Tech stocks like BlackBerry (TSX:BB)(NYSE:BB) stock are often the jewel in investor portfolios. The right tech stocks typically have high growth rates. They also have above-average profitability and long growth runways. Remember, tech companies are changing the future. They are making it more efficient. And they are giving us better ways of doing things and better experiences.

Please read on to learn about my top tech stock ideas to buy now.

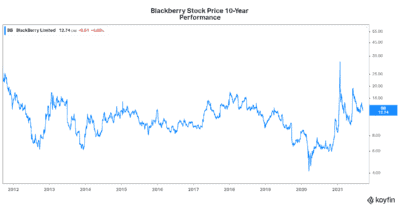

BlackBerry’s stock price: A roller-coaster ride with a solid underlying business

BlackBerry is Canada’s best known tech stock. It’s had a tumultuous ride, but I continue to be intrigued by it. This company has embarked on a transformation that many have doubted. How could a company go from being 100% about handheld phones to 0%? How could it survive the annihilation of its business?

Well, that’s exactly what BlackBerry did. Now we wait for it to thrive. We have had a couple of manias surrounding BlackBerry’s stock price recently. Blackberry’s potential is very intriguing. But some investors worry that the company has still not made a real money-making business out of its potential.

Let’s back up and review: what is BlackBerry today? In short, BlackBerry is a tech company that is involved in two of the most lucrative businesses. The first is the cybersecurity business, which is worth over $150 billion. It’s an increasingly relevant and high-growth business. Also, BlackBerry is a leader in embedded systems. It enables machine-to-machine connectivity. The company is best known in this area for its success in creating connected cars. But this technology is also used extensively in medical devices and robotics.

The problem is that these businesses are in the early stages. By definition, this means that there’s big risk attached to BlackBerry. Yet BlackBerry’s expertise and award winning technology will win the day, in my view.

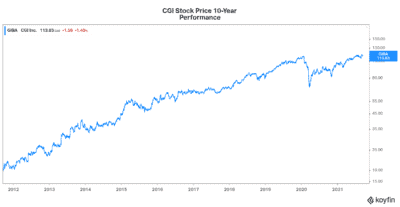

CGI stock: BlackBerry’s future? A top tech stock that has stands the test of time

CGI (TSX:GIB.A)(NYSE:GIB) is one of the largest IT and business consulting services firms in the world. During the pandemic, business remained quite resilient for CGI. Now, as a recovery takes shape, the digitization trend is building momentum around the world. And CGI is right there, front and centre. This company is the most profitable it’s ever been. And its plans to double in size in the next five to seven years remain achievable.

As a tech stock, CGI is the best example of stability and growth that Canada has. Yet its valuation remains reasonable. CGI’s stock price has risen along with the company’s profitability. Its three-year return of 36% and its 10-year return of 475% highlight the company’s success.

It is far more established and stable than BlackBerry. Maybe BlackBerry’s stock price can also achieve this success.

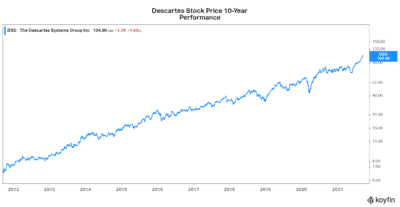

Descartes: A top tech stock with positive momentum

Descartes Systems Group (TSX:DSG)(NASDAQ:DSGX) is a $9 billion tech company with almost $500 million in revenue. It’s primarily focused on logistics and supply chain management. Compared to BlackBerry’s pursuits, it’s more established and safe. Growth is driven by the clear advantages to Descartes’s technology. In short, transportation and logistics companies have been brought into the light. For example, they are more efficient and reliable.

Descartes’s ultimate goal is to provide automation and optimization of the $4 billion logistics market. It’s consolidating this highly fragmented industry. Its acquisitions have expanded Descartes’s footprint while generating revenue and cost synergies. As a result, cash flows and margins have significantly increased.

Descartes is a tech stock that has a lot going for it. Its healthy balance sheet is a key strength. Its history of acquiring and integrating is second to none. And finally, it has a solid competitive position. The only drawback here is that Descartes stock is quite expensive. But I take comfort in the fact that the company continues to beat expectations.

Motley Fool: The bottom line

These three tech stocks have clear winning strategies. Although BlackBerry is at the beginning of its journey, it can very well achieve the same success as the other two. Therefore, they’re all top buys today. Just sit back while their technologies change the world and you make a handsome profit.