Air Canada (TSX:AC) stock has been a popular topic for us at Motley Fool. And for good reason. The upside potential that exists as travel reopens is huge. Today, Air Canada’s stock price is still trading at less than half of pre-pandemic levels. But at least it’s survived. Nevertheless, some Motley Fool readers may by looking for a different opportunity — an opportunity with just as much upside potential. Well, I have something for you: Western Forest Products (TSX:WEF) stock.

Air Canada stock may be dead money, as recovery takes longer than investors hope

At this time, Air Canada continues to lose massive amounts of money every quarter. Big uncertainty remains in terms of the future of travel. While flights are slowly resuming, people may remain skeptical for some time. This means that getting back to pre-COVID levels of travel will not happen overnight. Air Canada’s CEO addressed this back in 2020. It will take at least three years for the company to return to 2019 levels of revenue and capacity.

Given this harsh reality, investors should consider a company that’s currently raking in the cash — a company that’s performing well financially and operationally and that also has exposure to a recovery. Western Forest Products is that company.

Western Forest Products stock beats Air Canada on all metrics

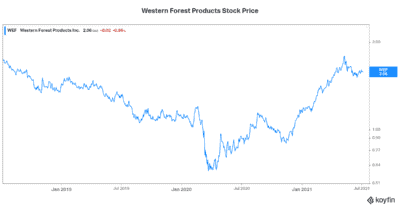

Western Forest Products is a major integrated softwood forest products company. It operates in the coastal region of British Columbia. Importantly, the housing market has remained quite buoyant. So, it’s no surprise that Western Forest Products stock is trading 50% higher than pre-pandemic levels. That’s much better than Air Canada’s stock price performance.

The company’s secret is that a big chunk of its revenue comes from its higher-margin specialty lumber. This translates into higher profitability margins for Western. In fact, Western Forest Products is at the top of the pack in terms of profitability in its industry.

Western Forest Products is a cyclical business. These businesses are notorious for losing significant amounts of money in cyclical downturns. But Western has been free cash flow positive in all but one year since 2012. Its future is not as uncertain as Air Canada’s. In Western Forest Products, we have visibility and financial strength. In Air Canada, we have a lack of visibility and financial difficulty.

Air Canada stock faces another hurdle: Soaring oil prices

Lastly, I feel like no discussion about Air Canada is complete without mentioning the soaring price of oil. Currently trading above $70, the price of oil will cut into Air Canada’s profitability. It is, in fact, Air Canada’s most significant operating expense. And this comes at the worst time possible. Air Canada is already struggling financially.

Motley Fool: The bottom line

I understand that Air Canada stock may be a good play on the reopening of economies and travel. But it’s also a risky proposition. Airliners have taken a hit. We don’t know exactly how things will look in our new “normal.” So, Motley Fool investors should consider Western Forest Products stock instead. This stock is an undervalued cash flow machine that should also benefit from a post-pandemic recovery.