Many stock market experts are forecasting a difficult period ahead. After all, the S&P/TSX Composite Index is hovering near all-time highs. But there are numerous top dividend stocks to buy now that can help shelter your portfolio. It doesn’t have to be that complicated. Just look for safety and dividend income. Fortis (TSX:FTS)(NYSE:FTS), Enbridge (TSX:ENB)(NYSE:ENB), and Northwest Healthcare Properties REIT (TSX:NWH.UN) all offer this.

Without further ado, let’s take a closer look at these three best dividend stocks to buy right now.

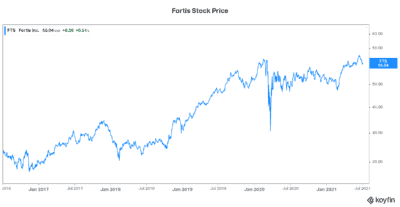

Fortis stock: A dividend stock like no other

Truth be told, I have had Fortis stock on my watchlist for a while now. It’s yielding 3.67% right now. Also, it’s the perfect combination of security, stability, and dividend growth. This company has been resilient throughout the pandemic. And this makes sense because of the type of business that it is.

Fortis is a leading North American regulated gas and electric utility company. Fortis’s earnings and cash flow are highly predictable. Its defensive business makes it so. It’s a highly regulated essential business (80% regulated or residential). This means that in the good times and bad times, Fortis will be okay.

Fortis is a top dividend stock to buy now. It’s a leading dividend stock that’s yielding 3.67%. It has 47 years of dividend growth under its belt. This is a track record that is unbeatable.

Top dividend stock to buy: Enbridge is yielding 6.7%

Enbridge stock usually doesn’t need much of an introduction. It’s an energy transportation and distribution company — a pipeline giant. These days, much controversy comes with this title. Oil and gas companies haven’t been a favoured investment choice due to environmental issues.

But today, Enbridge stock is flourishing again. In fact, it’s up 23% in 2021, as energy stocks are making a comeback of sorts. At the end of the day, the fact remains that Enbridge is a cash-flow powerhouse. A history of strong and predictable cash flows can give us confidence in this company’s future. Also, oil and gas will be essential to our lives for decades to come. And the Canadian energy industry scrambling to clean up its operations. So, the future might not be so dire for this industry.

In the meantime, Enbridge remains undervalued. It’s therefore one of the best dividend stocks to buy right now for its yield and its undervalued status.

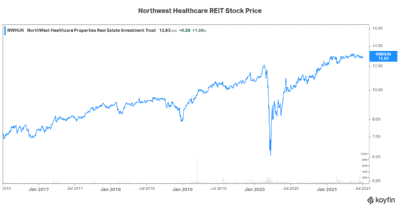

Dividend stock to buy: Northwest Healthcare also offers a +6% dividend yield

Northwest Healthcare Properties stock is an owner/operator of a diversified portfolio of healthcare assets in Canada as well as globally. This means that it has exposure to a highly defensive stream of revenue. It also means that Northwest Healthcare stock will be less sensitive to stock market and economic weakness.

Northwest Healthcare Properties is on a mission. Its goal is to continue to expand globally. An aging population in many parts of the world has made healthcare assets/infrastructure a very profitable business. Northwest Healthcare is expanding rapidly to take advantage of this.

The REIT’s portfolio consists assets such as office buildings, clinics, and hospitals. These assets are characterized by long-term indexed leases and stable occupancies. This defensiveness is a key reason that I view Northwest Healthcare stock as one of the best dividend stock to buy right now.

Motley Fool: The bottom line

The stock market continues to hover around all-time highs. At this point, I think it would be prudent to add top dividend stocks to shelter your portfolio from a possible incoming storm. Fortis stock, Enbridge stock, and Northwest Healthcare stock are three top dividend stocks to buy now.