Dividend stocks are an essential part of any investor’s portfolio. They’re suitable for the young and the old, and they never go out of style. Real estate investment trusts (REITs) are an increasingly relevant sub-sector of income stocks. They provide high, steady dividend income and are growing increasingly relevant in today’s market. The trick is, as usual, knowing the right ones to buy.

In this article, I’ll discuss two high-quality REITs that qualify as two of the best dividend stocks to own. You can buy them in order to start generating meaningful income today.

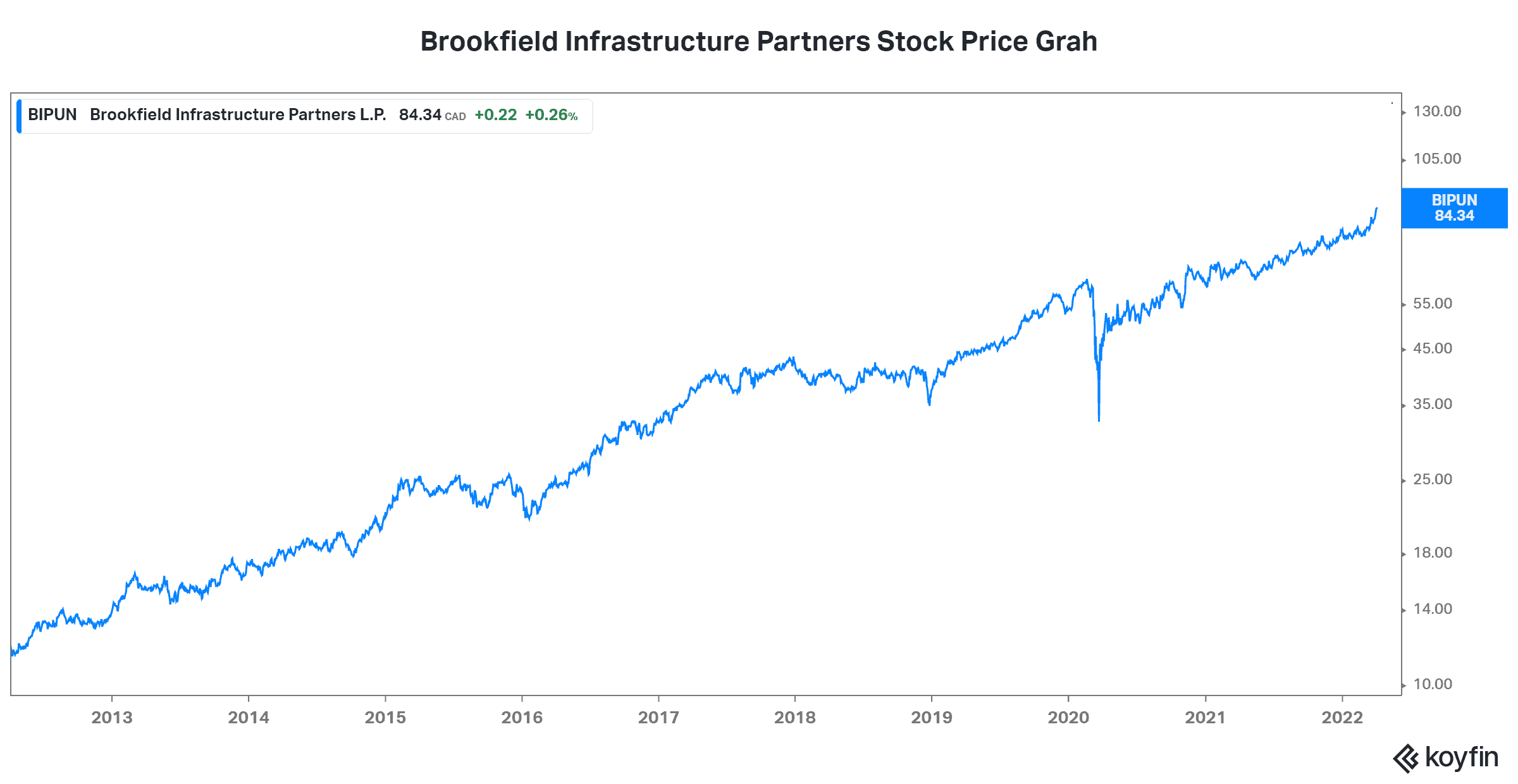

Brookfield Infrastructure: A 3.26% yield along with stability and excellent financial health

Brookfield Infrastructure Partners (TSX:BIP.UN)(NYSE:BIP) is one of the largest owners and operators of critical and diverse global infrastructure networks. These networks deliver some of the necessities of life to society. For example, energy, water, freight, and data. This translates into stable cash flows and high margins. It also translates into strong growth prospects.

In the last 10 years, those who have owned Brookfield Infrastructure stock have enjoyed consistent, growing income. In fact, Brookfield’s dividend has grown at an attractive compound annual growth rate (CAGR) of 8%. Similarly, those who have owned this stock have enjoyed strong capital appreciation of over 300%. Remember, this is a conservative, healthy, low-risk stock. Clearly, this risk/reward tradeoff has been exceptional.

Looking ahead, Brookfield remains a very attractive option for income. In its latest results, we saw clearly that its business is very healthy. Organic growth is strong, as are cash flows and financial liquidity and strength. In short, the future looks bright for Brookfield, as the macro environment remains strong. Furthermore, inflationary pressures are mitigated by the fact that 70% of Brookfield’s revenue is inflation indexed. All of this has culminated into Brookfield’s targeted 5-9% annual distribution growth.

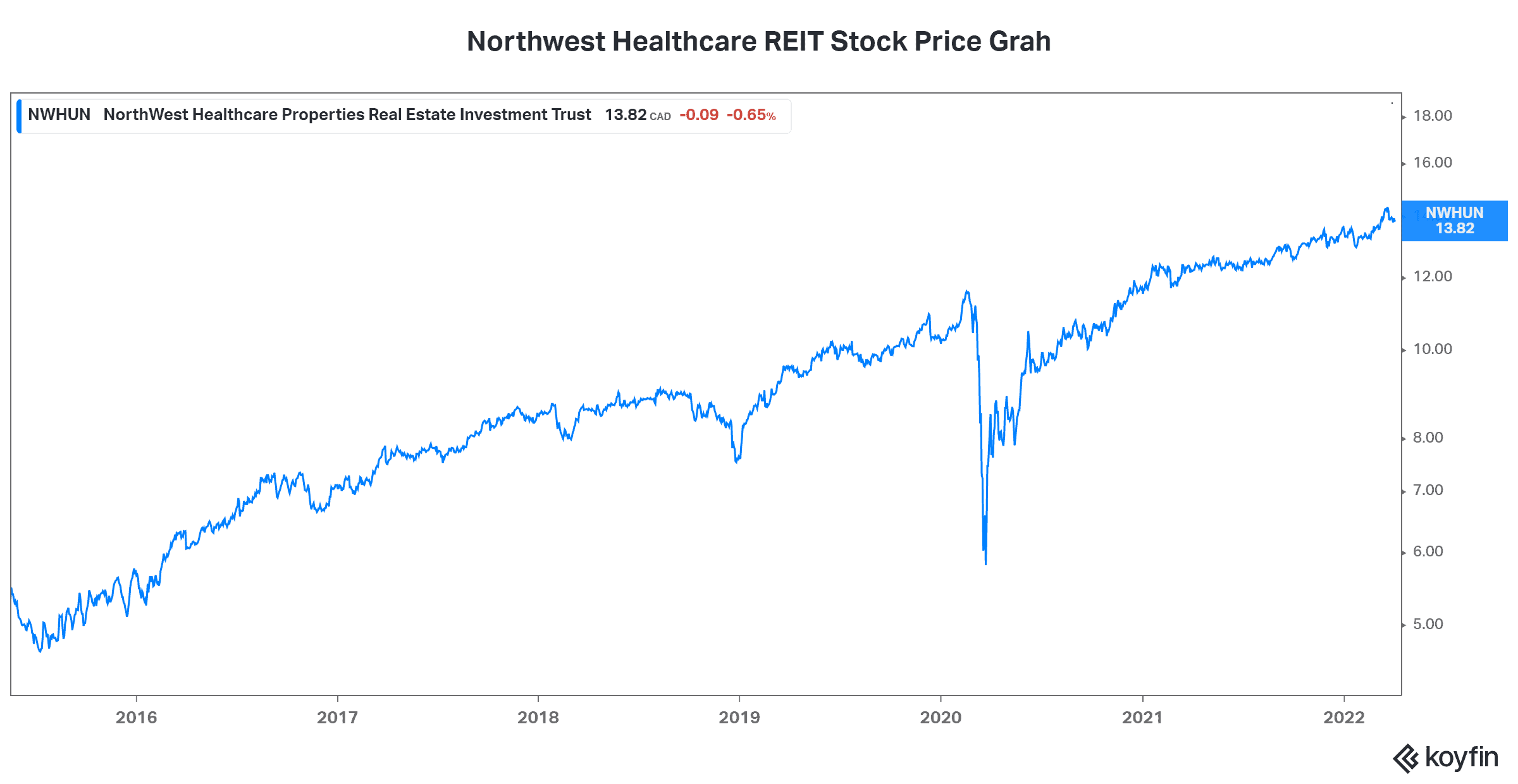

Northwest Healthcare Properties: A top 5.75% yield along with a strong position in healthcare real estate

Moving on to the next REIT, Northwest Healthcare Properties REIT (TSX:NWH.UN) is a Canadian REIT that owns and operates a global portfolio of healthcare assets. This REIT is another example of steady and consistent cash flows. Hence, it’s a good income stock for investors that are looking for income.

The healthcare industry is another industry that has very strong, long-term, secular growth characteristics. Aging populations, longer life spans, and better health care all play into this theme. As a global healthcare real estate REIT, Northwest is benefiting. It currently offers a high yield, which makes sense, because its balance sheet is more heavily levered. But mitigating this, we have a revenue stream that’s also highly indexed to inflation. This provides Northwest with that extra de-risking that you may be looking for. I know I am.

So, Northwest is an income stock that has seen a high, steady dividend over the last 10 years. It has been, in fact, one of the best dividend stocks to own. With a yield that has approached 10% at times, Northwest has been a star performer for income investors. Furthermore, investors have also enjoyed strong capital gains, depending on when they bought the stock. In the last 10 years, the stock has risen 11%.

Motley Fool: The bottom line

In conclusion, I would like to point out once again that looking for income these days has been challenging. REITs can help enormously, and if you choose the right ones, such as the two listed in this article, you will generate passive income for years to come.