I would say that for the average investor, cryptocurrencies like Solana (CRYPTO:SOL) can be a fun but dangerous game. It’s certainly been fun for those investors that have gotten in at the right time. But where’s the end game? How do we value cryptocurrencies? And how do they help us in our long-term goals? As we at Motley Fool always stress, long-term investing is the best way to invest. Buying quality investments/assets that we can reasonably expect to rise over the long term is always the way to go.

Why Solana looks good

As the best-performing cryptocurrency in 2021, it’s no wonder that Solana has peaked our interest. It is impossible and unwise to ignore that the price of Solana has risen from a mere $1.50 to almost $180 in the last year. This type of return in just one year is unheard of. We certainly all wish that we could have participated.

But the hard reality is that cryptocurrencies like Solana are risky propositions. Let’s remember the good side of what Solana is. Although it’s a newer cryptocurrency, Solana has really gained a lot of traction in the last year. It’s well-regarded due to fast transaction times and low fees. Similarly, it has the third-largest futures market. Due to these key advantages, Solana has a strong institutional adoption.

Why Solana may not be right for you

Now for the not so good side. The performance of cryptocurrencies is very much tied to the market and investor sentiment. I mean, we don’t have much to go on for valuing crypto. In my view, it therefore trades on the level of fear/confidence that investors are feeling.

So, Solana saw its price fall 65% since November 2021. That’s in just three months. In this simple calculation, we can see the perils of this investment. The risk/reward proposition is definitely high risk, with the potential to both make and lose a lot of money. But how do we evaluate where the price of Solana is headed? There is no easy answer. I, as well as well-known investing masters, like Warren Buffett, think that cryptocurrencies like Solana are, in large part, gambles. There are thousands of cryptocurrencies in the market. Which one, if any, will be here for the long term is anybody’s guess. And how would we accurately value them anyway?

So, this leads me to my next point. Why not invest in a real asset with real positive fundamentals that are clearly on its side?

Consider Waste Connections stock instead

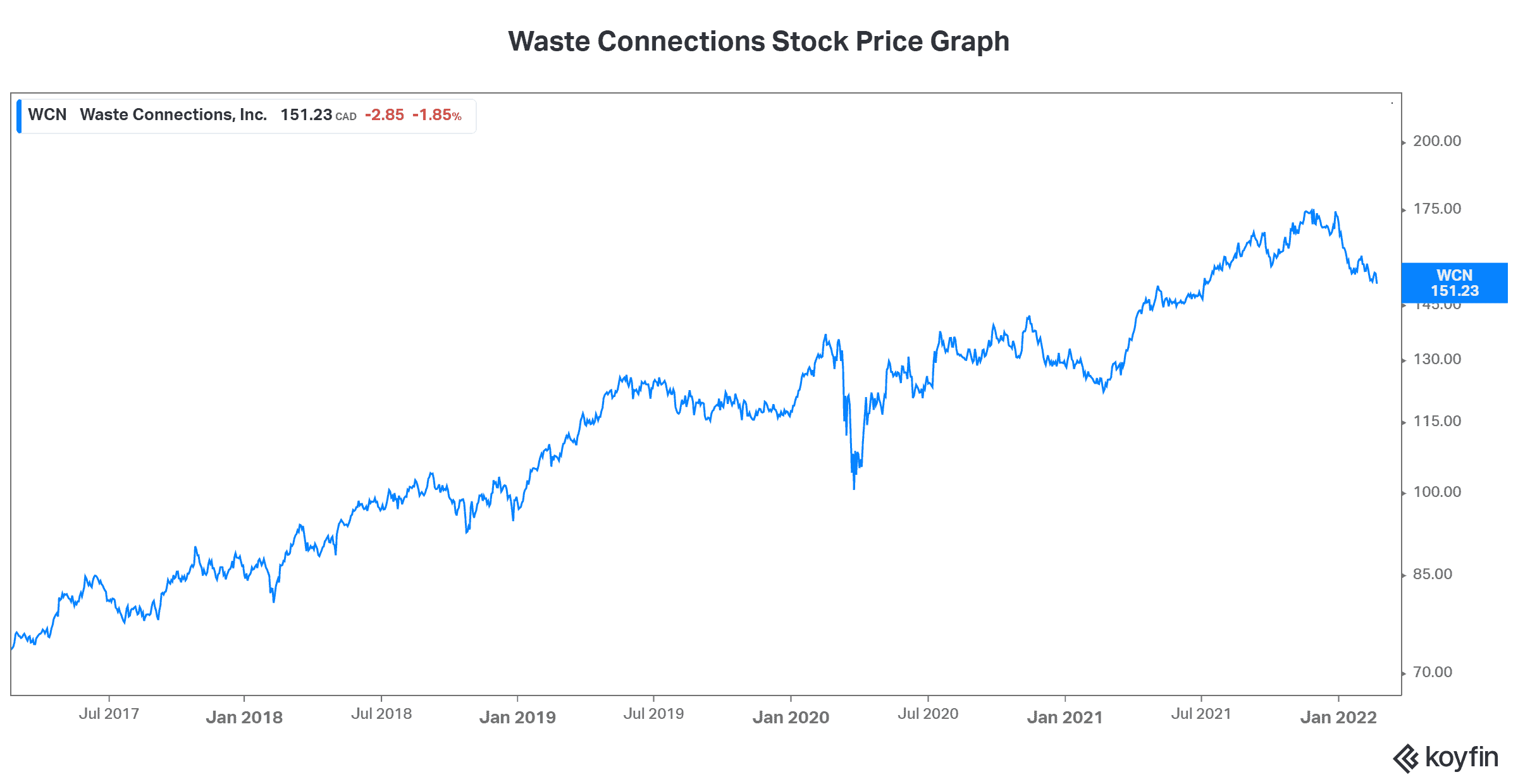

Waste Connections (TSX:WCN)(NYSE:WCN) is an integrated solid waste services company. It provides waste collection, disposal and recycling services in the U.S. and Canada. It’s a high-quality company in a booming industry. As such, Waste Connections stock has soared in the last many years. In fact, it’s up 20% in the last year alone. Its five-year return is 94% and its 10-year return is a rocking 425%. Take a look at Waste Connections’s stock price graph below.

This graph illustrates the stability and fortitude of Waste Connections stock. Investors didn’t have to deal with wild volatility, as Solana investors do. Also, Waste Connections shareholders benefitted from a generous return of capital program that included dividend and share repurchases. In fact, 2021 was the 18th consecutive year of positive shareholder returns.

Motley Fool: The bottom line

I understand that you might be saying that this is not an apples-to-apples comparison. One is not like the other. They’re totally different asset classes. And you would be right. But considering the risk/reward profiles of Solana and Waste Connections, which one would you prefer?