We all want to find the top stocks to invest in, and of course the companies you choose are the main ingredients in your success. But there are plenty of other factors to keep in mind — and they can make or break your potential returns.

Check your investing habits to be sure you’re not falling prey to these common investing mistakes.

1. Investing money that you’ll need soon

One of the first mistakes investors make is using money that they might need for something else soon.

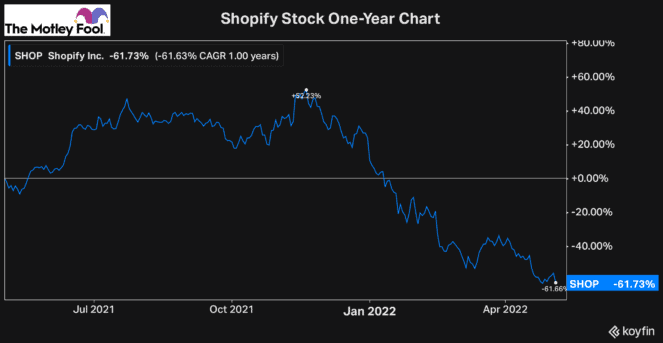

For example, let’s look at what happened to investors who bought Shopify a year ago when the price was around $1,400.

For a few months, the investment was gaining value. However, as you can see, it’s now down more than 60% from where it was this time last year.

So if you bought the stock a year ago and now need the money you invested to pay for something else, such as a down payment or a dream vacation, you’d have to sell your Shopify shares for less than half of what you paid for them.

To really invest for the long haul and commit to the stocks you’re buying for years, it’s crucial that you don’t need the cash you’re using to invest any time soon.

Pro tip: Let’s say you bought at the exact same time but are committed to owning Shopify for years. Now would be an excellent time to buy more shares to reduce your average cost.

2. Trying to time the markets

Another mistake investors make all the time is trying to “time the market.” It can be enticing to try to predict when stocks might drop or when an underperformer might finally rally. But more often than not, investors who try this get burned. (Just look at the example above again.)

It’s extremely difficult to tell where the stock market will go over the next day, week, month and — many times — even the course of a year.

This is why it’s crucial to invest for the long haul. As long as you focus on finding quality companies and stick with a long-term strategy, those businesses should eventually make money for you.

3. Buying stocks that you don’t understand

Finally, another highly common mistake investors make is buying companies that they don’t understand. This is often the result of hype and FOMO, or fear of missing out. However, when you buy any stock, it’s crucial you understand the business inside and out.

Without understanding how a business operates, what its major risks are, who its competitors are and so on, you won’t be able to decide if it’s truly a good investment for you.

Before investing in any stock, make sure you understand the business — and are actually interested in following its progress!