Soaring cash flows drive shareholder value. Of course, there are other things, but I’m talking real shareholder value. The kind that’s lasting. The kind that puts money in our pocket today and tomorrow. Right now the energy patch is a place where it’s raining cash. I mean, the sector is pumping out cash flow at a feverish pace.

So which energy stocks should you buy to benefit from this? Read on, I’ll walk you through my best picks: Cenovus Energy (TSX:CVE)NYSE:CVE), Peyto Exploration and Development (TSX:PEY), and Tourmaline Oil (TSX:TOU)(NYSE:TOU).

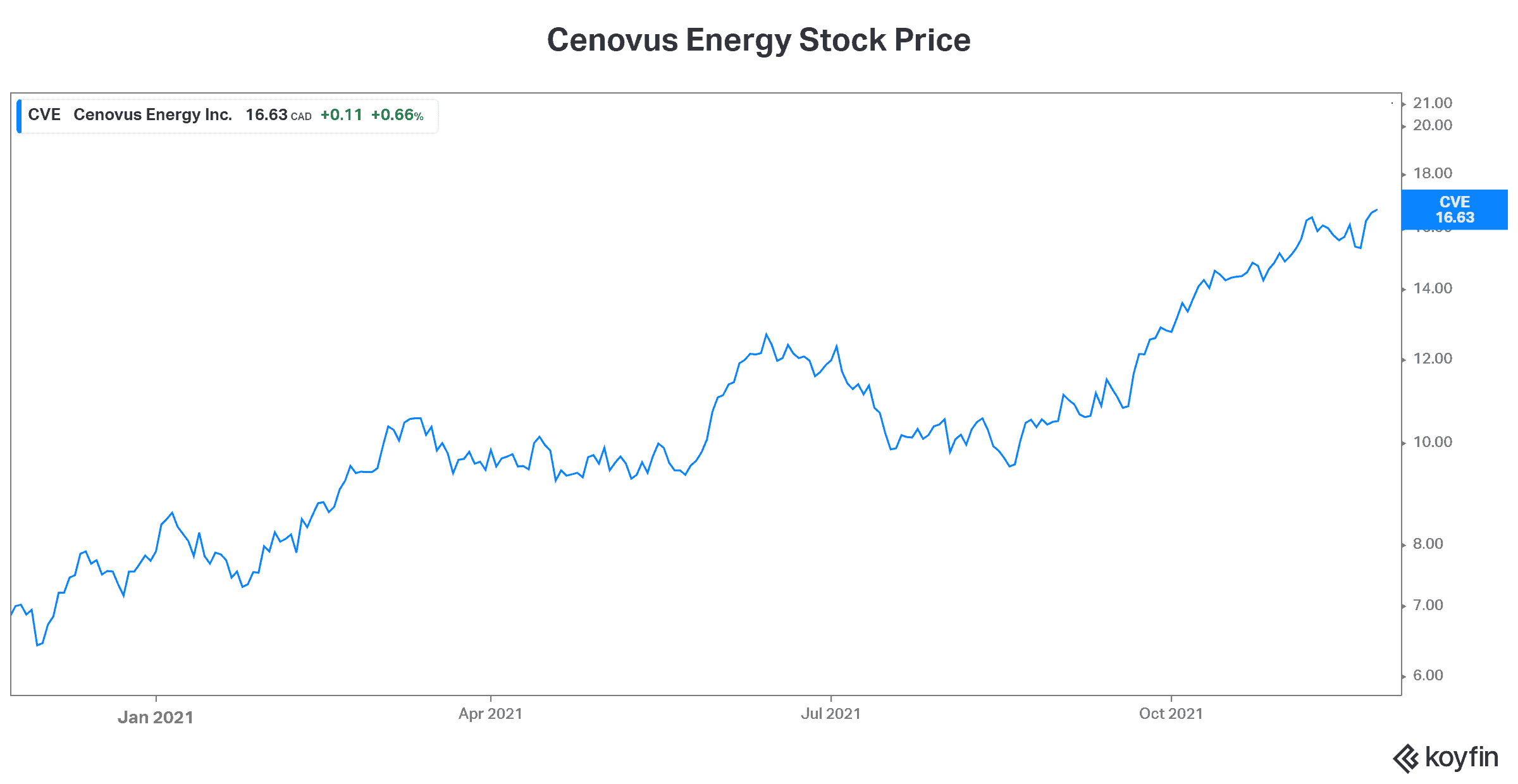

Cenovus Energy stock: 400% plus increase in cash flows

Cenovus Energy is the third-largest Canadian oil and gas producer. It’s also the second-largest Canadian-based refiner and upgrader. After many years of being ignored and undervalued, Cenovus Energy stock is finally in demand. Investors are buying this quality energy stock because shareholders have been making extreme amounts of money holding it.

The company’s latest quarterly results included a 400% plus an increase in cash flows and a doubling of the dividend. But it won’t stop here. In fact, the oil and gas boom has only begun. The positive fundamentals keep building. In short, the momentum is strong.

Demand is high and supply is low. This is true in the oil and gas commodity world. And it’s also true with respect to Canadian energy stocks. There are not that many left out there, especially top-quality ones like Cenovus. So the ones that are left will be in increasingly high demand. The longer these companies keep growing their cash flows so rapidly, the more investors will be clamoring for the stocks. This is what I expect will happen as we see fourth-quarter results in 2022.

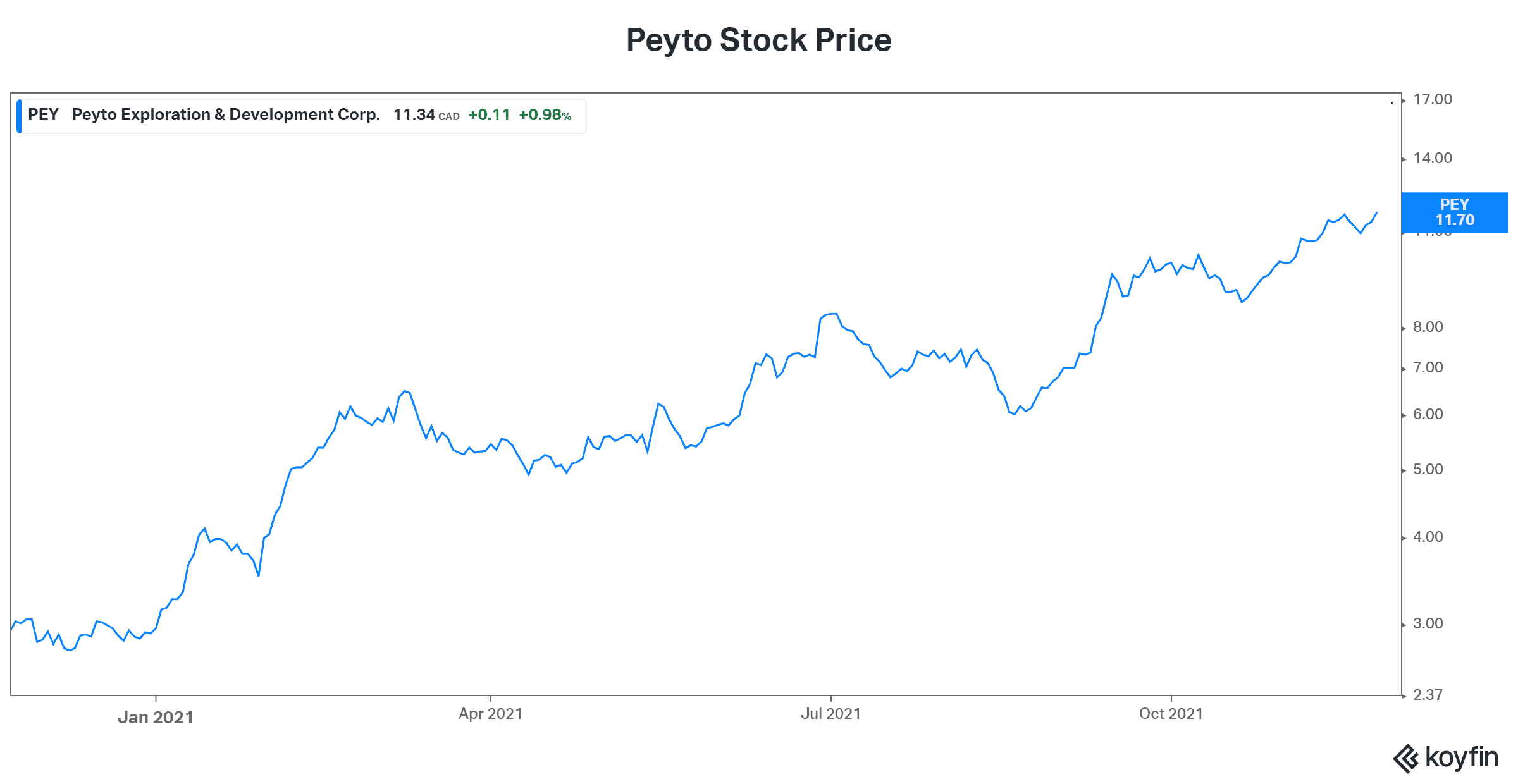

Peyto Stock: Natural gas leader doubling cash flows

Natural gas is a relatively low-carbon, low-emitting fuel. It’s the easiest replacement for high-carbon fuels such as coal. It will certainly be a key transition fuel as we fight to reduce our carbon footprint. There are many Canadian energy companies that will benefit from these simple facts. Peyto is one of them.

Peyto is one of Canada’s lowest-cost natural gas producers. The company has an exceptional asset base that’s benefitting from soaring natural gas prices. Finally, Peyto’s stock price is starting to reflect this. In fact, Peyto stock has risen significantly in 2021 as natural gas prices have skyrocketed. But the best part is yet to come. In fact, once Peyto is free from the hedging contracts that locked it into lower pricing, we’ll see even stronger growth. In short, 2022 will be significantly better than 2021.

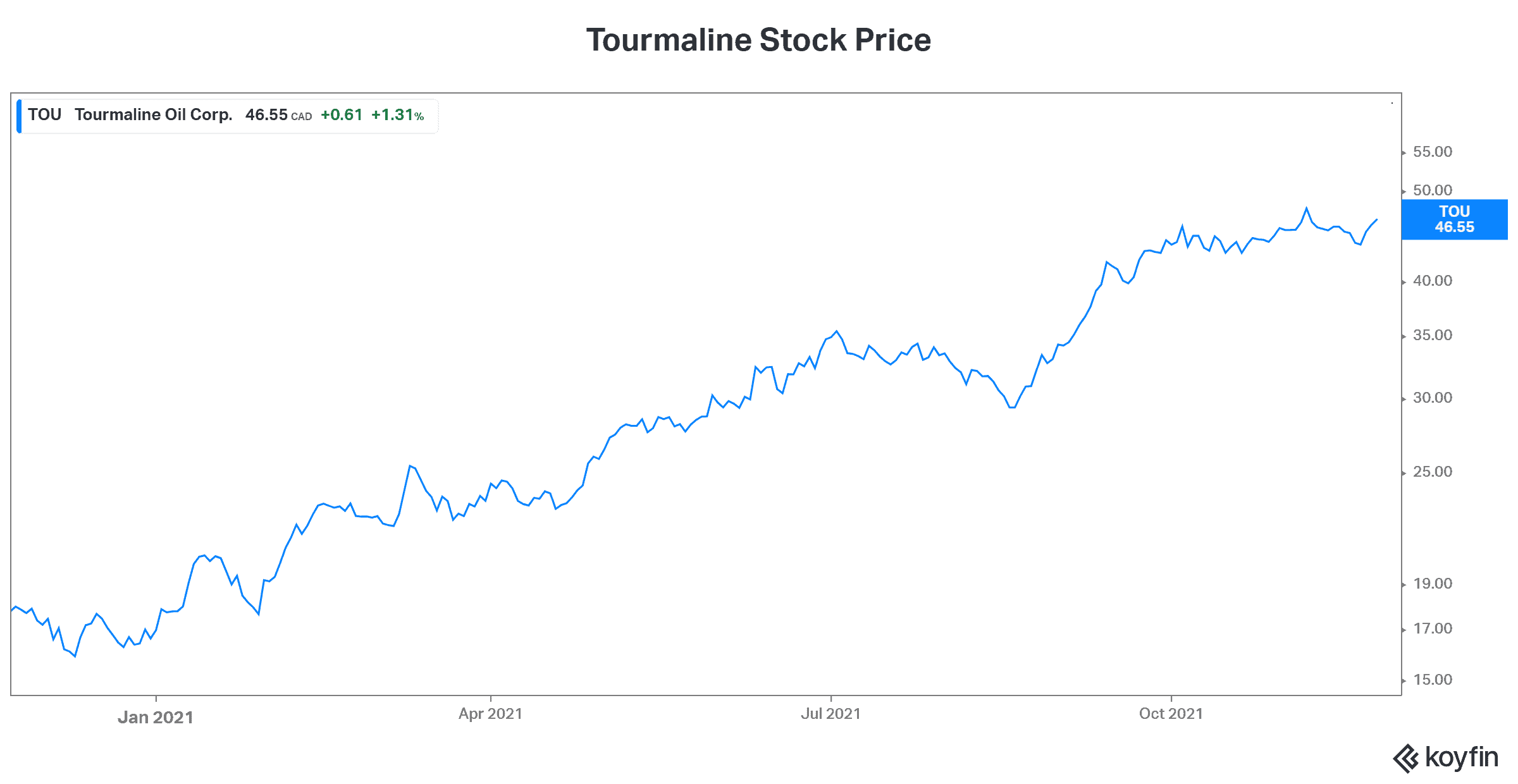

Tourmaline stock: Natural gas focus driving a 200% cash flow growth rate

Natural gas has soared 73% in the last year. This has come at a time when supply is low and demand is rising. It’s also a time of growing recognition that natural gas will still be needed for years to come. Tourmaline is well-positioned for this. Hence, its cash flows are soaring – as is Tourmaline’s stock price.

Ultimately, these soaring cash flows are translating into rapidly increasing shareholder returns. Tourmaline’s dividend growth in the last year has been nothing short of spectacular. Its regular annual dividend has grown over 40% to $0.68 per share. And the company announced a special dividend of $0.75 per share just last month. Looking ahead, management intends to continue to pay out excess cash flow in the form of dividends. Rising natural gas prices into 2022 can be expected to continue to prop up Tourmaline stock as well as other natural gas stocks.

The bottom line

Energy stocks are finally on the upswing after being in the doghouse for so long. This has come with the simple recognition that oil and gas is still necessary to power our lives.