Strong dividend stocks are really bright spots in investor portfolios. They provide passive income. And ideally, this passive income is growing. They also provide stability. The trick is to find those dividend stocks that have all of these qualities of stability, growth, and resiliency. It’s a rewarding exercise. In short, strong dividend stocks help with funding our living expenses and/or our retirement. So, what should we look for in dividend stocks? Well, we should look for stocks like Enbridge (TSX:ENB)(NYSE:ENB).

Simply put, Enbridge stock has a safe and growing business that can withstand a lot. Keep reading to find out why Enbridge is a dividend stock with a bright future.

Enbridge is setting itself up for continued stability

Being in the fossil fuels industry, it may seem counterintuitive when I say that Enbridge has a bright future. But hear me out. Renewables account for an increasing proportion of Enbridge’s earnings. It’s true that renewable power generation revenue at Enbridge remains very insignificant as a percentage of total revenue. But at least it now warrants a line in Enbridge’s revenue breakdown. This is a big step and is symbolic of the changes happening at Enbridge.

Enbridge is investing big in the future of energy. This means wind power, solar power, and everything renewables. For example, the company has entered the offshore wind market. It has three French offshore wind projects due for completion soon. Also, one of Enbridge’s long-term goals is to make sure that its assets are leveraged for hydrogen.

It also means investing in cleaning up the fossil fuels industry. It’s involved in carbon capture and in making its pipelines increasingly environmentally friendly. In short, this company is determined to gain a position in the clean energy future. And this means a lot for me as an investor. Because what this says is that Enbridge is responding to the changes in the energy industry. It goes a long way in ensuring that Enbridge has a place at the table in future energy deals.

Enbridge stock: A growing dividend

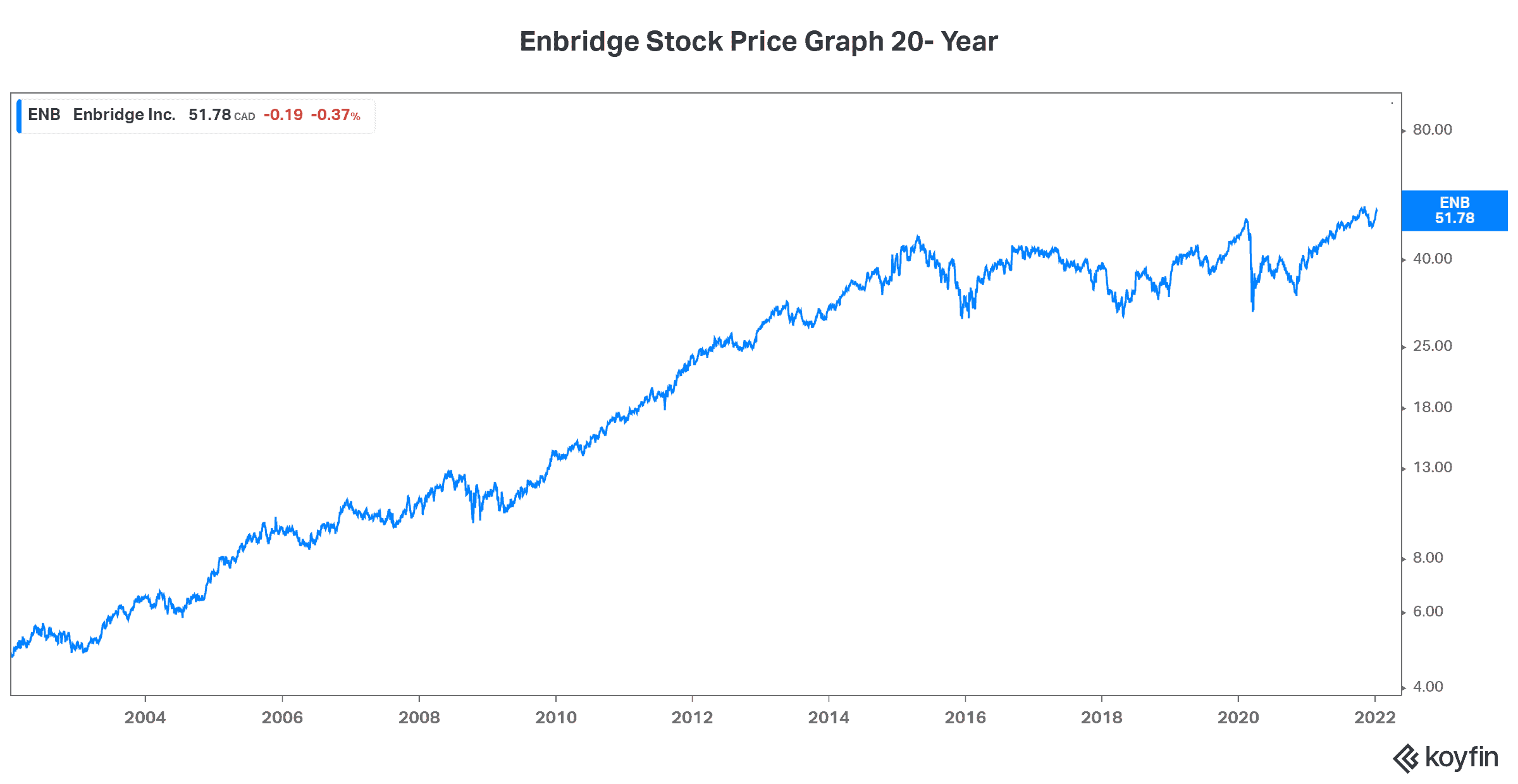

Enbridge has 26 years of dividend growth at a 10% compound annual growth rate (CAGR). This has been driven by Enbridge’s predictable business that has resilient and long-life cash flows. Today, Enbridge is a dividend stock that’s yielding a generous 6.6%. This yield is quite high, giving investors the chance for some significant passive income. It’s a significant part of Enbridge’s value proposition. Enbridge’s stock price appreciation is the other part.

Enbridge has staying power

Enbridge’s assets are a critical piece of North America’s energy infrastructure. In fact, Enbridge is one of North America’s leading energy infrastructure companies. It transports about 25% of the crude oil produced in North America. It also transports nearly 20% of the natural gas consumed in the United Stated. And to top this off, Enbridge Gas is North America’s third-largest natural gas utility. This presence will ensure that Enbridge remains at the forefront in the energy infrastructure business for years to come. Its extensive reach, connections, and assets will continue to be valuable as the energy industry transitions.

Motley Fool: The bottom line

Today, Enbridge is the oil and gas infrastructure giant that has a history of strong shareholder returns. It’s one of the most attractive dividend stocks because of this. Also, in my view, Enbridge’s stock price is mispriced for obvious reasons (it’s in the fossil fuels industry). With a very generous dividend yield today and a plan to transition to clean energy for tomorrow, Enbridge is a top dividend stock with a bright future.