If you could buy a TSX stock, but could never sell it, you would probably want to own a dividend stock. Why? Well, if you cannot sell and garner a capital gain, you would need dividend income to make up your return. Frankly, this is not such a bad problem to have.

Invest like Buffett: Buy and hold top TSX stocks for forever

Warren Buffett has famously said, “When we own portions of outstanding businesses with outstanding managements, our favourite holding period is forever.” Buying and holding great cash-yielding businesses for the long run is a great way to earn sleep-easy streams of income.

By not trading stocks, you save on trading commissions, you don’t have to pay tax (except on dividend income if not in a registered account), and you get to enjoy a company compounding your capital and raising its dividend distributions over a lifetime. It’s the ultimate passive investing!

How to find a forever stock

When looking for stocks to buy and own for forever, you’ll want to hold TSX stocks that have great managers, a stable or contracted base of revenues, high free cash flow yields, a great balance sheet, and secular trends that will support long-term growth.

Fortunately, the TSX has some really great dividend stocks to own for the long run. Here are two that look attractive in July.

A top TSX renewable stock

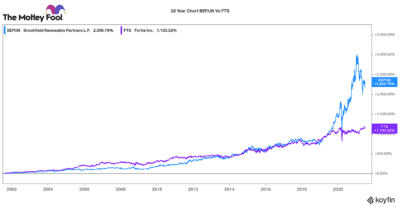

Brookfield Renewable Partners (TSX:BEP.UN)(NYSE:BEP) has some very, very long-term trends supporting its growth. Climate change is increasingly becoming a concern, and the world is moving to rapidly decarbonize. Consequently, sources of renewable power are only going to rise in demand.

BEP is a perfect TSX stock to benefit from this tailwind. It is one of the world’s largest pure-play renewable power stocks. Today, it generates over 21,000 megawatts (MW) of power capacity. It does this through a large portfolio of hydro assets as well as through solar, wind, storage, and distributed generation assets.

This TSX stock is a dividend-growth legend. While it pays a decent 3% dividend today, it has grown its distribution by a compounded annual growth rate (CAGR) of 6% since 2012. This company has a great management team, a strong balance sheet, and a 27,000 MW development pipeline to fuel growth for the decade ahead. BEP’s stock has pulled back in 2021, but right now looks like a great opportunity to own this stock.

A top safety stock to hold as a portfolio anchor

Stock markets are volatile. Consequently, it is nice to hold portfolio anchor stocks like Fortis (TSX:FTS)(NYSE:FTS). This is a very low beta stock. Its returns are not heavily correlated to the broader stock market index. As a result, it has a very stable trading pattern.

Fortis operates a large, diverse portfolio of regulated transmission utilities across Canada, the U.S., and the Caribbean. The company produces an incredibly reliable base of cash flows. Everyone needs natural gas and everyone needs power, so there is always a baseline of demand. Right now, Fortis is investing heavily to expand its utility infrastructure. Likewise, it should really benefit if the Biden infrastructure plan in the U.S. is approved.

Today, this TSX stock pays a 3.7% dividend. However, for the next five years, Fortis expects to grow its rate base and dividend payout by 6% annually. Given it has raised its dividend for 47 consecutive years, I believe it can achieve what it says it will. As a result, this is just a solid, safe dividend stock to tuck away and hold for a lifetime.