Gold stocks and gold prices are the ultimate hedge against the negative effects of inflation. This has proven to be true many times over. And this is ultimately relevant today, as we climb our way out from the long and difficult COVID-19 pandemic. Without further ado, here are two gold stocks to buy as inflation heats up: Agnico-Eagle Mines (TSX:AEM)(NYSE:AEM) and Barrick Gold (TSX:ABX)(NYSE:GOLD).

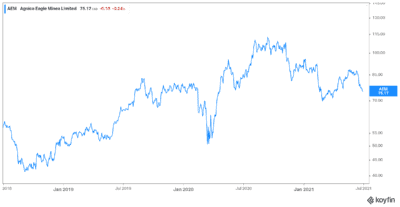

Agnico-Eagle Mines stock: Backed by an unmatched risk profile

As far as gold stocks go, Agnico-Eagle Mines is a gem. This is because of a few very differentiating characteristics. For example, Agnico-Eagle limits its operations to regions that are safe — politically and otherwise. This means that Agnico’s operations are in areas like North America, Europe, and Mexico. Compared to most other gold companies that have operations in many outright dangerous parts of the world, this is a key advantage.

Also, Agnico-Eagle Mines has an industry-leading cost structure. This has translated to strong cash flows and dividend increases. This is evident in the company’s 8% compound annual growth rate in its dividend in the last five years. It’s even more evident in the last year, when the dividend more than doubled.

As gold prices continue to rise, Agnico-Eagle’s fortunes will closely follow. Investors can count on a 2.25% dividend yield today. I expect that this dividend will keep growing, as Agnico continues to benefit from the strengthening gold price environment.

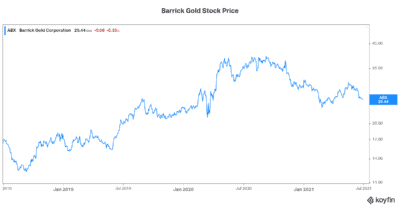

Barrick Gold stock: The go-to name for gold exposure

Barrick Gold is one of the largest and most well-known gold stocks on the TSX and globally. It’s the go-to stock for gold exposure. And it’s an ideal inflation hedge and safe haven. Rising gold prices are already positively impacting the company. Robust first-quarter results show this very clearly. A 12% increase in realized gold prices was accompanied by a 74% increase in free cash flow and an 81% increase in EPS.

This $45 billion gold company is performing quite exceptionally. Barrick Gold stock will continue to benefit from rising gold prices in 2021 and beyond. It’s a gold stock to buy for inflation protection.

Gold stocks as a hedge against inflation

The correlation between inflation and gold stocks is quite clear: when inflation rises, gold prices rise. And when gold prices rise, gold stocks rise. This been a tried and tested relationship that we can count on. But today, many investors question it. Is Bitcoin the new inflation hedge? Do cryptocurrencies replace gold in investor portfolios today? If so, will this be the new paradigm?

These are all good questions. Remember, asking good questions is the cornerstone of being a good investor. I, for one, do not believe that cryptocurrencies will replace gold as an inflation hedge. And this is evidenced by the sharp rise in gold prices in the last three years. Gold has, in fact, soared more than 40% in that time frame. I believe that gold will head even higher, as low interest rates and record stimulus drives inflation higher. Cryptocurrency is a wildly volatile asset, it does not and cannot replace gold for safety.

Goldman Sachs is in agreement with this view. In fact, analysts there also believe that the direction of gold prices is up — and up big. The investment bank’s target is for gold to hit $2,300 per ounce. This is a more than 30% increase from current levels.

Motley Fool: The bottom line

After the year that we have had, it seems highly likely that we are headed for a period of strong inflation. As in past periods of inflation, gold stocks will serve to hedge our money from this loss of value. Agnico-Eagle Mines stock and Barrick Gold stock are two of the top Canadian TSX gold stocks to buy today.