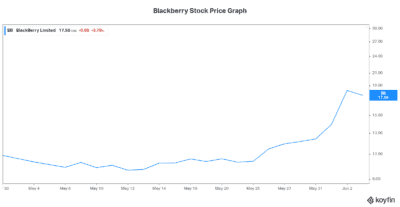

BlackBerry (TSX:BB)(NYSE:BB) is once again being caught up in meme stock mania! It’s an unexpected development that has sent BlackBerry’s stock price on a roller-coaster ride of volatility today. It’s also one that may have many Motley Fool readers wondering what to do. Should you buy or sell? Or should you steer clear of this madness?

Meme stock mania: A welcomed gift for BlackBerry shareholders

Anytime that a stock soars on sentiment or anything other than fundamentals, I recommend selling during the strength. As they say, “sell when others are buying.” This was never truer than in the case of these meme stocks like BlackBerry rallying to nosebleed heights.

I personally own BlackBerry stock. I was planning on selling it today during this strength. But it all happened so fast. It was up 20% one minute and down 5% 10 minutes later. I didn’t have enough time to get the necessary approvals. It was also my plan to buy it back when it headed lower. Trading stocks like this is not what we recommend at the Motley Fool. We believe that we should take a long-term view of stocks. It’s difficult to time things correctly in the short term. So, let’s remain focused on the long term.

But today, BlackBerry was once again caught up in the meme stock buying frenzy that took it to over $40 earlier this year. And even though today’s spike was rapidly obliterated, the stock is still up over 70% since May 25. In my view, it’s obvious that this spike will be short lived. I think we should therefore take the money that is on the table. I mean, BlackBerry stock has made us many years’ worth of returns only in the last week or so. If you like BlackBerry’s prospects, as I do, add it to your buy list and wait. You will likely have the chance to buy it again closer to $10. Patience is golden.

BlackBerry stock: The fundamental case

Consider this. I personally believe that BlackBerry is a very compelling company. I believe in its business model. And I believe in its leading technologies. I think that in the long term, BlackBerry will thrive. But I’m also aware that BlackBerry is not without its risks.

BlackBerry is focused on machine-to-machine technology. It’s also focused on the cybersecurity industry. These are two high-growth industries. They have very strong secular growth tailwinds. And they will undoubtedly create massive amounts of wealth for the companies that successfully penetrate them.

BlackBerry’s latest quarter was both encouraging and concerning. It was encouraging for its technological progress and partnerships. It was concerning for its lack of revenue growth once again. Let’s look at BlackBerry’s automobile technology as an example.

BlackBerry QNX is at the forefront of transforming automobiles into connected systems today and autonomous vehicles tomorrow. In the quarter, BlackBerry QNX continued to see a recovery of sorts after being hit hard in the early days of the pandemic. Interest in BlackBerry QNX is bouncing back to pre-pandemic levels. In fact, the company expects billing growth to be in the double-digit range for fiscal 2022. But right now, revenue growth remains elusive.

Motley Fool: The bottom line

BlackBerry stock is once again being caught up in the meme craze. Last time, the stock hit over $30. This time, it’s climbed above $20, only to rapidly tank to well below $18. Nobody knows for sure how high meme stocks can go in these rallies or how fast and hard they will fall. But I do know that it’s always best to trade on fundamentals. And BlackBerry’s fundamentals will take some time to catch up to its current stock price. Let’s wait to buy BlackBerry stock at a lower price.