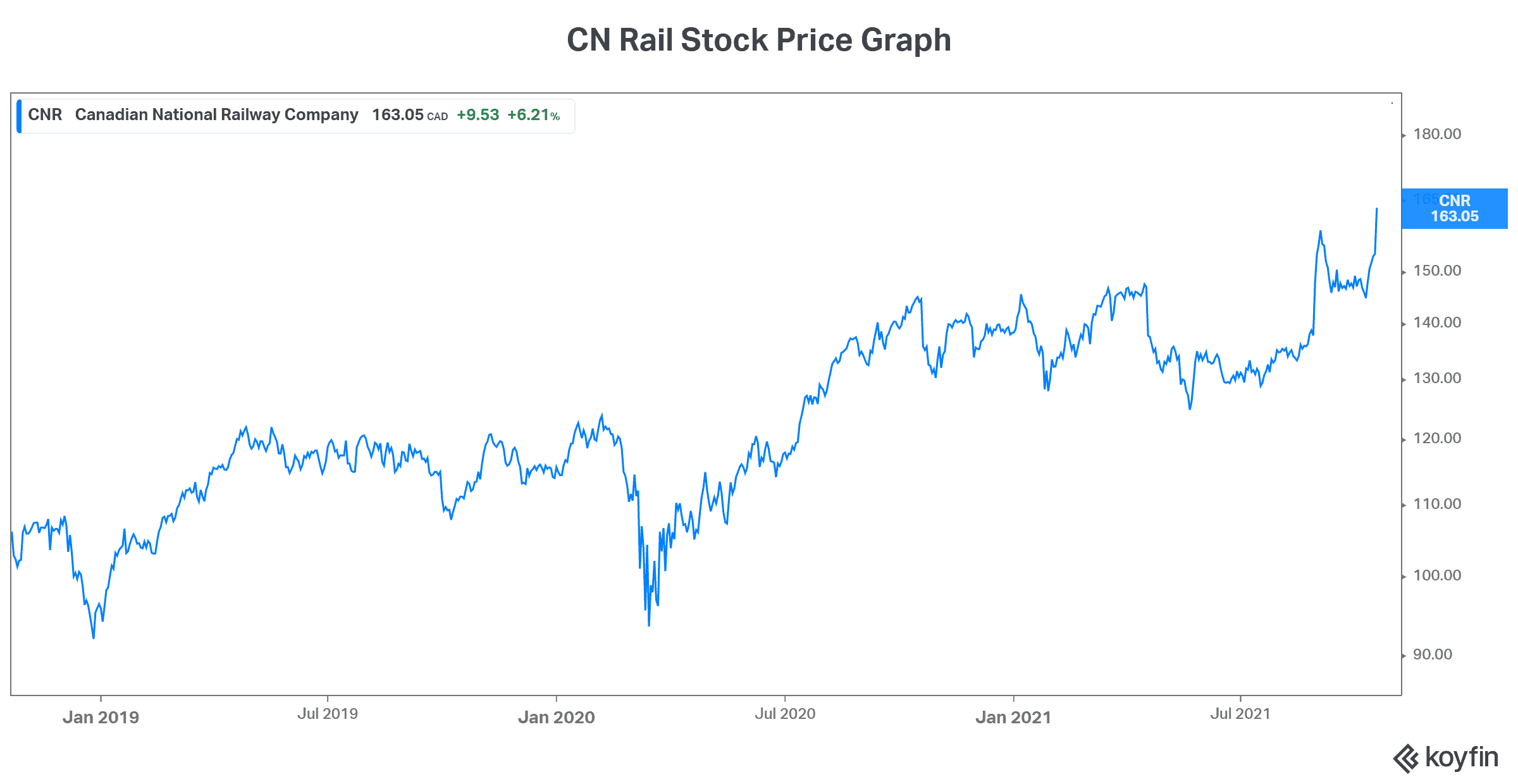

Canadian National Railway (TSX:CNR)(NYSE:CNI) doesn’t really need an introduction. It is, in fact, very well known for its size and presence in our supply chain. Yesterday, CN Rail reported its third-quarter earnings. Today, CN Rail stock price is rising.

Let’s dive into the results and see why Canadian National stock is rising.

CN Rail stock: Through thick and thin

Canadian National is the backbone of the Canadian economy. The Canadian railways, such as CN, transport more than $250 billion of goods annually. These goods come from a diversified list of sectors. This includes the resource sector (grain crops), crude oil, manufactured products, and consumer goods. In short, CN’s business is essential to the functioning of the Canadian economy. Also, CN has a wide moat and little competition. This is clearly a very attractive profile for any investor.

In CN Rail’s Q3 earnings results, we can clearly see the benefits of CN’s business model and strategy. Its diversified list of revenue sources has offered stability in revenues. When one sector’s volumes are weak, usually another one makes up for it. In the end, this leaves the company’s financials in a good place. It keeps us investors happy.

So, in Q3, revenue rose a respectable 5%, despite volumes declining 1%. A disappointing part of the result was CN’s operating ratio, which came in higher. Please recall that the lower the operating ratio, the better, as it’s a measure of cost efficiencies. I take comfort in the fact that the ratio was negatively impacted by one-time items, such as forest fires and global supply chain issues. Normalizing the ratio, it comes in at 59%, which is a phenomenal result. Free cash flow generated was just over $2 billion, returns were strong, and the business performed well.

CN Rail: The hydrogen economy to be as big as crude by rail?

Just as important as the company’s Q3 performance are its outlook and prospects. On this front, CN Rail is also thriving. 2022 should be a great year, with an expected 10% EPS growth rate and free cash flow of over $3 billion. And we have the emerging green business to look forward to.

Shipments of crude oil have really driven CN’s performance over the last few years. This has been the result of a lack of pipeline capacity. It was never anyone’s preferred mode of transportation for crude. This business was therefore always contingent on pipeline capacity status. So, it’s nice but not really the kind of business you can rely on.

The future for Canadian National Railway is shaping up. While inflation is rising, there are many new opportunities emerging for CN. For example, the use in technology is already driving increased efficiencies at CN. Also, there’s a big opportunity for rails to be more relevant to the supply chain. This means capturing more highway freight and competing with other modes in general. Lastly, the emerging hydrogen economy in western Canada will be a big opportunity for CN in the future.

According to management, this hydrogen business will be on the scale of the crude-by-rail business at its peak. And it will have long-term staying power. In fact, the government has signed an agreement for the building of a $1.3 billion hydrogen plant in Edmonton. This plant would produce clean-burning hydrogen fuel from natural gas. It would produce hydrogen-fueled electricity and liquid hydrogen for transportation. In turn, hydrogen products would make up part of the new green carloads that will increasingly be part of CN’s business.

Motley Fool: The bottom line

Canadian National Railway stock has historically been a top place to be for investors. Today is no different. After a difficult period due to the pandemic, CN is reporting strong results again. And CN Rail’s stock price is once again surpassing all-time highs. The company even reinstituted its share-buyback program as a way to return cash to shareholders. Lastly, CN is ready for the future. Investors can consider this stock a top holding that’s very shareholder friendly.