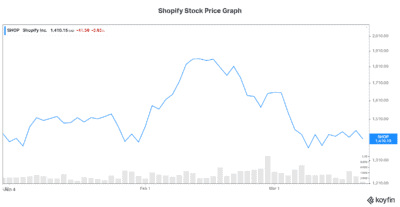

Shopify Inc. (TSX:SHOP)(NYSE:SHOP) is the leader in e-commerce solutions. It was on a rapid ascent before the pandemic. Then the pandemic happened. It shut everything down and accelerated Shopify’s rise. Today, Shopify stock is reflecting a lot of the good news. It’s trading at high-growth multiples. And it’s factoring in really high expectations. Lightspeed POS Inc. (TSX:LSPD)(NYSE:LSPD) is also flying high on the e-commerce boom.

But which e-commerce stock is the better buy today?

Shopify stock’s weakness is all about valuation

Sometimes, it really is all about valuation. And within this, there’s short-term valuation and long term valuation. Anything that we expect to happen in the long term is riddled with risk. That’s just the nature of the beast. So why would we fully pay up for it today?

Valuations go hand in hand with expectations of course. So a company can be doing a phenomenal job and its stock can still get crushed — at least in the short term. In the case of Shopify stock, its valuation was factoring in the type of growth that it saw in 2020. Shopify’s revenue increased almost 90% in 2020. Operating income soared, and the number of entrepreneurs turning to Shopify accelerated rapidly.

But the million-dollar question is whether this type of growth is sustainable. Well, Shopify management itself has answered this question. They have sent out their 2021 expectations. And they’re expecting slower growth. It makes total sense. I mean, at least part of its growth in 2020 was driven by lockdowns. This accelerated all things e-commerce.

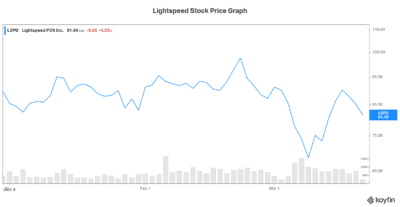

Shopify stock versus Lightspeed stock

Lightspeed POS is a software development tech company that offers omni-channel point of sale platform solutions. Lightspeed POS is also seeing rapid growth. Its focus is on the restaurant and retail industry which is severely lacking in its e-commerce channel.

With just $120 million of revenue in 2020, Lightspeed POS is in the earlier stages of its growth compared to Shopify. By contrast, Shopify generated $3 billion in revenue in 2020. And Shopify has been at this game for much longer. I mean, Lightspeed stock only IPO’d in 2019, whereas Shopify stock has been publicly traded since 2015.

Revenue at Lightspeed soared 80% in its latest quarter. While it’s not profitable as of yet, its growth and reach is accelerating rapidly. The e-commerce revolution is here to stay. Lightspeed’s focus on established restaurants and retailers is strong, thus enabling these retailers to emerge from the digital darkness. A digital presence is a must for them to survive and thrive. Lightspeed’s value proposition is therefore ultra-clear.

Another factor worth mentioning is the fact that Lightspeed POS stock is not as widely held as Shopify stock. This means that as investor demand for Lightspeed increases, it’ll drive up the price. This added demand for the stock will support its valuation.

The bottom line

The bottom line here is that Lightspeed POS stock is the better buy today versus Shopify stock. It’s in the earlier stages of its growth journey and is less widely held. And it’s offering is in high demand as retailers must adjust to the new digital world of e-commerce or die.