Growth stocks offer investors the possibility of massive capital gains. They’re often operating in a new, rapidly growing industry. And they usually have some sort of competitive advantage, such as first mover advantage.

The opportunity that growth stocks offer is alive and well today despite market turmoil. Without further ado, here are three growth stocks that could soar in the years ahead.

Ballard Power Systems: A fuel cell stock cleaning up the transportation industry

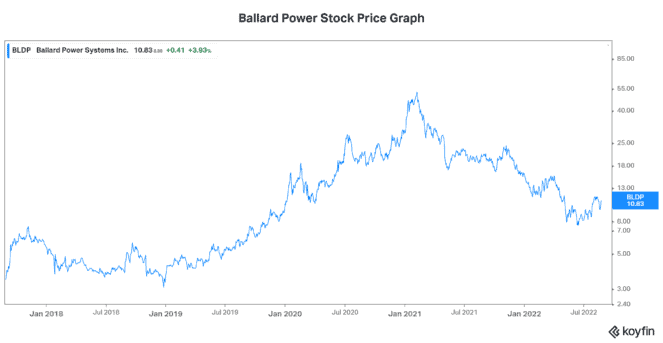

The first growth stock that I’d like to discuss is Ballard Power Systems Inc. (TSX:BLDP)(NASDAQ:BLDP). Ballard is a leading global provider of innovative clean energy and fuel cell solutions. These fuel cells already power transportation vehicles such as buses and trucks with zero emissions. The stock has been very volatile, as one would expect from growth stocks.

As we can see from Ballard’s price chart above, this growth stock has not been for the faint of heart. But for those of you that are willing to bear the volatility, the future looks bright. For example, Europe’s new hydrogen initiatives are accelerating the adoption of fuel cell electric vehicles. Earlier this year, a significant hydrogen initiative was approved by the European Commission. This plan will see Europe investing heavily in hydrogen in order to reduce its dependence on fossil fuels.

This is more good news for the hydrogen industry, and ultimately for Ballard. In fact, Ballard management expects that the momentum will accelerate sharply in the coming years. This means rapid growth in activity levels as well as rapid revenue growth. In its latest quarter, Ballard continued to make progress. While the company still posted a net loss, backlog sits at almost $100 million. This increased scale will continue to drive Ballard’s costs down and ultimately, result in positive earnings.

Well Health stock: Digitizing the health care industry at rapid speed

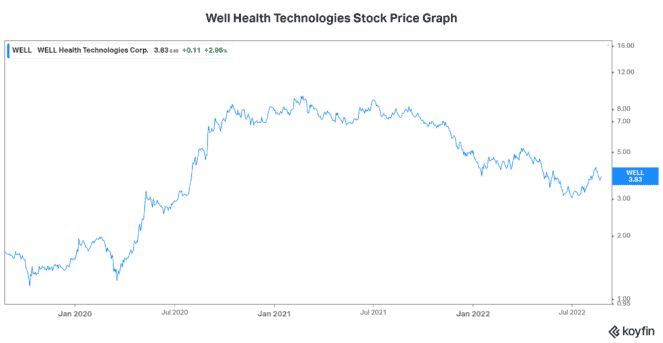

Well Health Technologies Corp. (TSX:WELL) is an omni-channel digital health company. Currently, the company is achieving rapid revenue and operating cash flow growth. This is being driven by soaring demand for its technology. Fortunately, the healthcare industry is finally embracing technology and this is evident in Well Health’s results.

In its latest quarter, Well Health posted record revenue and cash flows. In fact, revenue increased almost 130%. Furthermore, operating cash flow increased an impressive 450%. Yet, Well Health stock has languished. Like Ballard, Well Health has a leadership position in its industry. And it’s an industry that’s looking forward to leaps and bounds of progress. Both of these companies are changing the world for the better. Both of these stocks can be expected to benefit massively from their respective positions in their booming industries.

Well Health stock is backed by strong cash flow growth. It’s also backed by a reasonable valuation of less than two times sales.

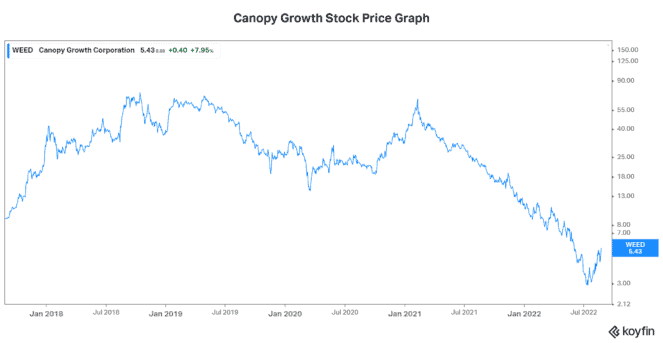

Canopy Growth: A cannabis stock whose day has come

When cannabis stocks were all the buzz a few years ago, I just watched. While I always believed in the potential of this industry, I refused to pay up for its stocks. Today, things are different. Cannabis stocks like Canopy Growth Corp. (TSX:WEED)(NASDAQ:CGC) have plummeted. Yet, the industry has progressed forward. This combination of lower valuations combined with lower industry and company risks, has me interested. I like that investors have lost interest. I also like that expectations priced into Canopy Growth stock have fallen dramatically.

So, Canopy Growth is a global cannabis company that has sealed itself a leading spot in the emerging cannabis market. This market has two parts to it, the medical cannabis market and the recreational market. Similar to any stock that’s operating in an emerging industry, Canopy Growth is currently burning cash. This has many implications for shareholders – most importantly, that it’s a high-risk name.

But the cannabis industry clearly has great potential. It’s a product that meets the needs and desires of many. So, it makes sense that the global cannabis industry’s market size was estimated at $28 billion in 2021. And that it’s expected to grow significantly in the next few years. Some estimates are calling for annual growth rates of 30%+.