Energy stocks have been on the rise in 2021, and so have their dividends. It’s amazing the difference a year can make. Last year, oil and natural gas stocks were basically left for dead. Today, they are rip-roaring skyward, as energy prices soar!

Canadian energy stocks are better positioned than before the pandemic

The exciting part is that Canadian energy stocks are much better businesses than they were even prior to the pandemic. The oil market crash in 2020 forced many traditional energy companies to shore up their balance sheets, reduce spending, lower their production costs, and unlock operational efficiencies. Many of these oil stocks are now breaking even at $40 per barrel of oil or less.

Suncor Energy stock is gaining momentum

One stock really starting to gain some momentum today is Suncor Energy (TSX:SU)(NYSE:SU). Prior to the pandemic, it was known as a reliable passive-income fixture for many Canadian investors. When it drastically cut its dividend in 2020, many investors were shocked and stepped away from the stock.

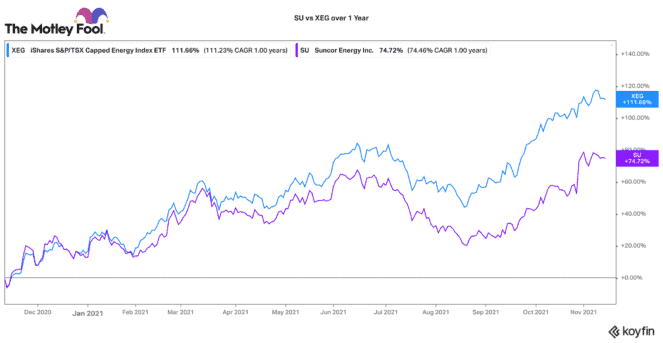

Higher debt, operational challenges, and poor sentiment have caused this stock to significantly underperform its TSX energy peers. While the S&P/TSX Capped Energy Index is up 111% over the past year, Suncor has only risen 74%. However, this is all starting to change.

Frankly, there was a lot to like when Suncor announced its third-quarter results in late October. In the quarter, oil production increased more than 13% over last year. Earnings from refining increased by almost two-thirds! Suncor delivered $0.71 per share in net earnings and $2.64 billion in funds from operation. Strength in energy prices and improving production capacity have clearly improved confidence in its business.

Suncor doubles its dividend after a strong third quarter

At the end of October, Suncor announced that it is doubling its dividend and effectively re-instating its payout to its pre-COVID-19 level. Its quarterly dividend will be increased from $0.21 per share to $0.42 per share. That moved Suncor’s dividend yield from around 3% to nearly 6%. The market clearly liked this move, because Suncor stock shot up 15% at one point.

Not only that, but Suncor’s board authorized the purchase of up to 7% (or 107 million) of Suncor’s shares over the next few months. Already this year, Suncor has bought back 63 million shares worth $1.7 billion. That is around 4% of the outstanding share count.

In addition, over 2021, Suncor has reduced its debt level by $3.1 billion. By year end, it expects total debt to drop to $15 billion. That would actually be $1 billion lower than its pre-pandemic levels.

A great dividend and some solid upside

All in all, Suncor is looking like a very interesting dividend stock to own. It is doing all the right things. After paying its capital expenses and funding the newly increased dividend, Suncor will split future free cash flow between share buybacks and debt reduction.

If energy prices remain constant or even rise, Suncor should be primed to keep rewarding shareholders. This energy super-major still trades at a discount to other peers. It could be a pretty sweet opportunity to clip some nice dividends and solid capital upside over the next few years.