Warren Buffett once said, “Diversification may preserve wealth, but concentration builds wealth.”

While buying an index fund and taking a passive approach to investing may be the best avenue for most investors to get market returns, smart stock picking could potentially lead to outperformance if you do your due diligence and hold for the long term.

So, the question is, if you were to create a Canadian stock portfolio, what would be your picks? Here are my top five.

Criteria and portfolio construction

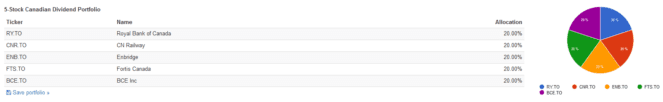

I opted for large-cap companies that have a history of profitable earnings, lower beta (volatility vs. the market), consistent dividend payments with ever-increasing yields, and wide economic moats. I then selected five blue-chip companies with these traits that were also “the best in class” among their industry peers:

- Bank: Royal Bank of Canada

- Railway: Canada National Railway

- Pipeline: Enbridge

- Telecom: BCE

- Utility: Fortis

When constructing this portfolio, I opted for an equal weighting of 20% to each stock, and annual portfolio rebalancing for simplicity. Dividends should be reinvested every quarter.

Historical performance

A cautionary statement before we dive in: past performance is no guarantee of future results, which can and will vary. The portfolio returns presented below are hypothetical and backtested. The returns do not reflect trading costs, transaction fees, or taxes, which can cause drag.

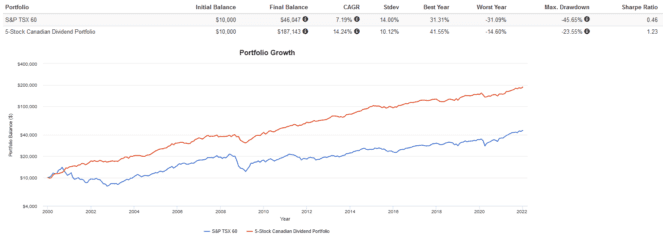

From December 31, 1999, to December 21, 2021, the Five-Stock Canadian Dividend Portfolio outperformed iShares S&P/TSX 60 Index ETF (TSX:XIU) on multiple metrics:

- Absolute returns: Higher CAGR of 14.24% vs. 7.19%

- Risk-adjusted returns: Higher Sharpe ratio of 1.23 vs. 0.46

- Volatility: Lower standard deviation of 10.12% vs. 14.00%

- Drawdowns: Lower peak-to-trough loss of -23.56% vs. -25.65%

An amount of 10,000 deposited at the start of the 22-year period and held to the end would have resulted in a final sum of $187,143 for the Five-Stock Canadian Dividend Portfolio compared to just $46,047 for XIU.

The Foolish takeaway

For investors looking to make a concentrated bet on the Canadian stock market, the Five-Stock Canadian Dividend Portfolio could be a viable alternative to the S&P/TSX 60 Index. However, investors should be aware of idiosyncratic risk when it comes to this portfolio. That is, the risk that one of the five picks no longer does as well in the future.

This portfolio also requires more work rebalancing holdings and reinvesting dividends. Investors must also fend off the urge to chase performance when a particular company does well or panic sell when one does poorly. Investors should continually assess each company’s present and future performance prospects and keep up with the news for maximum success.