Toronto-Dominion Bank (TSX:TD)(NYSE:TD) is one of Canada’s two leading bank stocks. The other one, of course, is Royal Bank of Canada (TSX:RY)(NYSE:RY). Both Canadian banks have strong franchises. Both bank stocks are trading at all-time highs. What does this mean for Motley Fool investors?

Is it a bad time to buy bank stocks? Should you focus on the long-term outlook, which is positive? Or should you hold on and wait for a better entry point?

Bank stocks: Long-term vs. short-term

Long-term economic trends support the idea that Canadian banks will continue to thrive. For example, economic growth is rebounding, as consumers are increasing their spending. Also, vaccines are making their way through to the population. The reopening has only just begun. We can now look forward with more certainty. Clearly, many of the things that drive economic growth will eventually return.

But what about the shorter-term outlook? With bank stocks like TD and Royal Bank trading at all-time highs, what’s the upside from here? Are bank stocks too expensive to buy right now? I mean, there’s plenty of excess capital in the system, which is encouraging. This capital will drive increased investments but lower loan growth.

At this point, we are still not over the pandemic. While investors have reason to be optimistic, it seems like maybe valuations have gotten ahead of themselves. Because there’s still plenty of uncertainty. What will happen to jobs? Can Canadian banks re-establish credit card activity? Will loan growth return to previous levels? And finally, will inflation rear its ugly head?

TD Bank: A leader in driving efficiencies and risk culture

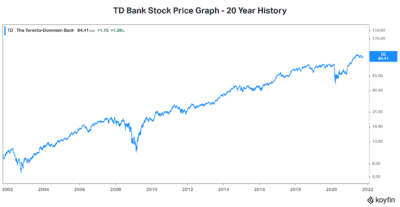

It’s truly remarkable to see how TD Bank stock has performed. For shareholders, the long-term stock chart is a sight to behold. In this Motley Fool article, I’m not debating whether I think TD Bank stock is a good investment. I’m simply stating that now is not the time to buy. I feel like there are too many potential problems brewing. Also, the stock is trading at all-time highs. Lastly, valuations are also near all-time highs.

Thankfully, TD Bank is a superbly diversified bank. We only need to look at its latest results to see this. In fact, in the first nine months of fiscal 2021, TD Bank blew the lights out. Earnings increased over 56% and provisions for credit losses are now being recovered. It’s a reflection of TD Bank’s strength. It’s also a reflection of a well-handled response to the pandemic.

Since 1995, TD Bank has delivered an 11% annualized dividend growth rate. The banks have been regulated to stop increasing dividends during the pandemic. But in the longer term, this dividend growth history shows no signs of stopping.

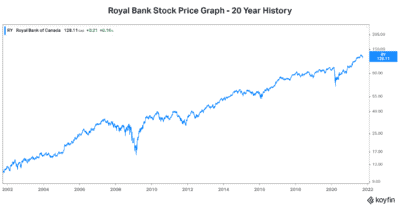

Royal Bank stock: A dominant position with leading returns and scale

Royal Bank is Canada’s largest bank, with a market capitalization of $182 billion. It enjoys leading operating efficiency and scale as well as a dominant market share in many segments. But like TD Bank, Royal Bank stock is also trading at all-time highs. Despite mounting risks, investors have piled into this stock. I recommend that Motley Fool investors stay on the sidelines for now. Consider piling in when the stock dips, as I believe it will.

In this recovery, the top two Canadian banks hope to capture market share. And given their leading scale and efficiencies, it might be a natural progression. As a result, I believe that in the long run, these banks will continue to please shareholders. However, let’s choose our entry points wisely.

The bottom line

TD Bank and Royal Bank have been pillars of success. Their long-term growth stories have brought shareholders stable income and capital gains. Once again they have survived and even thrived in a crisis. These stocks are definitely solid long-term holdings. However, I think that right now, there is a high risk of short-term stock price weakness. If you want to build a position in these Canadian banks, I recommend waiting to buy on this weakness.