Reddit stocks like AMC Entertainment Holdings (NYSE:AMC) stock have been on a whirlwind of a ride. In fact, the meme stock craze seems far from over as AMC’s stock price continues to soar. What should serious fundamental investors like us at Motley Fool do about this? The short answer is nothing. The long answer is to just simply focus on the real stuff and its fundamentals that will drive stock prices in the long run.

So I say, forget Reddit stocks. Check out ESG stock Ballard Power Systems (TSX:BLDP)(NASDAQ:BLDP) instead.

Reddit stocks like AMC stock are high risk, gambling stocks

So if you’re thinking of investing in AMC stock, we can already assume that you’ve got a high tolerance for tolerance. You’re trying to make a significant return similar to the returns that Reddit stocks have been gifted with. But if this is what you’re thinking, I’d like to stop you right there.

Yes, Reddit stocks have returned very lucrative amounts. But did anyone predict it? Was it even possible or likely to predict it? By the same token, how can we predict what happens next? I think you can see where I’m going with this. The future is murky for these Reddit stocks. We don’t know when they will go bust and must therefore stick with the fundamentals. This is what we teach at Motley Fool.

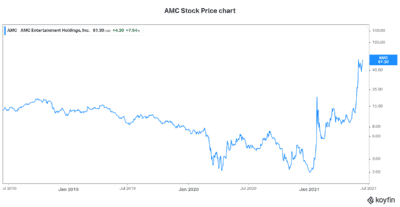

When investing, it’s equally important to look at your downside risk. Surely, the downside risk with Reddit stocks is quite high as they’re floating on thin air. Take a look at AMC’s stock price graph below. The stock has risen more than 2,500% in 2021 alone!

Ballard Power stock: An ESG stock with a bright future

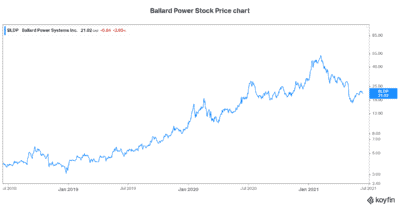

So Ballard Power stock has also had a volatile ride and has skyrocketed almost 500% from the end of 2019 to February 2021 highs of over $50.00. But since then, Ballard stock has plummetted almost 60%. That’s a 60% fall in just a few months. So as we can see, Ballard Power stock is also not for the faint of heart. Like Reddit stocks, it’s very volatile.

But unlike many of the Reddit stocks like AMC stock, the fundamentals are bright. It’s an ESG stock that has real fundamental drivers. And this means that the risk is worth taking. Also, the level of volatility is lower.

The fuel cell market is rising and on the cusp of booming. Costs have been cut significantly. And governments around the world are deploying fuel cell vehicles. For example, Europe is pushing hard for a fuel cell public transportation system. China is even more advanced on this push. Fuel cell-powered heavy-duty vehicles such as buses have outperformed on reliability, power, distance, and recharging times.

Ballard Power stock: Unlike AMC stock, it’s a well-calculated risk

While Ballard Power stock has had its own problems, it remains a stock to buy for long-term gains. I mean, its problems are not anything like AMC stock’s problems. For example, Ballard suffers from the fact that it’s involved in a new and emerging industry, the fuel cell industry. It’s an exciting and lucrative industry.

It’s an ESG industry that is changing the world with its zero-emissions fuel. But because it’s a new industry, the risk is high. There’s adoption and acceptance risk. There’s the risk that comes with building something new. We don’t know for sure where revenues and costs will settle.

But this risk is one I can stomach. AMC’s stock price is up thousands of percent as the Reddit crowd has gotten their claws into it. But fundamentally, the company is a dog. High debt levels. Cash flow burn. And a perilous future that does not warrant its stock price surges. It’s a gamblers’ game. AMC stock is trading on the Reddit-induced short squeeze. It’s not sustainable.

The bottom line

So in conclusion, I want to say be careful of these Reddit-driven stocks like AMC stock. Stick to fundamental investing because any other way is just gambling. Consider Ballard Power stock if you’re willing to take on some extra risk for the potential of a super-high reward.