The tax-free savings account (TFSA) is continuously expanding. Today, it’s an account that provides us with ample opportunity for tax-free income. In fact, the TFSA contribution limit will increase by $6,000 in 2022, bringing the cumulative TFSA room to $81,500. That’s almost $100,000 of investments that are sheltered from taxes. Therefore, it’s imperative that investors try to max out on this contribution room. The tax savings are significant. In fact, they’re a game-changer. For example, let’s assume that we invest $80,000. If that investment comes with a 5% dividend yield, that’s $4,000 in annual dividend income Tax-free!

Without further ado, here are the three top dividend stocks to buy for your TFSA.

Canadian Natural Resources stock: A TFSA stock with big upside

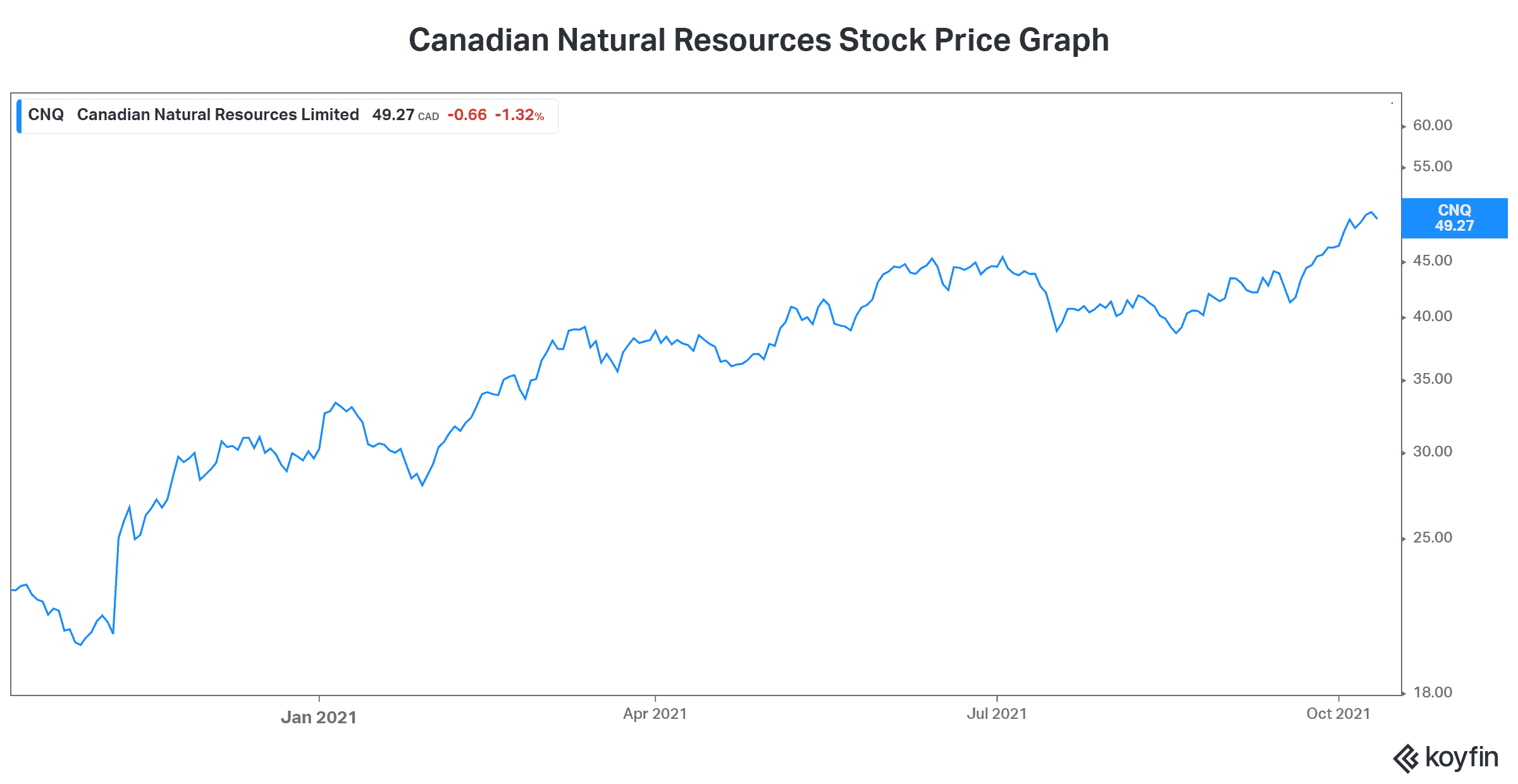

Energy stocks have been roaring back in 2021. And Canadian Natural Resources TSX:CNQ)(NYSE:CNQ) is no different. In fact, it’s one of the leaders. It’s a Canadian oil and gas company with a highly diversified and resilient asset base. This translates into a high degree of predictability. It also translates into shareholder value creation.

We at Motley Fool like to hear that, as do all investors. TFSA investors have already benefitted big by owning Canadian Natural stock. The stock has been extremely resilient through difficult times. In 2021, CNQ stock has soared over 60%. And as a nice bonus, its dividend yield stands at 3.8% today – and was much higher earlier this year when the stock price was lower.

Enbridge stock: A TFSA stock with a 6.5% dividend yield

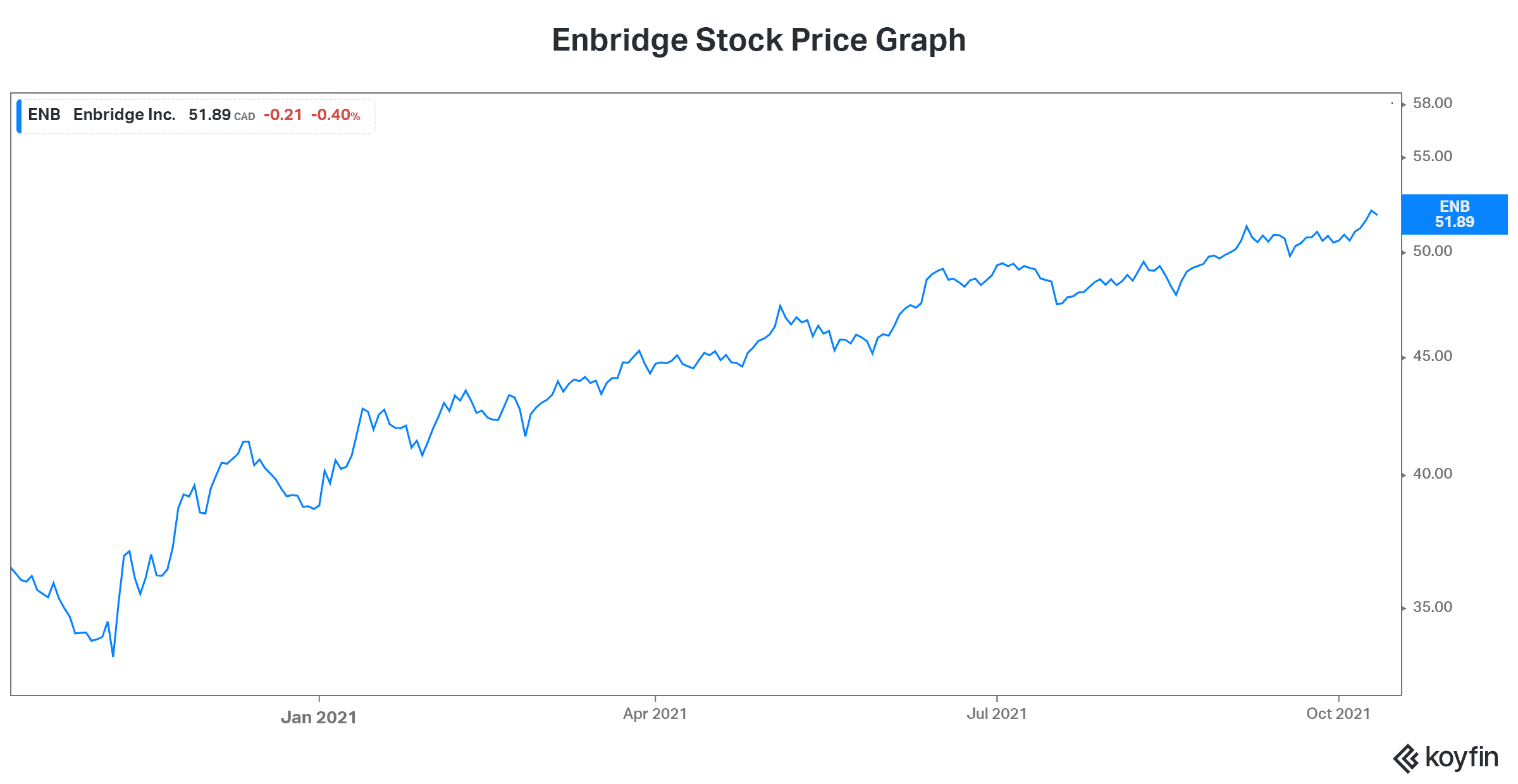

Oil and gas infrastructure is a big business. And Enbridge is a big company with a $105 billion market capitalization. In short, Enbridge (TSX:ENB)(NYSE:ENB) is one of Canada’s leading energy transportation and distribution giants. It has oil and gas assets and operations across North America. These are assets that have delivered steadily rising cash flows and stable returns and make a perfect addition to a TFSA account.

Today, Enbridge’s dividend yield is a solid 6.5%. This dividend has grown consistently over time and will continue to grow. In the last five years, Enbridge’s dividend has grown at a compound annual growth rate of 8.85%. Let me remind you, this was a period when the price of oil was extremely volatile. But Enbridge continued to chug along, happily growing its cash flow and increasing its dividend.

The demand for oil and gas is rising. And this will take energy stocks like Enbridge higher over the next few years.

Fortis stock: A TFSA stock for predictability and security

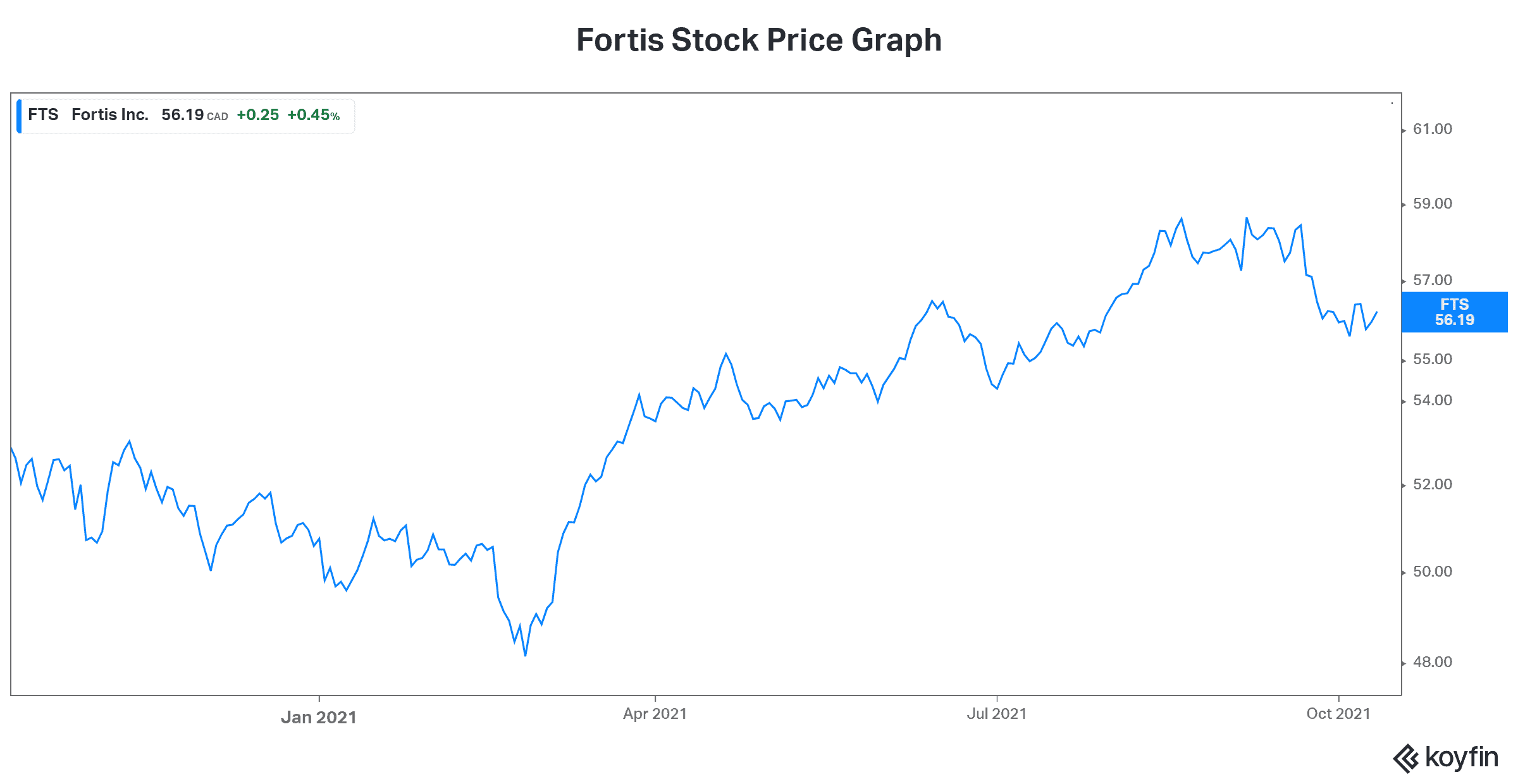

Fortis (TSX:FTS)(NYSE:FTS) is a gem. It’s a dividend stock with an almost 50-year history of dividend payments and dividend growth. Fortis has, in fact, been an investor’s dream. Today, Fortis is still an ideal stock for TFSA investors. It will provide you with years of dividend income, without worries.

Fortis is a leading North American regulated gas and electric utility company. This is a business that’s highly defensive. And Fortis is a company that’s also highly defensive, affording it the ability to raise dividends all these years. It’s also behind Fortis stock’s consistent and steady rise higher over many decades. Going forward, Fortis expects continued dividend growth. In fact, the company expects a 6% annual dividend growth rate through 2025.

The bottom line

With the TFSA contribution limit set to increase again in 2022, investors should consider adding all or some of the stocks mentioned in this Motley Fool article. Enbridge stock is the highest yielding, but all are valid options. This is because years of dividend growth, combined with years of dividend tax savings, make them ideal TFSA stocks to buy today.