Previously, I wrote about the ways that Canadians can invest in the major U.S. stock indexes using Canadian-denominated exchange-traded funds (ETFs).

I recommended this approach because for the majority of retail investors, currency conversion costs are expensive, a hassle, and reduce returns.

Even with the higher management expense ratios (MER), foreign withholding tax (FWT), and currency risk, Canadian-denominated ETFs are still the best option for investing in U.S. stocks for most.

There is an exception. If you are comfortable with using Norbert’s Gambit to convert CAD to USD for cheap (which I covered earlier this week with a how-to guide), and are investing in your RRSP, you can save significantly by using a U.S.-denominated ETF.

This is the art of asset allocation, or optimizing investments based on where they are held and in what proportion. Let’s get right into it!

Why do we want U.S. ETFs in an RRSP?

If currency conversion fees are a non-issue, then U.S. ETFs are preferable in an RRSP for two main reasons:

- MER: The MERs of U.S. ETFs are dirt cheap, often coming in 50% lower than their Canadian counterparts. For example, the Vanguard S&P 500 Index ETF (NYSE:VOO) and the Invesco QQQ Trust (NASDAQ:QQQ) have MERs of 0.03% and 0.20%, respectively, compared to 0.08% and 0.39% for their Canadian counterparts.

- FWT: U.S. stocks and ETFs incur a 15% tax on dividends. That is, a normal annual dividend yield of 1.50% would be reduced to 1.275%. This can add up over time to ding returns. However, this does not occur in an RRSP, allowing you to maximize gains.

The best candidates for the role

My top picks here would be VOO and QQQ, for tracking the S&P 500 and NASDAQ 100 respectively. Whichever one you decide on really boils down to your views for the U.S. stock market. Are you more bullish on the overall aggregate market, or do you want to make a bet on large-cap tech growth?

If it’s the former, VOO is your best bet. With a 0.03% MER, it is as cheap as ETFs get. VOO is is passively managed, replicating the S&P 500 index as decided by Standards & Poor’s.

Currently, VOO holds 512 stocks, with the largest concentration in information technology, followed by consumer discretionary, health care, financials, communications, industrials, consumer staples, energy, real estate, materials, and utilities.

If it’s the latter, QQQ is your best bet. The NASDAQ 100 index excludes financial stocks, focuses on stocks listed on the NASDAQ Exchange, and only holds 101 large-cap U.S. growth stocks.

The index is heavily concentrated in the U.S. tech sector, which makes up 50% of the weighting of this fund. As a result, ETFs tracking this index have more return potential but also more volatility.

How have the funds performed?

A word of caution: the backtest results provided below are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results. Hypothetical returns do not reflect trading costs, transaction fees, or actual taxes due on investment returns.

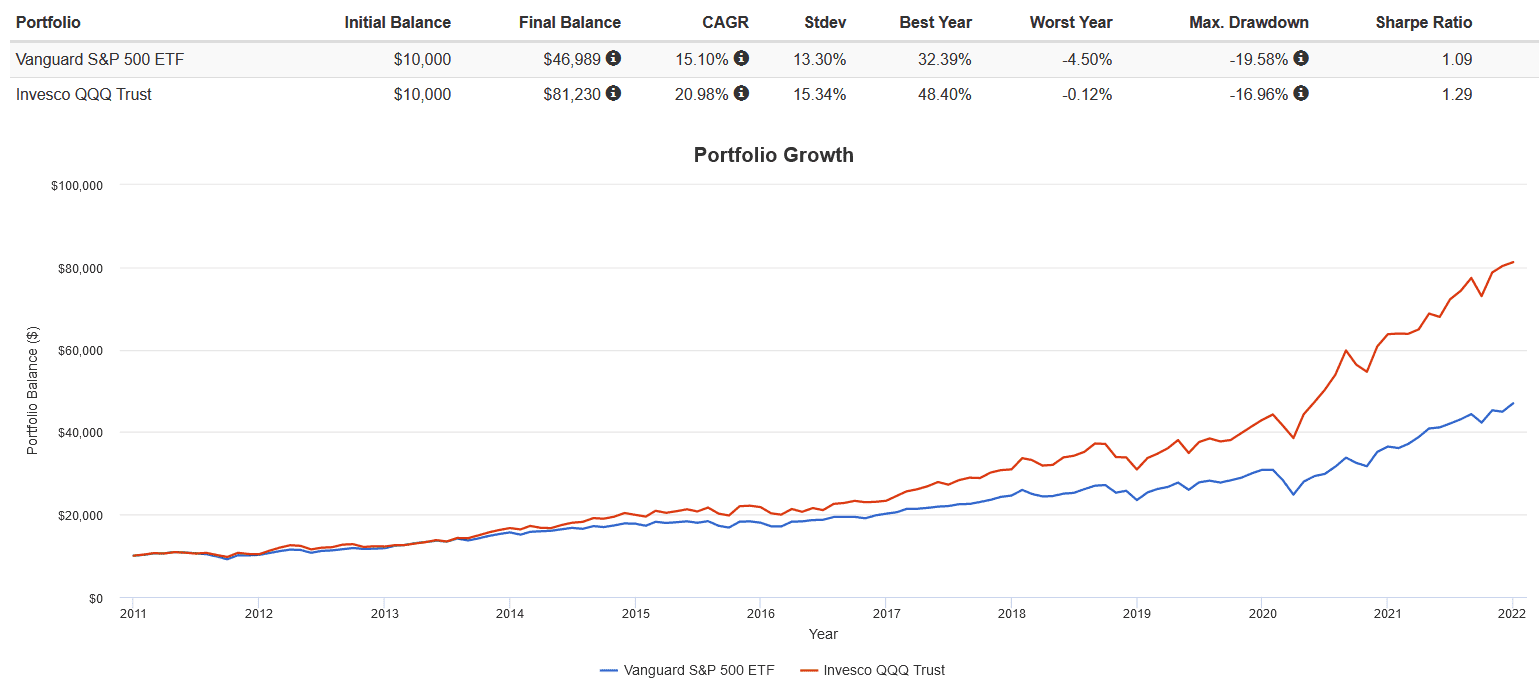

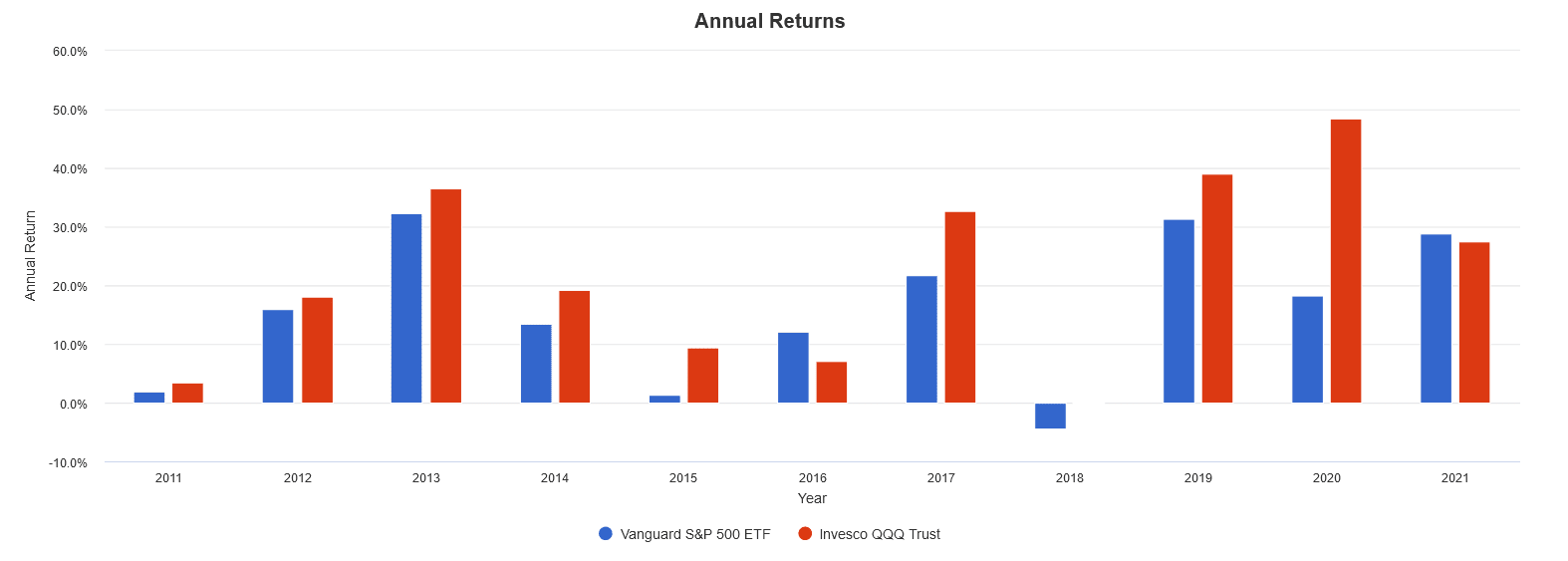

From 2011 to the present, with all dividends reinvested, QQQ had higher absolute and risk-adjusted returns than VOO, but also higher volatility and drawdowns. There is a caveat to this though, so keep reading!

The Foolish takeaway

If you’re able to convert CAD-USD cheaply and plan on investing in your RRSP, using U.S. ETFs like VOO and QQQ can save you big on MER and FWT.

From my point of view, I would pick VOO. Diversifying is always better. Investors should avoid succumbing to recency bias and chasing performance. The strong performance of QQQ over the last decade is tempting, but may not continue.

In 2021, QQQ actually lagged VOO as large-cap tech and growth stocks faltered amid a 7% inflation rate in the U.S.! VOO’s concentration of financial and energy sector stocks allowed it to pull ahead, whereas QQQ lacked them.

Regardless, both ETFs are excellent buy-and-holds for Canadian investors with a high risk tolerance and long time horizon.