TSX stocks are some of the best ways to build riches for retirement. But not all of us Motley Fool investors have a ton of cash sitting around, waiting to be invested. Still, even if you only have $10, you can be putting that away towards your Registered Retirement Savings Plan (RRSP). That alone could help you reach riches by the time you retire.

Have a plan

First off, you’ll need to come up with a plan on what riches means to you. We’ll be doing an example here, but meet with your financial advisor to come up with one that makes sense to you. Does riches by retirement mean you’ll have a million dollars? Two million? Or do you just want a cushion of some kind and plan on selling your home for cash?

Whatever the case may be, your financial advisor will guide you through it. They’ll also come up with a plan on how you can put aside cash to invest towards your retirement goal using your RRSP. That RRSP is important, as every dollar you put towards retirement is taken off your net income during tax time (up to a limit found on your Notice of Assessment).

But for this example, let’s say you can afford to put away just $10 per month. You then want to find some TSX stocks to put that $10 towards, perhaps through the dollar-cost averaging method. This is where you reduce volatility by consistently investing in stocks once a month, for example, instead of all at once. So, let’s see what we can turn that into.

Find the right TSX stocks

If you’re looking for TSX stocks for your RRSP, you’ll want strong performers. I don’t mean just finding growth stocks and hoping for the best. Blue-chip companies are a far better option, with long-term investing the best way to achieve riches for retirement.

These companies would include the Big Six banks, major energy companies, and other household names of industries. If you’re going to be investing just $10 a month, then I would look for blue-chip companies with dividends and decades of growth. That way, you can almost guarantee they’ll be there decades from now as well.

An option to consider

Motley Fool investors may want to consider a Big Six bank like Toronto-Dominion Bank (TSX:TD)(NYSE:TD) right now. It’s one of the TSX stocks in the banking sector that’s seen a fall during this time of high interest rates. Shares are still down 12%, and it trades at a valuable 10.31 times earnings.

However, the Big Six banks, including TD stock, all have a history of rebounding to pre-drop prices within a year. Right now, shares are on the climb, up 6% in about a month’s time. Furthermore, you can lock in a 4.27% dividend yield.

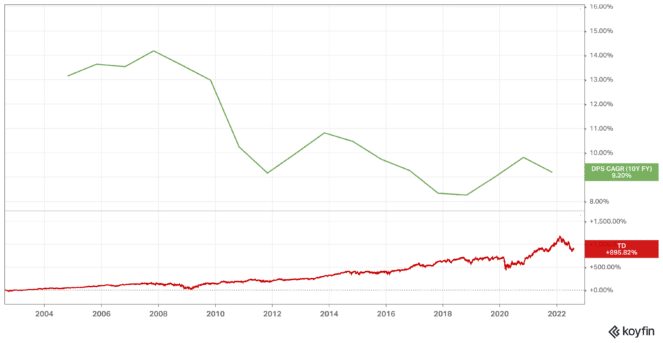

If you were to use the dollar-cost averaging method, you would need to save up some cash to purchase shares. So, let’s say you invest that $120 per year, and, on top of that, reinvest dividends to your RRSP. Looking back at TD stock, it has a historical compound annual growth rate of 9.2% for its dividend and 11.9% for its share growth. To reach retirement in 40 years, you would then have a portfolio worth $203,765 from using this method — all from just $120 in investment per year!