way we work, live, and do business. Telus International is helping companies across many different industries. Individual digital transformations are happening at a rapid pace. By all accounts, Telus International is a huge success. For example, revenue grew 20% in 2020. Also, EBITDA margins were a strong 24%. The future of Telus International remains bright.

Telus Health is another differentiated business endeavours that might follow this same path. Telus Health is Telus’s response to a healthcare system that’s been lacking. It had been steadily growing before the pandemic. But today, it’s booming. The pandemic has brought the necessity of digitizing the healthcare system to the forefront.

Telus’s Google cloud deal will help this digital transformation

Telus’s strategic alliance with Google Cloud has many far-reaching benefits. For example, it will drive innovation within key industries. These industries include health, security, and agriculture. This partnership will “help fuel a fundamental shift to digital.” It will “leverage data and AI to create valuable insights and improve customer experiences in multiple verticals.”

This innovation drive is big news for Telus. The partnership with Google is not exclusive, so it doesn’t limit Telus. And management estimates that it’ll result in $800 million of value creation. Enough said. We get the picture. This deal is transformational.

Motley Fool: The bottom line

Telus stock is a leading telecom company and more. It’s successfully digitizing different industries. At the same time, it’s delivering solid cash flow and dividend growth for shareholders.