This year has been filled with a lot of anxiety for investors. And it’s on top of a few years of market uncertainty, with analysts predicting a drop in the market at any moment. Well, we had that drop, due to inflation and interest rates rising again and again. And it’s caused many to move away from the growth stocks we saw rise in the past.

But instead of moving away, it’s now time to look forward to more growth in the future. And there have already been some great ones in 2022, ones that should continue climbing. With inflation coming down to 7.6% year over year in July, now is the time to look forward. And I would start with these three growth stocks.

Tourmaline

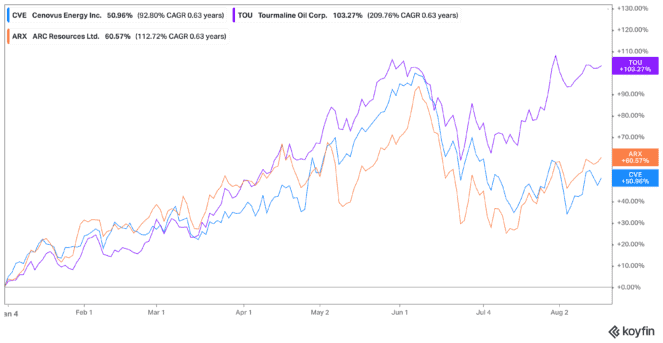

Leading the top spot in growth stocks this year is Tourmaline Oil (TSX:TOU). The shares of Canada’s largest natural gas producer are up a whopping 102% on the TSX year to date. But here’s the really great part. Tourmaline stock still trades at a valuable 10.4 times earnings!

Plus, investors can latch on to a 1.19% dividend yield. Not high, true, except that you’re here for growth stocks. And in that sense, Tourmaline stock doesn’t get much better. But the question is whether it can continue this growth.

In short, yes and no. Yes in the sense that analysts believe there is still strong growth ahead for growth stocks like this one. Will it double again, though? Probably not. Still, analysts love the company’s acceleration of growth and business plan to create capital returns. Tourmaline stock now has an average target price of $93, representing a potential upside of 22%.

Arc Resources

In second place comes Arc Resources (TSX:ARX), with shares up 60% year to date, and yet again trading at a steal at just 8.4 times earnings! This comes even as ARX announced record earnings recently, with the oil and gas producer averaging 336,112 barrels of oil equivalent per day. The company managed to achieve record free funds flow up 67% year over year, and increased its guidance for the year.

Analysts continue to believe this will be one of the growth stocks to continue growing in 2022, though again perhaps not as much as it has so far this year. Even still, ARX stock currently has a consensus price target of $24, representing a potential upside of 33% on the TSX today. Plus, you can add a 2.69% dividend yield to your allocation of growth stocks.

Cenovus

Sensing a theme here? Cenovus (TSX:CVE)(NYSE:CVE) has also been a major winner in 2022, with shares up 47% year to date. Yet again it trades at 11.3 times earnings, putting it in value territory among these other growth stocks.

Cenovus stock I think I like the most among all three of these growth stocks. That’s because Cenovus stock took measures to stoke growth before the pandemic while it had the cash, and bought up Husky Energy. It’s now the third largest oil and gas producer in the country, creating $1 billion in synergies. Management recently announced it will be acquiring the remaining 50% interest in its Toledo refinery, along with strong earnings that saw debt reduced by about $2 billion year over year.

Given its more diverse and larger position in the oil and gas sector, I’d look more to Cenovus stock for future growth in 2022 and beyond. It’s one of the growth stocks building up steam, whereas the others may run out of it.