Inflation is coming. In 2022, a myriad of factors are causing economists to sound the alarm on inflation. Far from being transitory, this sharp rise in inflation has staying power. This should have us thinking of ways that we can hedge our portfolios against inflation. Gold stocks like Barrick Gold (TSX:ABX)(NYSE:GOLD) are the best way to do this. They provide passive income with a hedge against inflation.

Simply put, gold stocks like Barrick Gold are a natural inflation hedge.

Hedge inflation with Barrick Gold stock

You may be thinking, “So what? Money has been mispriced forever.” Yet gold stocks have lagged. The market keeps going up and thriving. You may also be thinking that inflation has been looming for a long time now. Yet, gold stocks like Barrick Gold have underperformed dramatically. We cannot ignore this inflation reality any longer.

The U.S. inflation rate is at 40-year highs. Over time, this inflation will reduce the value of the U.S. dollar. Remember that the value of gold is inversely related to the value of the U.S. dollar. This means that we can expect a falling U.S. dollar. This, in turn, will cause investors to flock to better stores of value, such as gold.

Barrick Gold stock: The most well-known gold stock globally

Barrick Gold is one of the largest and most well-known gold stocks on the TSX and globally. It has a market cap of at $43 billion, and it’s the go-to stock for gold exposure. Also, Barrick’s assets are spread all over the world. This includes some politically risky and unsafe areas. So, Barrick Gold is an established safe haven in times of trouble. Because gold is a good store of value, this gold stock should be the same.

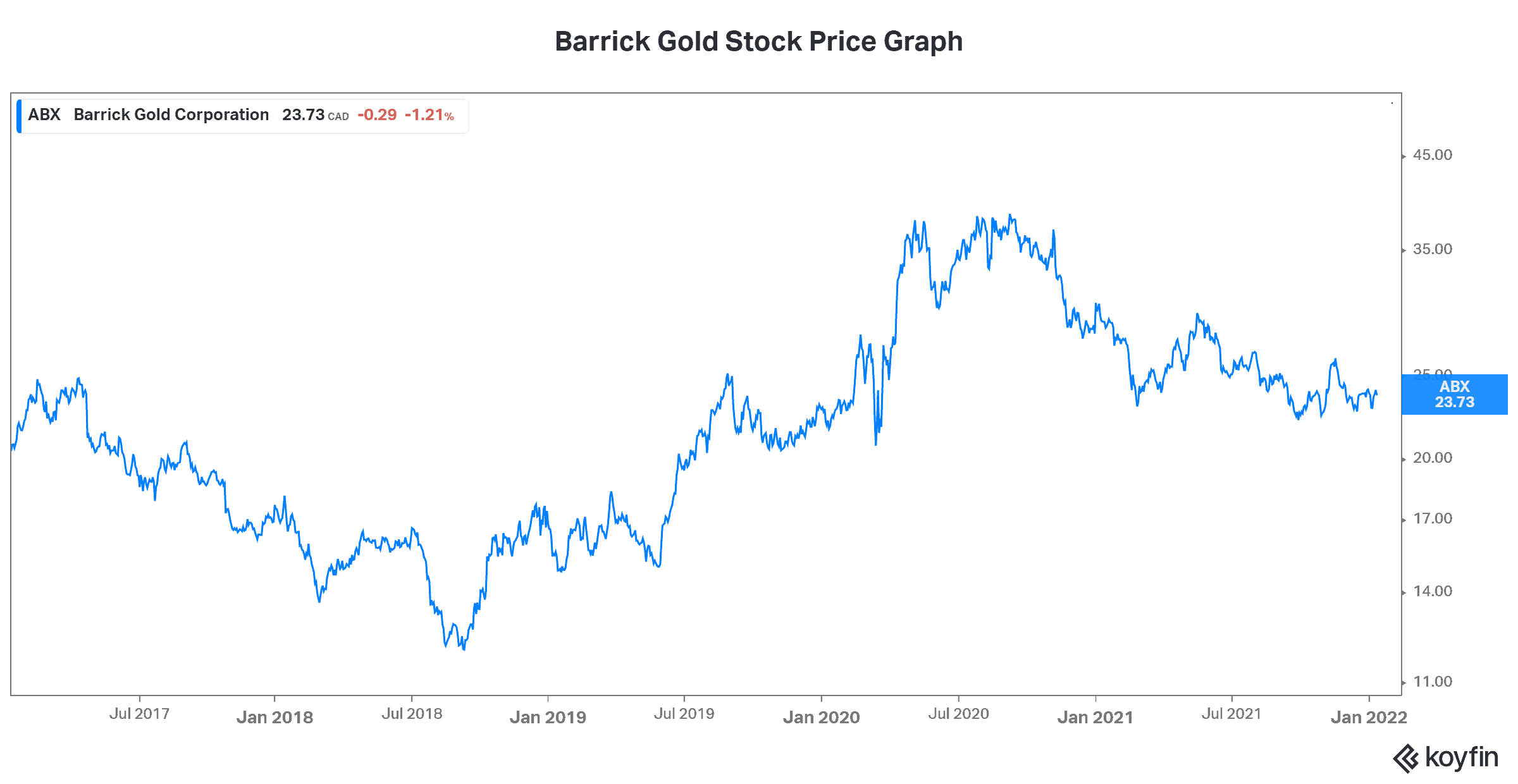

But despite rapidly rising inflation, Barrick Gold stock is outperforming. In fact, it’s trading near its 52-week lows. Furthermore, even its long-term price chart looks pretty bad. Well, I’m here to say that I think this will be changing in the next few months. Barrick Gold will take its place as the inflation hedge and the safe haven that it is.

On top of the positive macro environment for gold stocks, Barrick also has numerous company-specific factors that make it attractive. Once a heavily indebted gold company that struggled to move forward, Barrick’s fortunes are rapidly improving. Some years ago, most gold companies went through a period of rigorous cost cutting. Persistently low gold prices a few years ago necessitated this. This has translated into significant growth in cash flows for gold companies today and tomorrow. Barrick Gold stock is cheap. It has high margins. And it’s cash flows are rising along with the price of gold.

Not loving Barrick Gold? Look at Agnico-Eagle Mines for passive income

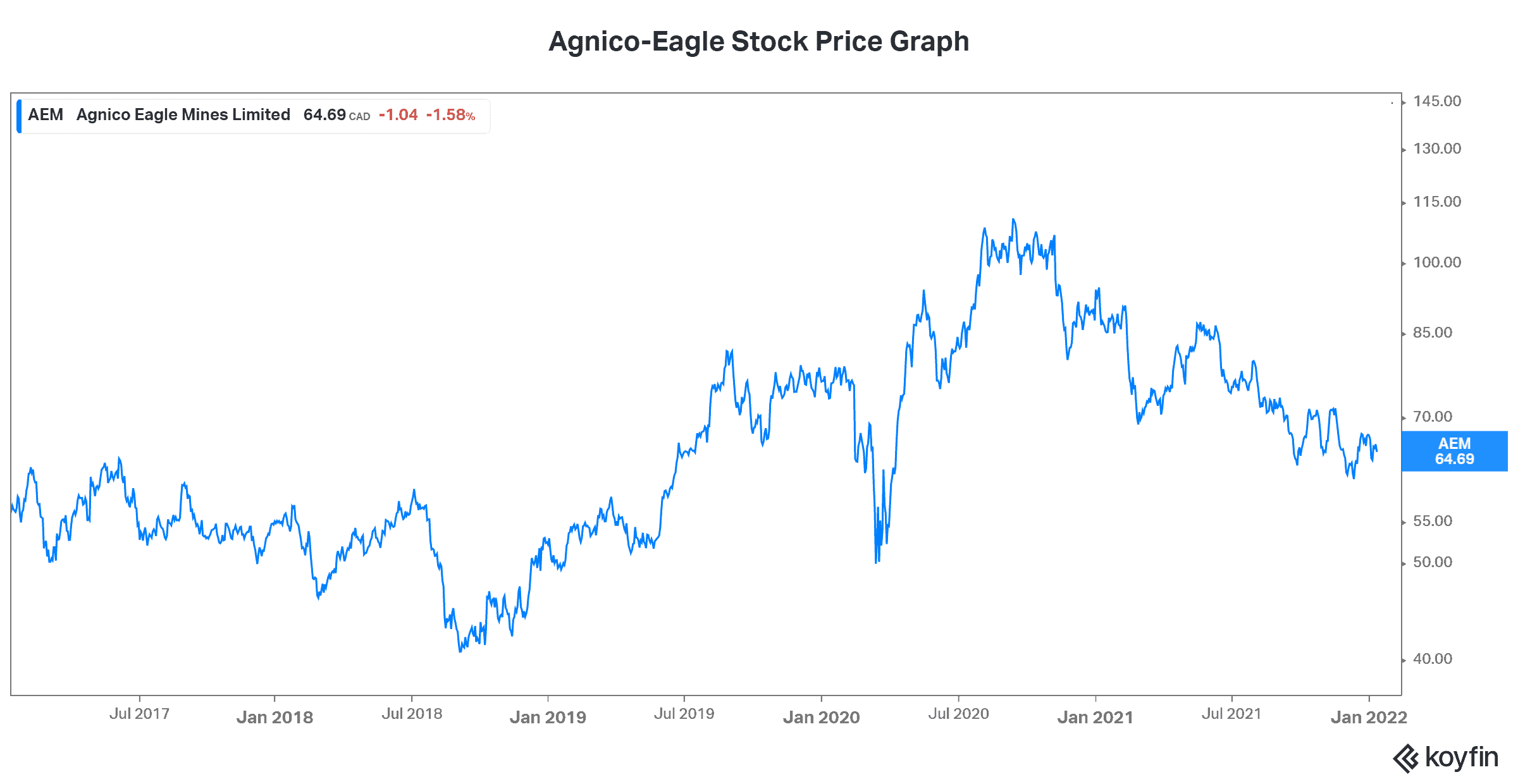

Barrick Gold stock is not for everyone. It has mines in some politically unstable areas of the world. And shareholder returns at Barrick are not optimal. Agnico-Eagle Mines (TSX:AEM)(NYSE:AEM) has a higher return on equity of over 11% and a fast-growing dividend yield. Agnico just might be the better gold stock for passive income. If it could get around the fact that it’s lesser known, then we would have the clear winner.

It’s lesser known because of a few very differentiating characteristics. For example, Agnico-Eagle limits its operations to regions that are safe — politically and otherwise. Compared to most other gold companies that have operations in many outright dangerous parts of the world, this is a key advantage.

Also, Agnico-Eagle Mines has an industry-leading cost structure. This has translated to strong cash flows and strong dividend increases. This is evident in the company’s 8% compound annual growth rate in its dividend in the last five years. It’s even more evident in the last year, when the dividend more than doubled.

Motley Fool: The bottom line

Gold stocks like Barrick Gold may very well be the next big movers in the market. They hedge against rising inflation, effectively protecting your money. They also provide a vehicle for passive income.