You can make different types of investments inside a Tax-Free Savings Account (TFSA). One of the riskiest types of investments you can have in your TFSA is stocks. Because they are riskier, the potential return is much higher than that of a savings account, for example. When you buy stocks in your TFSA, your capital gains are not taxable, which means you can keep all the profits. On the other hand, you can’t claim capital losses. If you want to buy and hold stocks in your TFSA for a long period of time, blue-chip stocks are an excellent choice.

A blue-chip stock is a large company with a great reputation. These are usually large, well-established, financially sound companies that have been in operation for many years. They have reliable profits, often paying dividends to investors. Metro (TSX:MRU) and Fortis (TSX:FTS)(NYSE:FTS) are two excellent blue-chip stocks to buy in a TFSA.

Metro

This leading food and pharmaceutical company has operations in Quebec and Ontario. Metro is one of the largest food retailers in Canada with stores such as Metro Plus and Food Basics. Its pharmacies include Metro Pharmacy and Drug Basics.

Jean Coutu is the largest acquisition by Metro, which resulted in the creation of a $16 billion retail leader.

Not surprisingly, as the economy stalled, we still needed our basic necessities and the consumer sector remained strong, especially among grocery stocks. And Metro is among the best stocks among consumer staples.

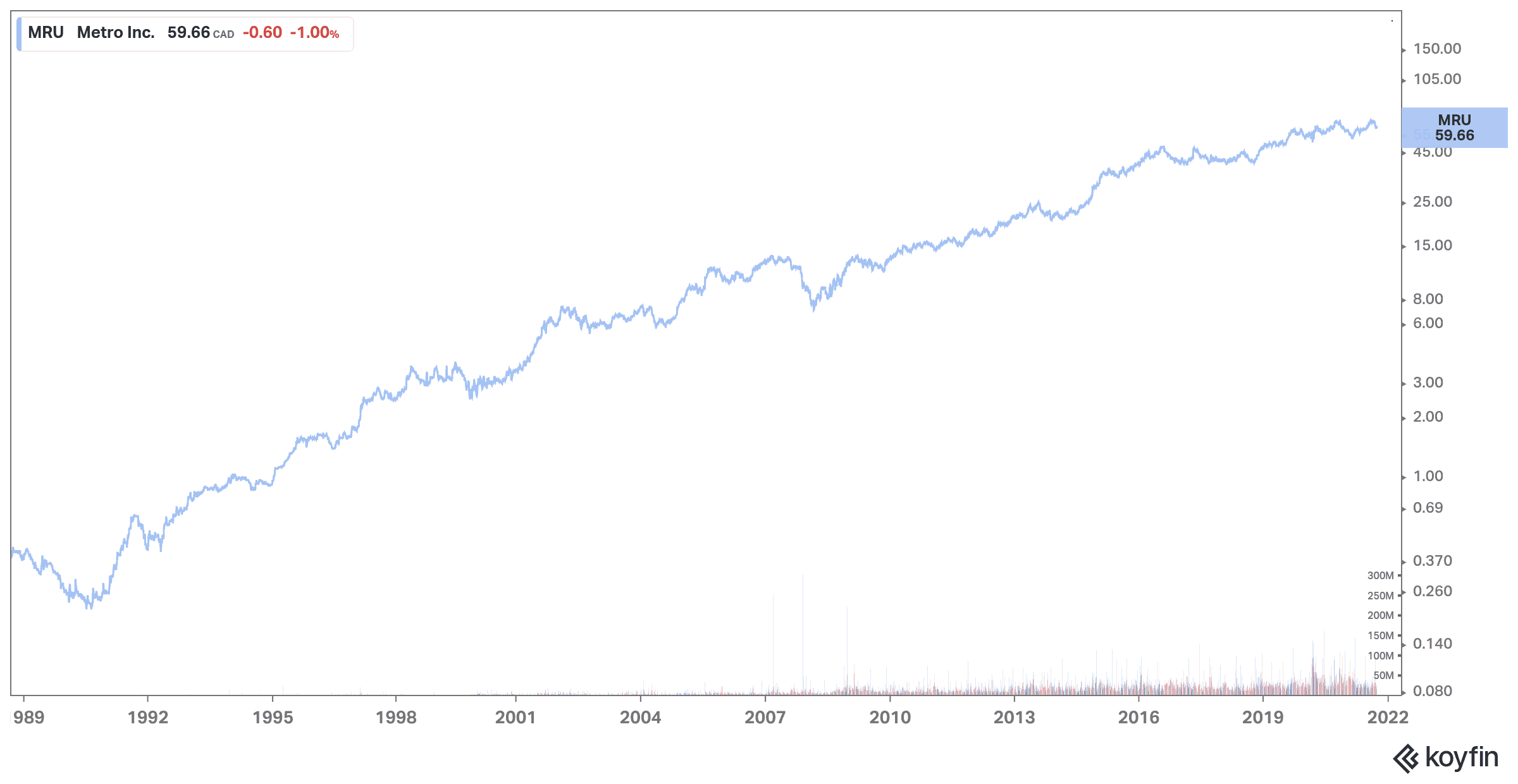

A quick glance at Metro’s long-term chart shows that the grocer has historically been a top performer. The stock is having consistent and reliable growth.

Despite its low yield of less than 2%, Metro is one of the best dividend growth stocks in the country. It has a 26-year dividend growth streak and a five-year compound annual growth rate (CAGR) of 14%.

In times of rising inflation, a company like Metro has the potential to outperform. Defensive consumer stocks like Metro tend to outperform growth stocks in environments of rising rates and inflation.

Fortis

This Canadian company is the country’s largest utility stock by market capitalization and one of the top 15 utilities in North America. It operates in 10 countries, but the majority of its assets and consumer base are in Canada and the United States.

The utility industry is highly regulated, often resulting in constant cash flow. With its 2.2 million electricity customers and 1.1 million gas customers paying their bills, Fortis has a very important source of income. As the population continues to grow, the demand for energy will increase with it and utility companies are able to take advantage of this.

The company is also gearing up for a green future and developing clean energy assets, so it would likely be ready when government policies or changing consumer sentiment accelerate the conversion to green energy.

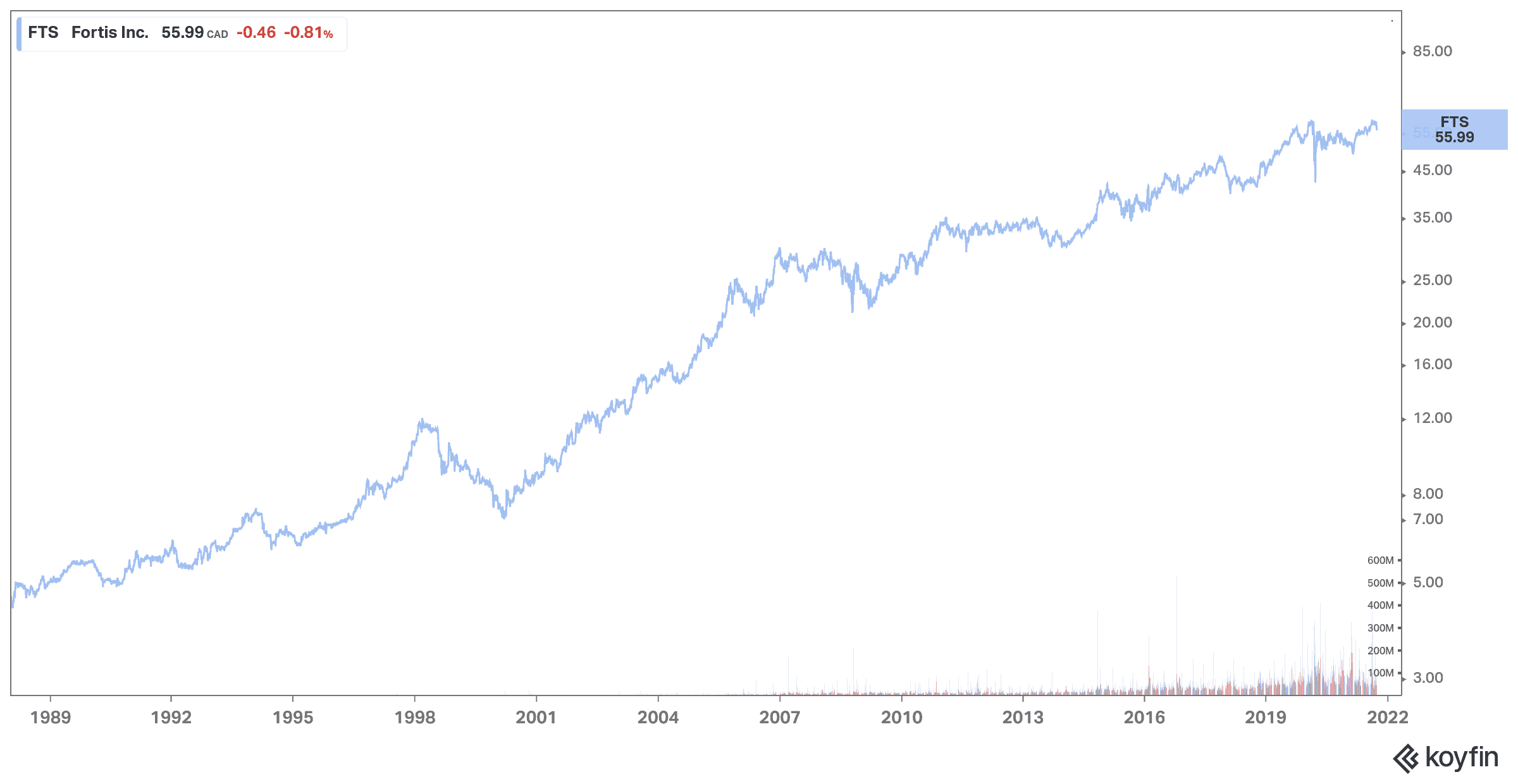

Fortis has the second-longest streak of dividend growth in Canada at 48 years.

With a yield above 3.5%, the company increased the dividend at a rate of 6.79% over five years with a payout rate below 60%.

Over the next five years, Fortis is expected to spend $19.6 billion in capital expenditures, allowing it to increase dividend payouts at an annual rate of 6% through 2025.