Enbridge (TSX:ENB)(NYSE:ENB) is one of Canada’s top energy transportation and distribution giants. Enbridge stock is one of Canada’s best stocks to buy. It benefits from its extensive oil and gas assets in North America. It also benefits from its growing renewable asset base.

Enbridge stock is well suited for investors who are looking for dividend income. It’s also well suited for investors who are looking for meaningful capital gains. Without further ado, here are the three reasons that Enbridge stock is a top stock to buy now.

Enbridge stock: A 7% dividend yield and lots and lots of cash flow

So, Enbridge is in the oil and gas sector. This means that it’s surrounded by a black cloud, as the fossil fuel industry is being shunned by many. This situation has caused Enbridge stock to be greatly undervalued. It’s caused Enbridge’s dividend yield to rise to 7%, as Enbridge’s stock price has been hit.

At the same time, Enbridge remains the defensive and predictable business it has always been. It remains a business that pumps out strong cash flows and shareholder returns. As an example of this, we can look at the company’s first-quarter results and outlook. The quarter brought in over $2.76 billion in distributable cash flow. Furthermore, Enbridge expects distributable cash flow per share to grow at a 5-7% growth rate through 2023.

We can also look at the company’s history of dividend growth. In the last five years, Enbridge’s dividend has grown at a compound annual growth rate of 8.85%. Let me remind you, this was a period when the price of oil was extremely volatile. But Enbridge continued to chug along, happily growing its cash flow and increasing its dividend.

Enbridge stock: The ESG stock of tomorrow?

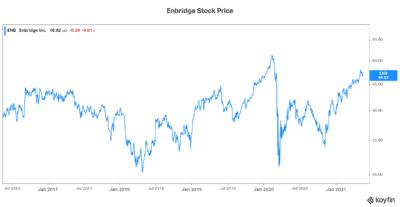

But what should investors make of the stock’s dismal five-year performance? Is Enbridge really on its way to oblivion? Or were the last few years just setting a new foundation? Is Enbridge creating the building blocks of a different way forward?

I think that Enbridge is definitely in a transitioning mode. And I think that Enbridge is successfully positioning itself to be a force for change. Enbridge is targeting net-zero emissions by 2050 and a 35% reduction by 2030. In the meantime, Enbridge is positioned in the best way for this gradual shift to clean energy.

There are many things that Enbridge is involved in, which will all contribute to a cleaner future. For example, Enbridge’s wind farms will be in service in 2022 and 2023. Also, Enbridge is seriously looking at carbon-capture projects. As Enbridge management puts it, this is “a key to achieving lower carbon emissions.”

Finally, natural gas will play a critical role in the short to medium term, It will support the shift to renewables and it’ll replace dirtier forms of energy.

Enbridge is a top stock to buy now, as natural gas will lead society into a lower carbon future

There’s a growing demand for energy globally. Developing countries are growing rapidly, and this will require more and more energy. Natural gas will be a key beneficiary of this. It will replace coal, which is much dirtier. And it will support renewables.

Enbridge is positioning itself to benefit from positive natural gas fundamentals. These robust long-term fundamentals are driving Enbridge’s export strategies. More specifically, Enbridge is expanding its export infrastructure, as it prepares to meet the demand of Asian and other developing countries.

Motley Fool: The bottom line

Enbridge’s stock price remains undervalued today. This is due to a whole host of issues. The biggest one being the fossil fuel industry’s negative impact on the environment. But Enbridge is taking the necessary steps to ensure its long-term viability. And in the short term, Enbridge continues to generate significant cash flows and shareholder returns.