The S&P/TSX Composite Index has had a rough 2022. After two years of very strong performance, it’s down more than 5%. So the tide has begun to turn, and it’s never fun to watch our TSX stocks fall. But there is a bright side – every period of turmoil leads to bargain prices for a select number of stocks.

Without further ado, here are three TSX stocks that are great deals today.

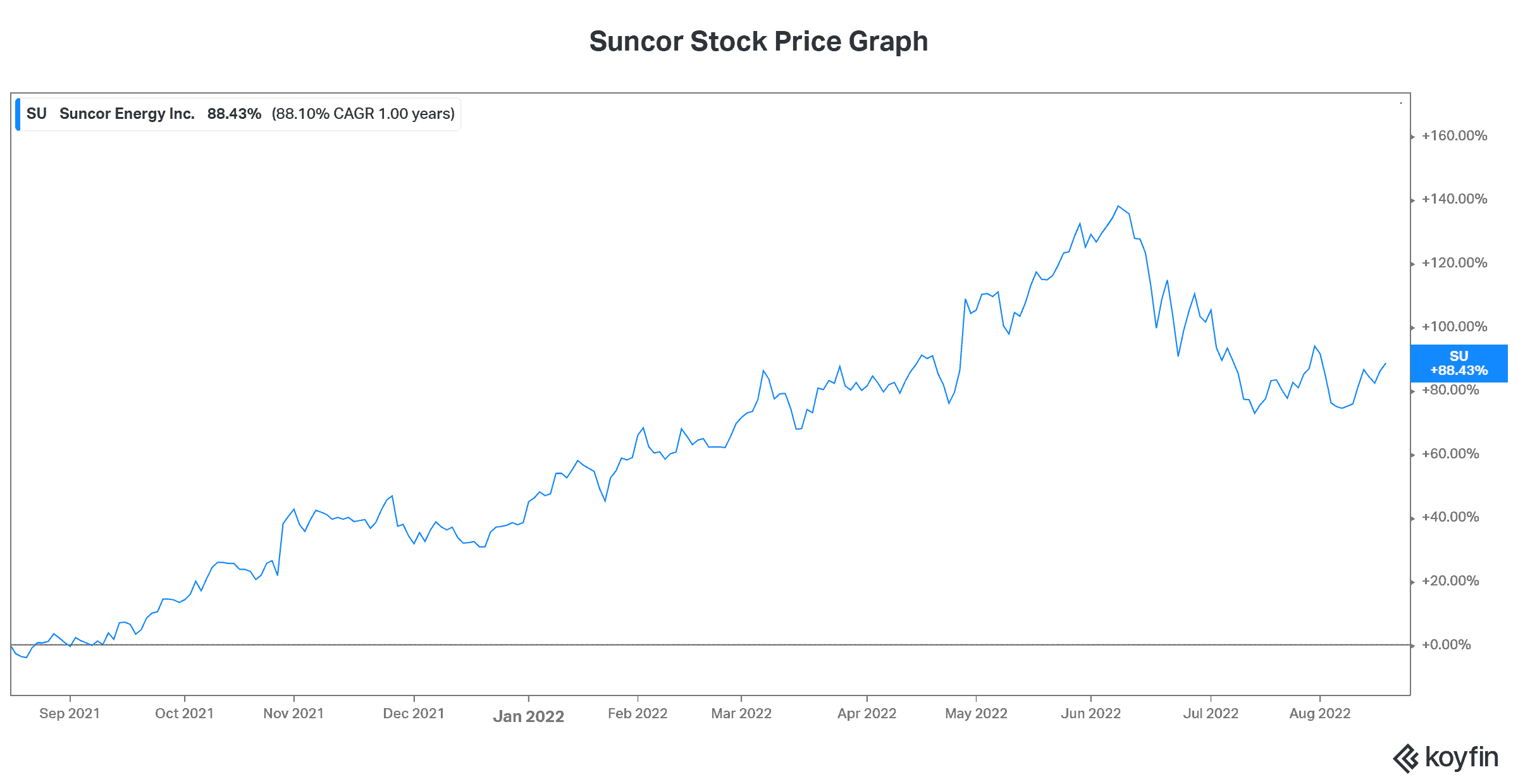

Suncor: One of the best TSX stocks that’s still on sale

Suncor Inc. (TSX:SU)(NYSE:SU) is Canada’s $54 billion premier integrated oil and gas giant. This means that Suncor is involved in the upstream business (oil and gas production), as well as the downstream business (refining). These businesses each have their own demand/supply fundamentals. This diversification translates into steadier and less volatile results.

For investors, this is a great deal. But the deal doesn’t end there. In 2022, safety issues have plagued Suncor. On top of this, oil prices have fallen from their highs. We also have environmental concerns that are always looming in the background with oil and gas companies. The end result is clear and simple – Suncor stock is significantly undervalued today.

Despite soaring cash flows and a 4.4% dividend yield, Suncor is valued at a mere 4.4 times 2022 earnings. At an earnings growth rate of 260%, the stock is cheap. While this year can be viewed as the top in terms of oil prices, 2023 will also be strong, with earnings expected to be 190% higher versus 2021. Suncor stock trades at a mere 5.5 times 2023 earnings.

Cash flows at Suncor are soaring, its dividend is rising fast, and returns are through the roof. For example, adjusted funds from operations hit a record high last quarter, coming in at $5.3 billion, up 33% sequentially and more than double last year.

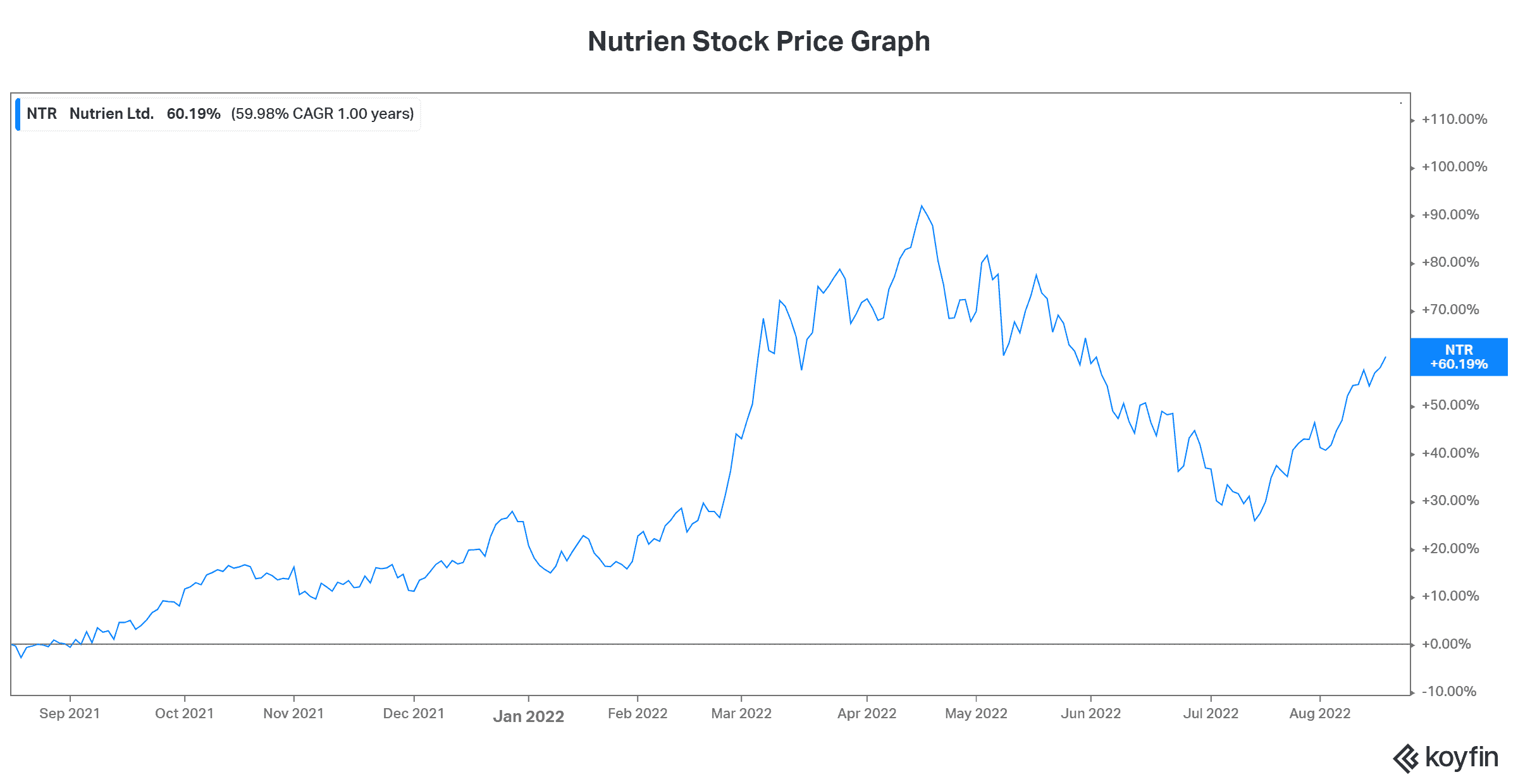

Nutrien: Feeding the world and offering up a deal

Nutrien Ltd. (TSX:NTR)(NYSE:NTR) is the world’s largest fertilizer producer and agricultural input retailer. It was formed through the January 2018 merger of PotashCorp and Agrium. This vertically integrated business benefits immensely from its scale. This is driving efficiencies and ultimately, cash flows.

Nutrien is another of the TSX stocks that has fallen hard. It’s down more than 15% in the last few months.

But once again, this weakness has created a deal – Nutrien stock trades at a paltry 7 times this year’s expected earnings. These earnings are booming, as commodity prices are strong and synergies from the merger are coming through.

At this valuation level, Nutrien is one of the TSX stocks representing the best deals out there today. In short, the global population is increasing. As a result, agricultural industry analysts are forecasting steady and growing demand for the foreseeable future. So don’t be discouraged by the cyclical nature of the agricultural industry. While it’s subject to changing demand and supply levels on a short-term basis, things are looking good for the long term. And the stock is cheap, cheap, cheap!

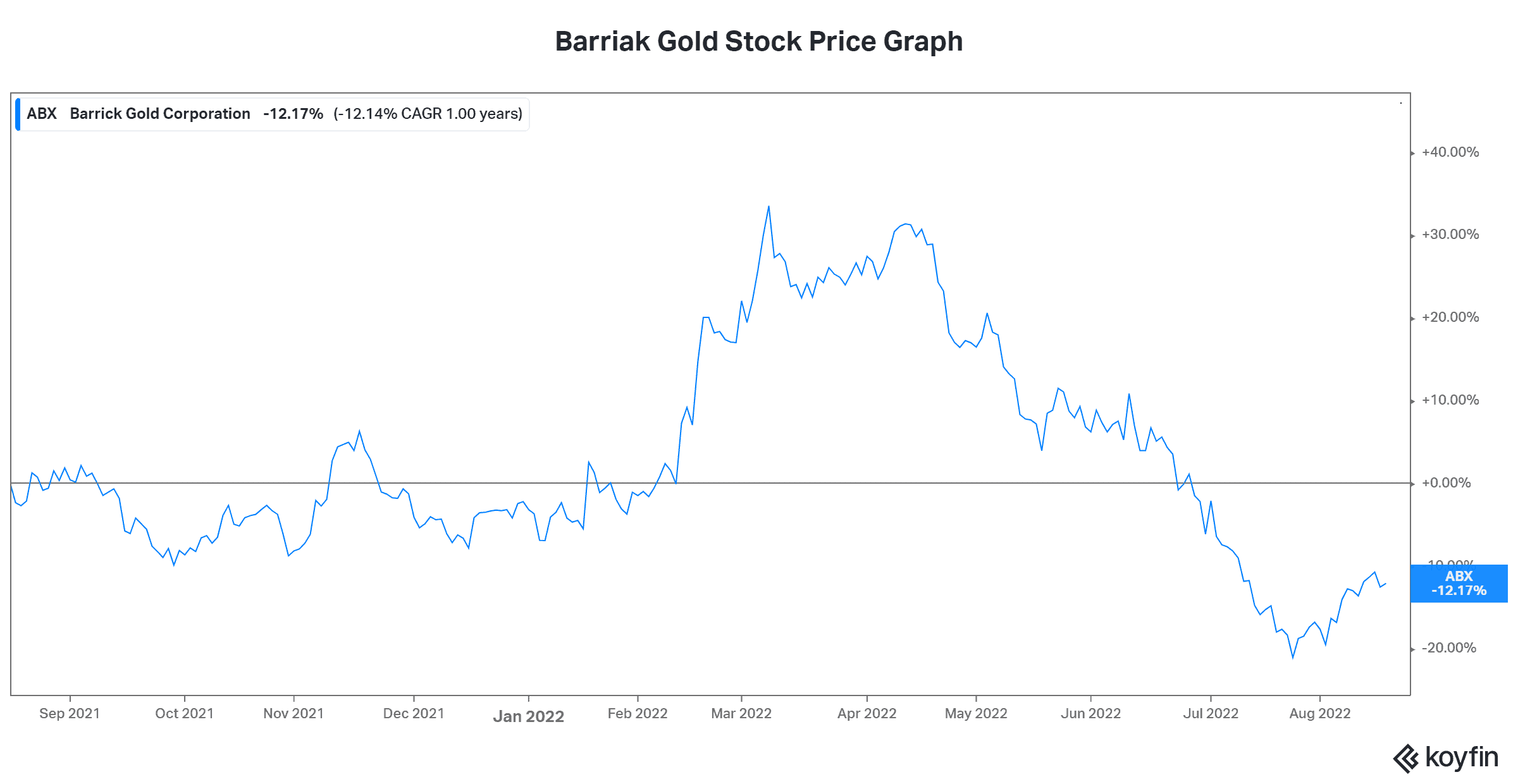

Barrick Gold Stock: One of the top TSX stocks for gold exposure – and a bargain

Barrick Gold Inc. (TSX:ABX)(NYSE:ABX) is the biggest and most well-known gold stock globally. And today, it’s trading at bargain valuations. It’s down almost 40% from its 2022 highs, and trades at less than 15 times earnings.

Yet gold still has a favourable outlook, in my view. And Barrick Gold stock has been beating expectations lately.

So, while gold has lost a bit of its appeal in the mind of investors, it remains a very strong store of value. This means it’s a good inflation hedge. The US inflation rate is at 40-year highs. Over time, this inflation will reduce the value of the US dollar. Remember that the value of gold is inversely related to the value of the US dollar. This means that we can expect a falling US dollar. This, in turn, will cause investors to flock to better stores of value, such as gold.