Bombardier (TSX:BBD.b) had been one of Canada’s “great corporations” for many years. Today, it’s hanging on by a thread. It is, in fact, significantly smaller than what it was – unrecognizable to those of us who knew it way back when. With the release of third-quarter results, Motley Fool investors may be asking whether it’s time to buy Bombardier stock.

Let’s take a look.

Bombardier stock: a long and sordid history

Bombardier is a cautionary tale. More than 20 years ago, Bombardier stock was flying high and seemed untouchable. But in the background, there was always the issue of government subsidies. Would Bombardier even have a business without these subsidies?

Today, this is all history. In the end, a massive amount of money was lost on all sides. In fact, Bombardier is a shell of what it used to be. To escape bankruptcy, the company initiated a complete shakeup. It sold its commercial jet division. It also sold its train division. Not surprisingly, Bombardier stock got killed.

Bombardier’s third-quarter results: A glimmer of hope?

At this time, Bombardier is focused on the business jet market. It’s a much smaller market than what some of us may be used to with Bombardier. But it’s a healthy one. In fact, business jet flight hours are currently above 2019 levels. In the U.S. flight hours have actually risen more than 40% so far in 2021.

This positive backdrop is evident in Bombardier’s third-quarter results. Revenue rose, earnings improved, and free cash flow was $100 million. For a company that was on the verge of bankruptcy not too long ago, this is huge. So Bombardier is thinking strategically in this new era. Cost-cutting, efficiency drivers, margins, and cash flow are the priorities.

I think that it’s good that Bombardier is finally talking about the right things. Bombardier always had quality aircraft. It always has the expertise. The problem was in costs, efficiency, organization, and profits. Essentially, it wasn’t a “real” business. I mean, subsidies sheltered Bombardier from the consequences of a badly run business. As we all know, this did not end well.

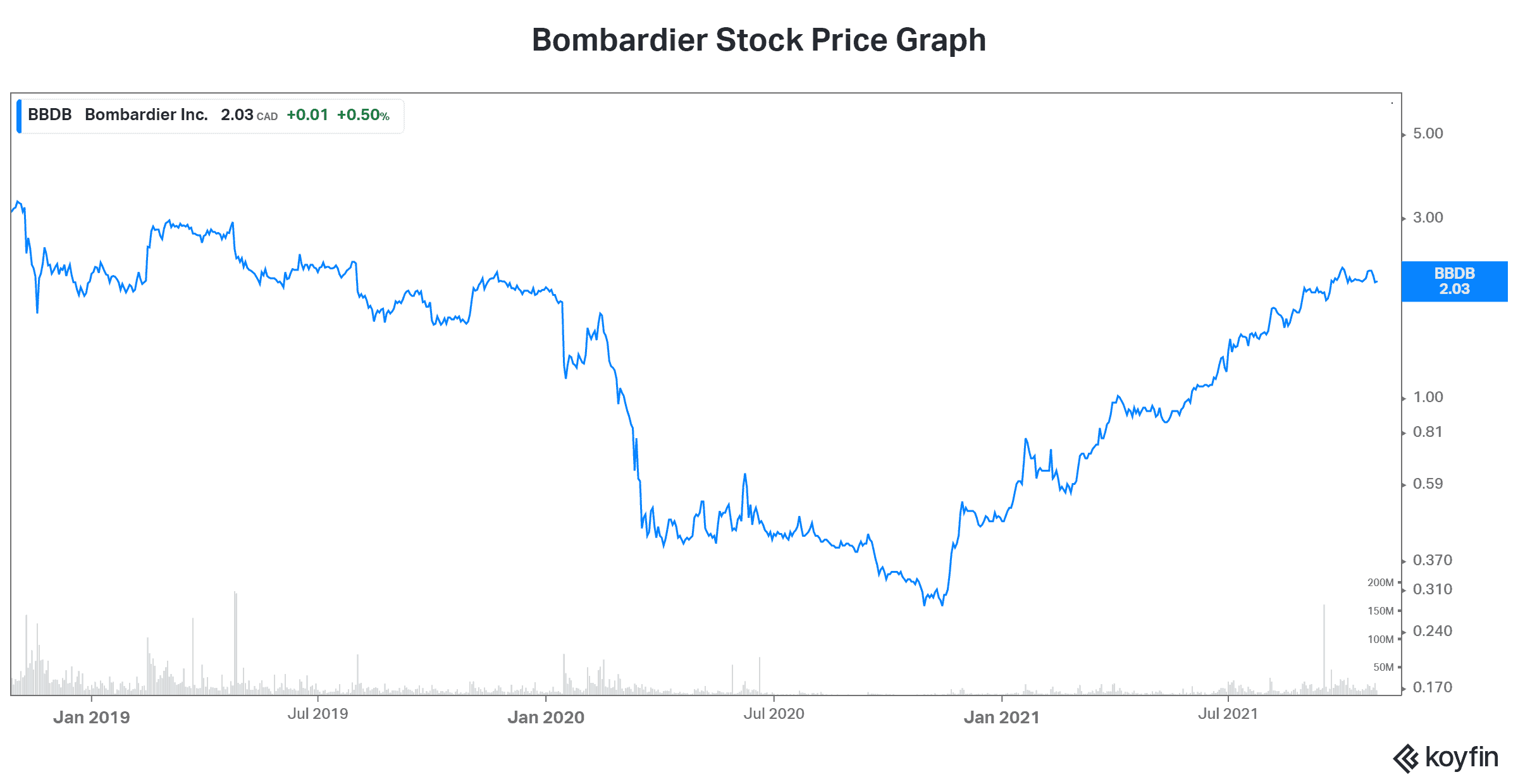

Bombardier stock rallies 320% in 2021

It’s pretty shocking that Bombardier stock started the year trading at only $0.48 per share. There are a few things worth noting here. In a nutshell, the urgency of the situation has eased a bit. Bombardier’s debt situation is significantly improved. The company has basically bought itself more time. There are no debt maturities until December 2024. This has also come with major interest savings and will form the building blocks for better days ahead.

So this is certainly all good. But make no mistake, Bombardier stock is still a high-risk proposition. I like the fact that it’s focusing hard on the servicing markets. And as flight hours increase, service facilities are filling up fast. This is very positive as it’s a higher margin revenue stream. It’s also a less capital-intensive one. Finally, the services revenue stream is also a more repeatable and predictable one. These are all good things for this company that has been sorely lacking these qualities.

The bottom line

Bombardier stock is certainly starting to look interesting here. It’s well-suited for Motley Fool investors that are looking for a high-risk, high-return scenario. Keep in mind though, Bombardier is not out of the woods yet: it will take time to build its new strategy. The upside is big but the downside remains.