Albert Einstein once described compound interest as “the eighth wonder of the world.” Patient investors who buy high-quality stocks, reinvest dividends, and hold for the long term are capable of turning even modest amounts into comfortable retirement nest eggs.

Still, for investors starting out with less money (think $1,000ish), investing can be daunting. Imagine trying to buy a share of Alphabet (Google) pre-split when the stock traded at over US$2,000 per share! You’d barely be able to afford half a share, let alone diversify with other stocks.

This can be discouraging, but fear not! There is a solution if you’re strapped for cash. With this alternative, even the humblest of investment portfolios can grow strongly.

ETFs to the rescue

Thanks to exchange-traded funds (ETFs), not having lots of money isn’t a problem anymore. ETFs can hold a portfolio of up to thousands of various stocks and trade with their own ticker on a stock exchange. When you buy a share of an ETF, you’re essentially gaining exposure to all of its underlying stocks.

This approach is capital efficient. For instance, an ETF might trade at a price of $100 per share yet hold over 1,000 stocks in it. With your $1,000, you can now buy 10 shares of that ETF and gain proportional exposure to all of its underlying companies. This way, you become diversified without needing to buy 1,000 stocks!

Index ETFs are best

There is a catch, though: the management expense ratio (MER). This is a percentage deducted from your investment annually. For example, an ETF that charges a 0.05% MER would cost your $1,000 investment an annual fee of 0.05 * $1,000 = $5.

Keeping this as low as possible is ideal, and the best choice to make for a low MER is an index fund. These are passively managed investments that track an existing stock market index, like the S&P 500. With index funds, fees are low, since the fund manager isn’t actively trying to pick stocks.

I like the S&P 500 index. It tracks 500 of the largest stocks traded on U.S. exchanges and is the benchmark for retail and professional investors to compete against. When people talk about “beating the market,” they’re usually referring to the S&P 500.

Why the S&P 500

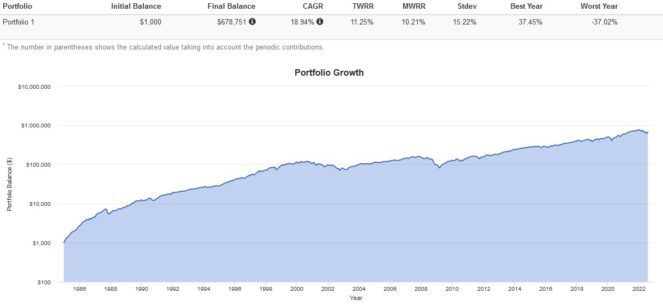

Since its inception in 1957, the S&P 500 has returned a compound average growth rate (CAGR) of around 10% with dividends reinvested. This is a fantastic return, which, according to the Rule of 72, could double your money every seven years or so. Let’s use a real-life example to see this in action.

Imagine you started investing in 1985 as a broke 18-year-old student with just $1,000 to your name. You invest it all in a fund tracking the S&P 500. Every month thereafter, you scrounge up $100 and invest it promptly in a disciplined and consistent manner.

After holding 37 years, consistently putting in $100 every month, reinvesting all dividends, and never panic selling, you would be able to retire early at 55 with a cool $678,751.

This is incredible considering that all your hypothetical self did was buy an index fund, invest small amounts consistently, and stay the course. If you started with more than $1,000, or contributed more than $100 monthly, your returns would have been even better.

Do you want to implement this passive, hands-off investing strategy? A great ETF to use is Vanguard S&P 500 Index ETF, which has a low MER of just 0.09%.